The document discusses local and stochastic volatility models, highlighting issues with the Black-Scholes pricing model, particularly its reliance on constant volatility. It emphasizes the importance of volatility estimation, detailing the limitations of the Black-Scholes model, including volatility clustering, jumps in stock prices, and the need for more sophisticated models like Dupire's local volatility model and Heston's stochastic volatility model. Finally, the document outlines how these models aim to improve pricing accuracy and better capture market behaviors.

![Dupire LocalVolatility Model

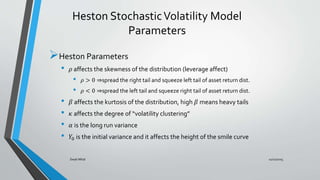

𝜎 → 𝜎 𝑡, 𝑆 the volatility becomes a function of time and Stock price 𝑆𝑡

The Black Scholes equation now becomes

𝜕𝑉 𝑡,𝑆

𝜕𝑡

+ 𝑟𝑆

𝜕𝑉(𝑡,𝑆)

𝜕𝑆

+

1

2

𝜎(𝑡, 𝑆)2 𝜕2 𝑉(𝑡,𝑆)

𝜕𝑆2 − 𝑟𝑉 𝑡, 𝑆 = 0

If there are continuous prices across expiry and strikes then a unique local volatility

exists. [Ref: Gyongy [2]]

11/11/2015Swati Mital](https://image.slidesharecdn.com/localstochasticvolatility-151111100059-lva1-app6891/85/Local-and-Stochastic-volatility-16-320.jpg)

![Dupire LocalVolatility Implementation

What do we need?

• Smooth, Interpolated IV surface (𝐶1

𝑖𝑛 𝑇, 𝐶2

𝑖𝑛 𝐾)

• No arbitrage across strikes and expiry

• Numerically stable techniques for partial derivatives

Interpolation across Strikes

• SABR, Spline based Interpolation

Stochastic Alpha Beta Rho

• SABR admits no arbitrage

• 𝛼 𝑡 represents overall level of ATM volatility

• 𝛽 𝑡 represents skewness, 𝛽 = 0 ⇒ normal, 𝛽 = 1 ⇒

𝑙𝑜𝑔𝑛𝑜𝑟𝑚𝑎𝑙

• 𝜌 represents shape of skew

• 𝜈 measures convexity (stochasticity of 𝛼(𝑡))

• Analytical Formula by Hagan [3] provides 𝜎𝑖𝑚𝑝 𝑇, 𝐾

11/11/2015Swati Mital

𝑑𝐹𝑡 = 𝛼 𝑡 𝐹 𝛽 𝑡 𝑑𝑊 𝑓 𝑡

𝑑𝛼 𝑡 = 𝜈𝛼 𝑡 𝑑𝑊 𝛼 𝑡

𝐹 0 = 𝐹

𝛼 0 = 𝛼

𝑑𝑊 𝑓

𝑑𝑊 𝛼

= 𝜌](https://image.slidesharecdn.com/localstochasticvolatility-151111100059-lva1-app6891/85/Local-and-Stochastic-volatility-20-320.jpg)

![StochasticVolatility Model

StochasticAsset Price and StochasticVolatility

𝑑𝑆𝑡 = 𝜇 𝑡, 𝑆𝑡, 𝑌𝑡 𝑆𝑡 𝑑𝑡 + 𝜎 𝑡, 𝑆𝑡, 𝑌𝑡 𝑆𝑡 𝑑𝐵𝑡

𝑑𝑌𝑡 = 𝑎 𝑡, 𝑆𝑡, 𝑌𝑡 𝑑𝑡 + 𝑏 𝑡, 𝑆𝑡, 𝑌𝑡 𝑑𝑊𝑡

𝑊𝑡 = 𝜌𝐵𝑡 + 1 − 𝜌2 𝑍𝑡, 𝜌 ∈ [−1,1]

Market is incomplete as there is one traded asset and two driving Brownian

MotionsW and B.We can hedge randomness of asset but what about

volatility? No unique risk free measure Q!!!

Heston took 𝜌 ≠ 0, 𝜇 𝑡, 𝑆𝑡, 𝑌𝑡 = 𝜇, 𝜎 𝑡, 𝑆𝑡, 𝑌𝑡 = 𝑌 and volatility follows CIR

process

𝑑𝑆𝑡 = 𝜇𝑆𝑡 𝑑𝑡 + 𝑌𝑡 𝑆𝑡 𝑑𝐵𝑡

𝑑𝑌𝑡 = 𝜅 𝑄 𝛼 𝑄 − 𝑌𝑡 𝑑𝑡 + 𝜈 𝑌𝑡 𝑑𝑊𝑡

Feller condition for Yt > 0, 2𝜅 𝑄 𝛼 𝑄 > 𝜈2

11/11/2015Swati Mital](https://image.slidesharecdn.com/localstochasticvolatility-151111100059-lva1-app6891/85/Local-and-Stochastic-volatility-23-320.jpg)