Fixed Income - Arbitrage in a financial crisis - Swap Spread in 2008

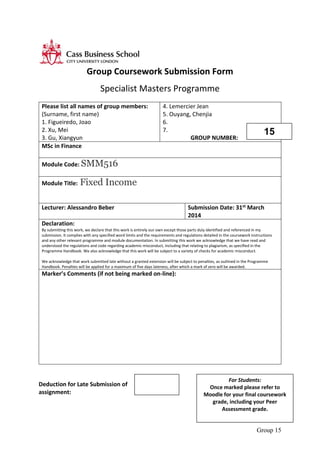

- 1. Group 15 Group Coursework Submission Form Specialist Masters Programme Please list all names of group members: (Surname, first name) 1. Figueiredo, Joao 2. Xu, Mei 3. Gu, Xiangyun 4. Lemercier Jean 5. Ouyang, Chenjia 6. 7. GROUP NUMBER: MSc in Finance Module Code: SMM516 Module Title: Fixed Income Lecturer: Alessandro Beber Submission Date: 31st March 2014 Declaration: By submitting this work, we declare that this work is entirely our own except those parts duly identified and referenced in my submission. It complies with any specified word limits and the requirements and regulations detailed in the coursework instructions and any other relevant programme and module documentation. In submitting this work we acknowledge that we have read and understood the regulations and code regarding academic misconduct, including that relating to plagiarism, as specified in the Programme Handbook. We also acknowledge that this work will be subject to a variety of checks for academic misconduct. We acknowledge that work submitted late without a granted extension will be subject to penalties, as outlined in the Programme Handbook. Penalties will be applied for a maximum of five days lateness, after which a mark of zero will be awarded. Marker’s Comments (if not being marked on-line): Deduction for Late Submission of assignment: Final 15 For Students: Once marked please refer to Moodle for your final coursework grade, including your Peer Assessment grade.

- 2. Group 15 Fixed Income Arbitrage in a Financial Crisis: TED Spread and Swap Spread in November 2008

- 3. Group 15 Part I Context Albert Mills is a former fixed-income strategist and trader at Morgan Stanley who has recently joined one of his past colleague James Franey in the investment management company that he founded - Kentish Town Capital (KTC). Mills’ knowledge about interest rate derivatives is the main contribution to his new employer, and Mills has direct responsibility on $75 million (the overall size of KTC is $300 million). KTC’s strategy was to focus on fixed income relative value strategies, and had stayed away from the mortgage market due to a lack of knowledge in this specific area of securities. As a result the fund was clearly ahead of many competitors at the time of the case study (November 2008). The economic environment at the time was the post Northern Rock’s and Lehman Brother’s collapses and the subsequent turmoil in financial markets. Market volatility had increased substantially across asset classes as Lehman’s counterparties had suddenly become exposed to a great amount of market risk previously offset by their trades with Lehman and as a result a flight to quality was taking place, with a very risk-averse sentiment ruling investors’ decisions. Many investors had been closing positions and investing in Treasury bills alone, prime brokers as KTC had increased collateral requirements to a point where it was almost impossible to hold positions in anything but treasuries as well. KTC’s profit had derived from selling short long-dated treasuries and going long in shorter- dated treasuries, in duration-matched amounts (which is in some way a convergence trade). As the fund betted on a steepening yield curve which had been triggered by the FED’s cut in short-term rates, it had done well in spite of the crisis and Mills felt it was now time to exploit opportunities in the market for U.S. dollar fixed-floating swaps. At that precise date the thirty-year U.S. dollar fixed-floating spread had decreased from 30.25 to 6.25 basis points, having even been negative some days before this. The size of the swap spread (6.25 basis points) was considerably low compared to the historical values that averaged between 30 and 60 basis points, and Mills had never imagined that this value could ever be negative. Given these values that he deemed “abnormally low” he felt that the current low spreads presented a profitable trading opportunity.

- 4. Group 15 Part II 1. What is the swap trade that Mills is studying? The swap trade that Mills is studying is a “bet” on swap spreads widening from their current level (0.0625% or 6.25 basis points) back to average historical values (30 – 40 – 50 basis points). The trade in practice Mills is long the swap –he pays a fixed rate and receives a floating rate (i.e. Libor). Meanwhile he buys the corresponding amount of 30-year treasury (May 2038) in order to be neutral in terms of market interest rates (the DV01 values are matched), using repo financing (see Q2). Swap leg: Mills pays 2.128% every 6 months (4.2560% per annum), the fixed leg of the swap, for the next 30 years. Mills receives the 3-month LIBOR rate (reset every 3 months), the floating leg, for the next 30 years. Treasury leg: Mills receives 2.0965% every 6 months (4.193% per annum), the yield of the May 2038 treasury. He used a repurchase agreement (“repo”) to finance the purchase and hence pays the repo rate (0.15% annually). Matching the bonds duration to become neutral to interest rate fluctuations Mills is long the swap and shorts the treasury. If interest rates go up/down, the value of his swap increases/decreases (he pays a relatively lower/higher interest rate compared to the market rate, which is valuable). In order to hedge this interest rate exposure, he buys a bond with the same maturity (May 2038) in the right proportion to match the duration: The swap with fixed leg has a DV01 of $1.7 million for $1 billion notional – The May treasury 2038 has a $1.746 million DV01 for the same notional. Mills buys $0.97 billion of the thirty treasury (1.7/1.746 = 0.973). The “dirty” price of the treasury $0.97 billion is $1.04 billion, including the accrued interest ($2.13 per 100 face value).

- 5. Group 15 Turning the trade into a profit There is two ways the trade can be profitable: Flows The floating leg, in most cases, will be profitable as the repurchase rate is a collateralized borrowing rate and as a result it should always be lower than the LIBOR rate (unsecured borrowing rate between financial institutions). On the fixed rate, Mills will pay the swap spread, currently 0.0625%; on aggregate the flows will more or less cancel out as the negative payment of the fixed leg will be matched by a positive payment on the floating rate. The effect on the value of the trade should therefore be low. Leg values The position will benefit when the spread widen: the treasury yield (4.193%) decreases and/or the swap fixed rate (4.2560%) increases. If the yield goes down, the treasury will sell at a premium. This works the same way on the swap fixed leg if the swap rate increases. This part of the trade is the most important to monitor. 2. How could Mills finance the trade? As mentioned in Q1, Mills will use a repurchase agreement to finance the purchase of the treasury. He will pay the repo rate (0.15% annually) and will have a haircut of 2% (he will need to post $21 million in capital to borrow the $1.04 billion needed to buy the bond). 3. What is the TED spread? The TED spread or Treasury-Eurodollar spread is the difference between the 3-month futures contract for U.S. Treasuries and the 3-month contracts for Eurodollars having identical expiration month. The spread measures the credit risk of the borrowers associated with Eurodollar futures as Treasury bills had always been assumed to be risk free. When the TED spread increases, default risk should also be increasing, which will in turn lead investors preference to safe investments. Inversely, default risk is considered to decrease when the TED spread falls. How would you compute it empirically? The Three-month TED spread is calculated as the difference between the 3-month LIBOR rate and the 3-month Treasury bill yield. The 3-month Treasury bills which are originally quoted at discount rate are converted into bond equivalent yields. In this sense, the spread measures banks credit worthiness, reflecting the difference in borrowing rates for an uncollateralized loan by banks and a safe loan to U.S. government. Therefore, TED spread is often used to track the difference between the LIBOR and the appropriate repo rate, as these are no more than loans secured by government bonds.

- 6. Group 15 4. What are the risks in the trade that Mills is about to put on? Risks can arise whether the swap spread narrows or widens as Mill anticipated. [Narrowing spread] The yield on the 30-Year Treasury bond increases An increase in yield on the 30-year Treasury bond has two implications. As the value of the bonds decreases when the yield to mmaturity increases, the broker might require KTC to post additional cash collateral to compensate for the negative price change or ask to sell some Treasury bonds which will have as a direct effect to reduce leverage. The liquidity of the 30- year Treasury bond will then affect KTC’s ability to sell the bond. Therefore, it is important for KTC to have sufficient capital reserve to meet cash requirements. Secondly, in the renewed repo transaction, the broker might increase the haircut to reflect the risk for a drop in value of the collateral. [Narrowing spread] 30-year swap rate decreases If Mills has been required to post initial margin against the swap, additional cash collateral may also be required if the swap rate declines. Again, this will require KTC to have some cash reserve. [Widening spread] 30-year swap rate increases and effect on counterparty risk Inherent in any OTC contract, the counterparty might not be able to fulfill the promised payments. Particularly, when the market rate increases, the counterparty risk will increase as the floating leg could have received more in exchange for paying the same amount. The success of Mill’s trade will also depend on his ability to renew repo agreements every 3 months for 30 years (or until the spread widens). Why is the spread so low? Can the spread turn negative? Why? Higher yield on long-term Treasury bond In mid-October 2008, the US Treasury announced the purchase of preferred shares from nine large financial institutions, which would mainly be financed by issuing long-term Treasury bonds. The large increase in supply of Treasury bonds drove up their yield and hence imposed a downside pressure on swap spreads. The principal exchanged in a Treasury bond transaction is to be repaid at maturity (30 years later in this case) whereas the principal is not exchanged in a swap transaction and the timely payments are marked to market. In addition, the swap losses due to default of a counterparty are only equal to the cost of replacing the position, when a default of a counterparty in bonds

- 7. Group 15 often means a loss of the principal. As such, the relatively riskier delivery method of Treasury bond is reflected by a higher yield. Lower 30-year swap rate After Lehman’s bankruptcy, investors sought for replacing hedges as their swaps with Lehman had become void, which was an enormous market force. Fixed rate bond issuers, who have timely fixed obligations would benefit from a steepen yield curve to pay the floating. Secondly, sovereign debt managers also tend to reduce the duration of their outstanding debt (both ask to receive the fixed rate in a swap). Thirdly, institutional investors wish to benefit from the carry gain by entering in swap. Finally, commercial banks are less inclined to hedge their short term variable rate deposits. As a result, there would be relatively more floating than fixed-rate payers in the interest rate swap market. The swap rate thus decreased to reflect the higher demand for the floating position. From the fixed-payers’ perspective of view, another reason that might contribute to a lower swap rate is the lower hedging cost of floating swap dealers. In addition, capital requirements and regulation may induce investors to use swap instead of bonds, reducing the yield of swaps (risk-weighted asset regulation for instance). Another explanation is the view of the market that governments like any entities can default which drove up government bond yields.