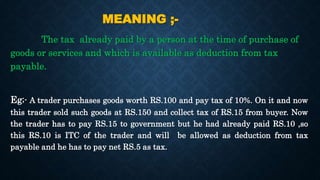

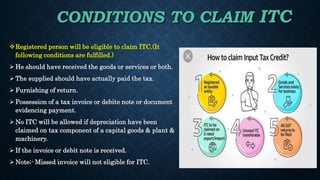

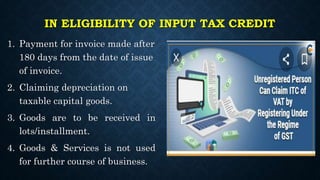

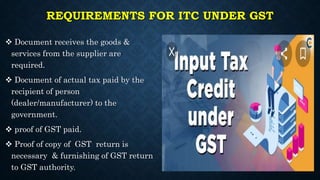

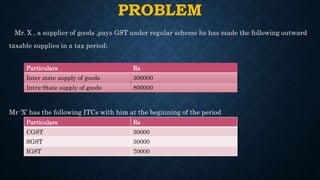

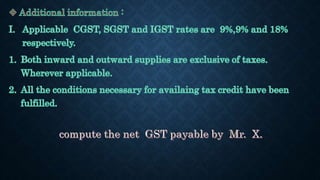

The document discusses the concept of Input Tax Credit (ITC) under GST, outlining its definition, how to claim it, eligibility conditions, and instances of ineligibility. It specifies requirements for claiming ITC, including possession of tax invoices and tax payments made. Practical examples are provided to illustrate the application of ITC in business transactions.