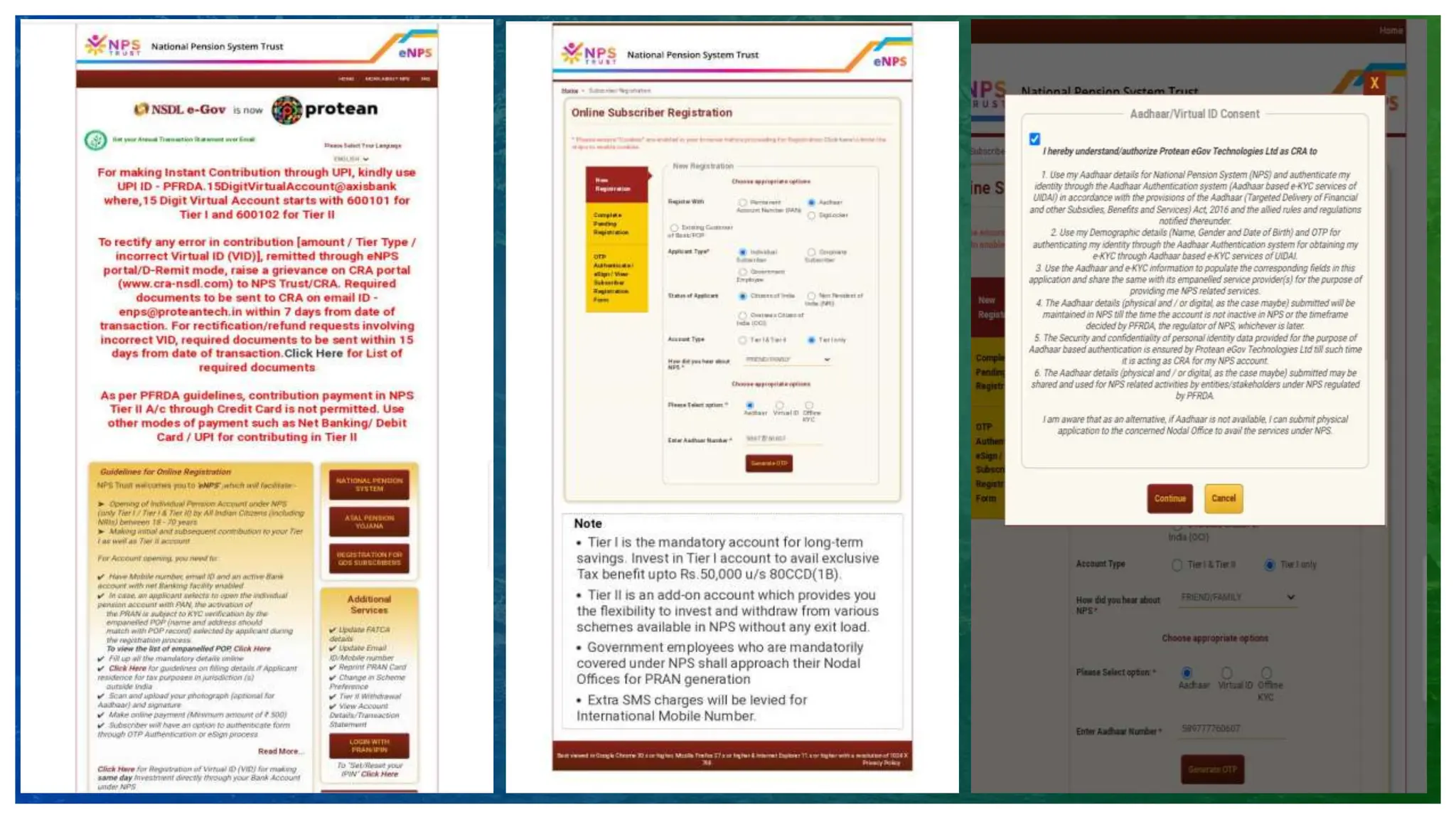

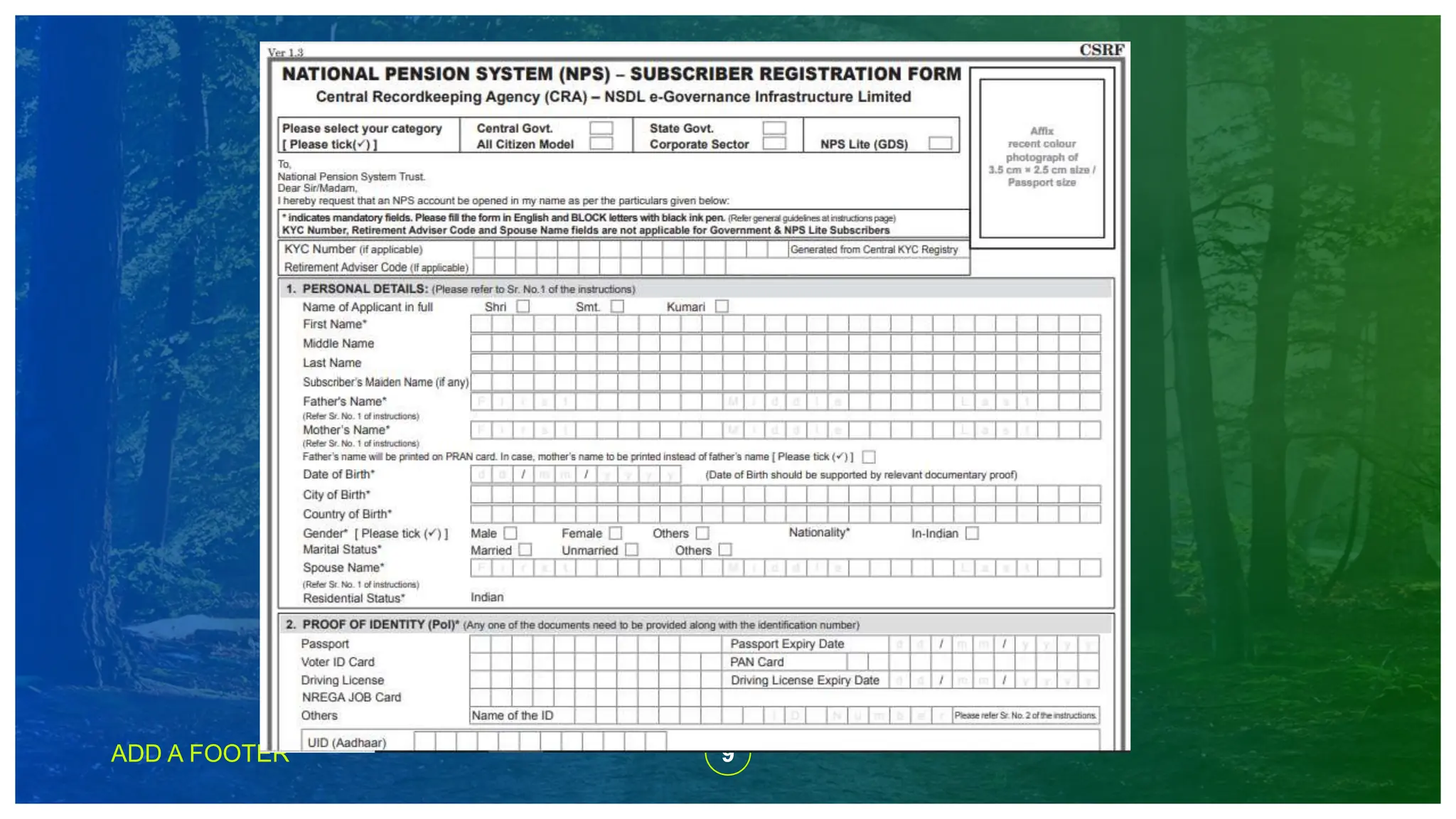

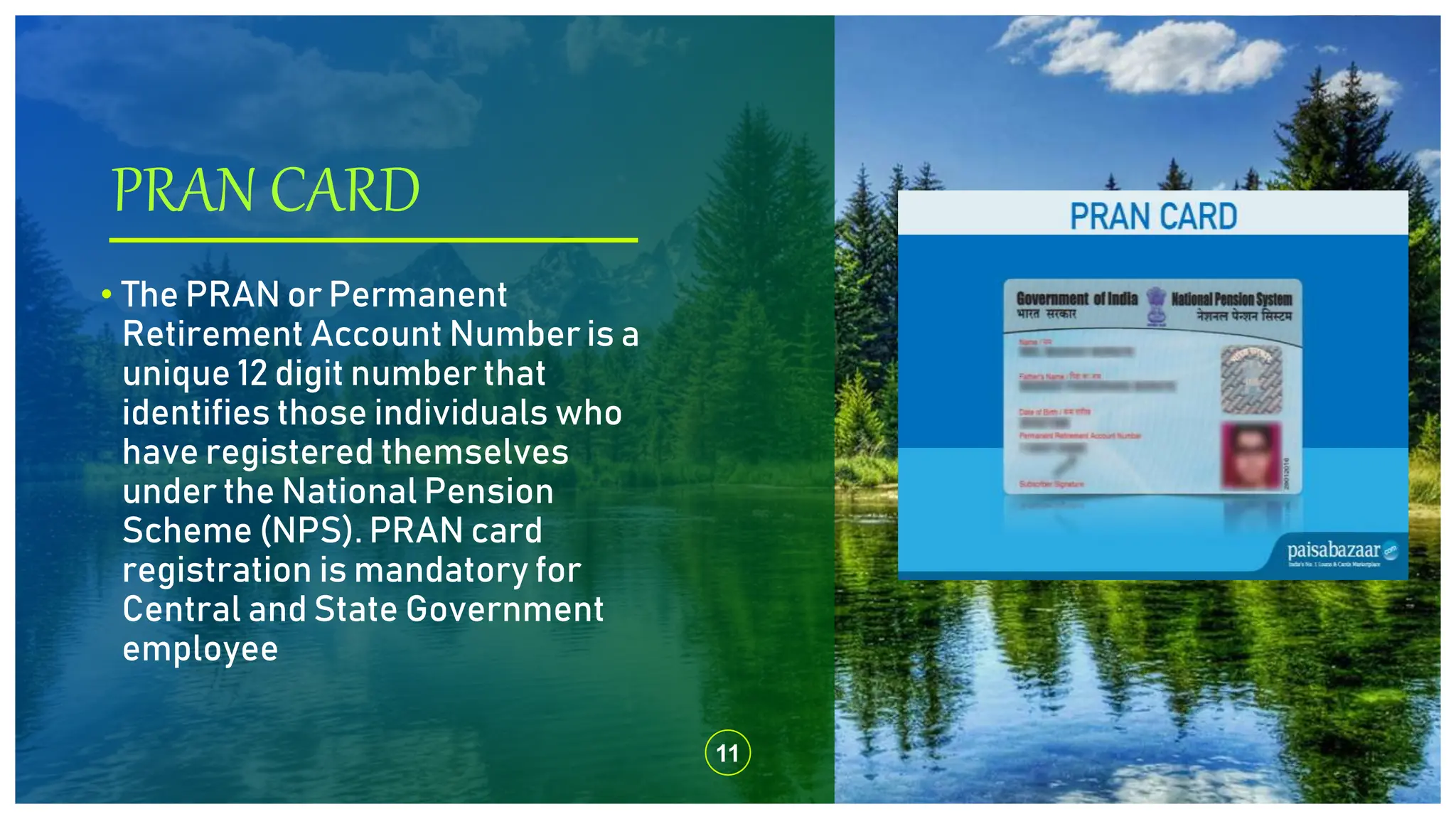

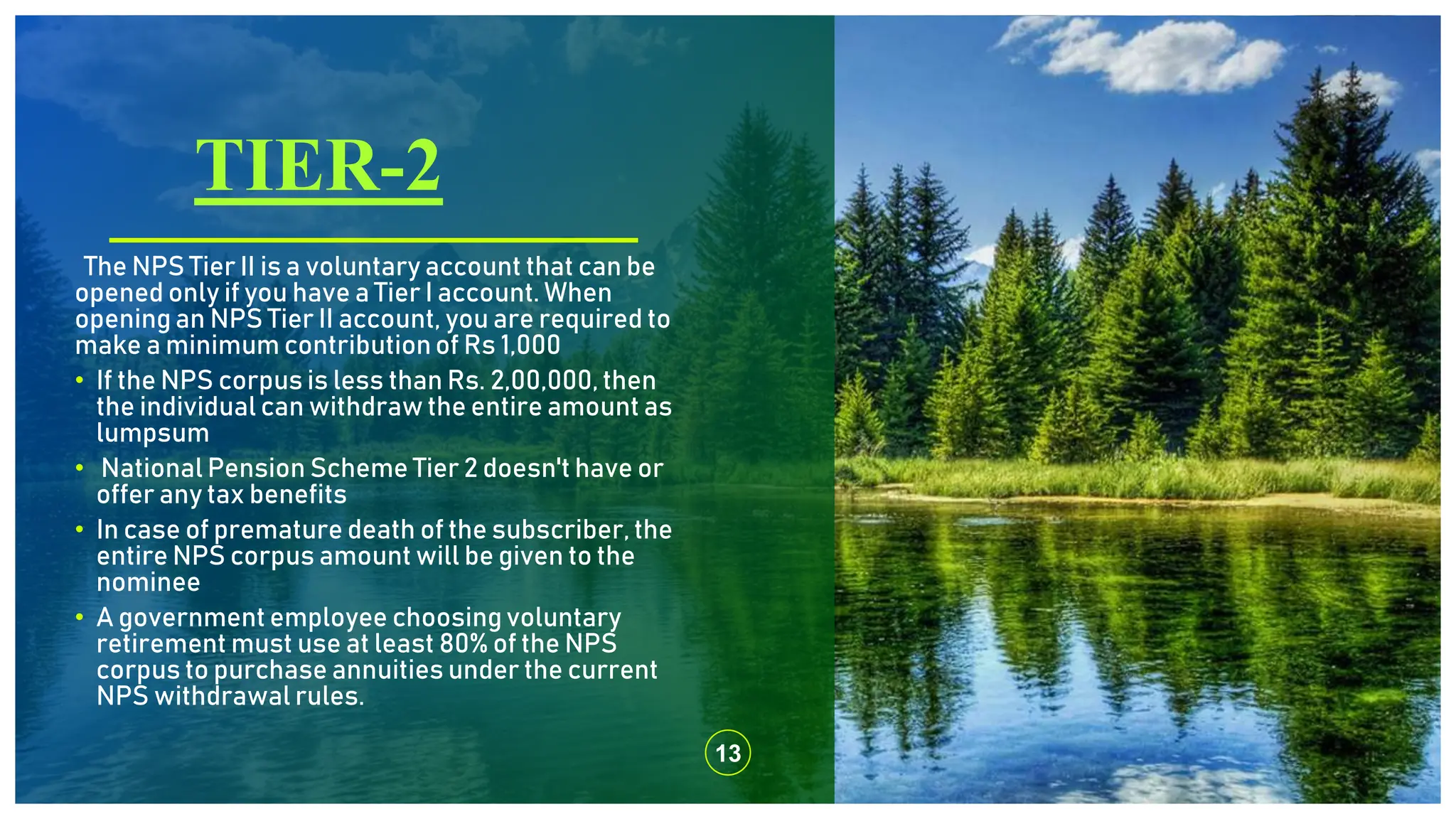

The document discusses the National Pension Scheme (NPS) in India. NPS is a social security program open to both public and private sector employees between 18-60 years old, except armed forces personnel. It is regulated by the Pension Fund Regulatory and Development Authority (PFRDA). To open an NPS account, one can visit a point of presence like a bank or post office either offline or online. A Permanent Retirement Account Number (PRAN) is issued upon registration. There are two tiers of accounts - Tier 1 offers tax benefits and matures at age 60, while Tier 2 is voluntary and does not provide tax benefits. The document outlines the fund managers in the government and non