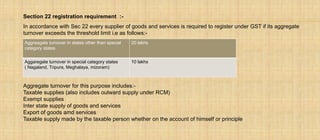

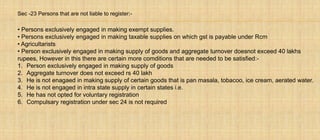

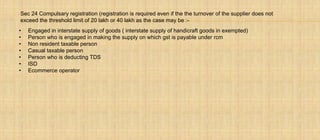

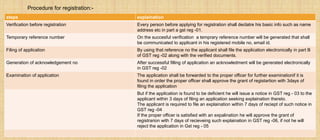

Registration under the Goods and Services Tax (GST) involves obtaining a unique GST identification number (GSTIN) from tax authorities. This allows businesses to legally collect tax from customers, claim input tax credits, and seamlessly transfer credits nationally. Section 22 requires registration for businesses with aggregate annual turnover over Rs. 20 lakh, or Rs. 10 lakh for certain states. Exemptions apply for agriculture, low-turnover businesses, and those exclusively providing exempt supplies. Section 24 mandates registration for interstate suppliers and other special cases regardless of turnover. The registration procedure involves verification, application filing, examination, and issuance of a certificate including the GSTIN and effective date.