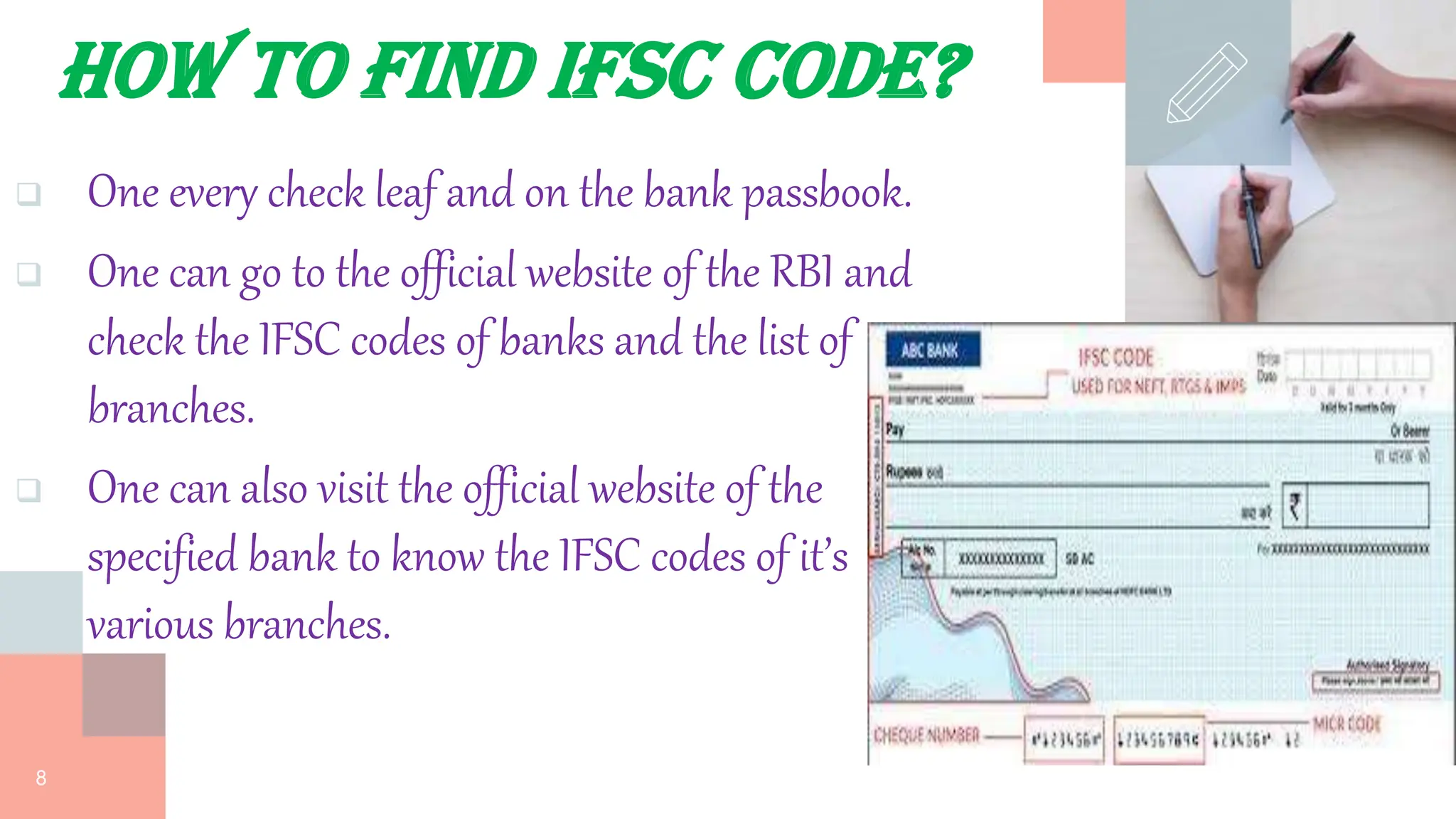

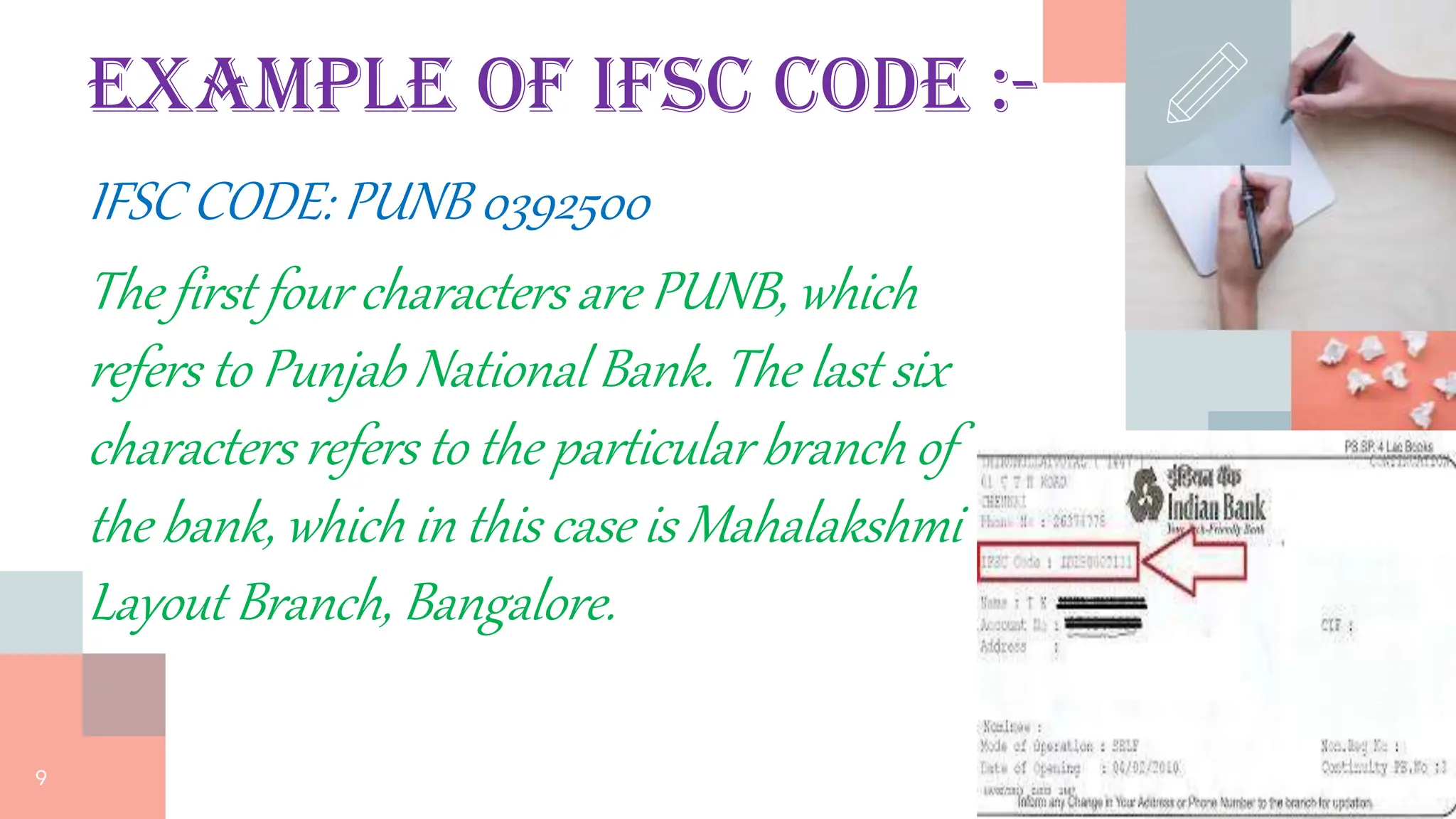

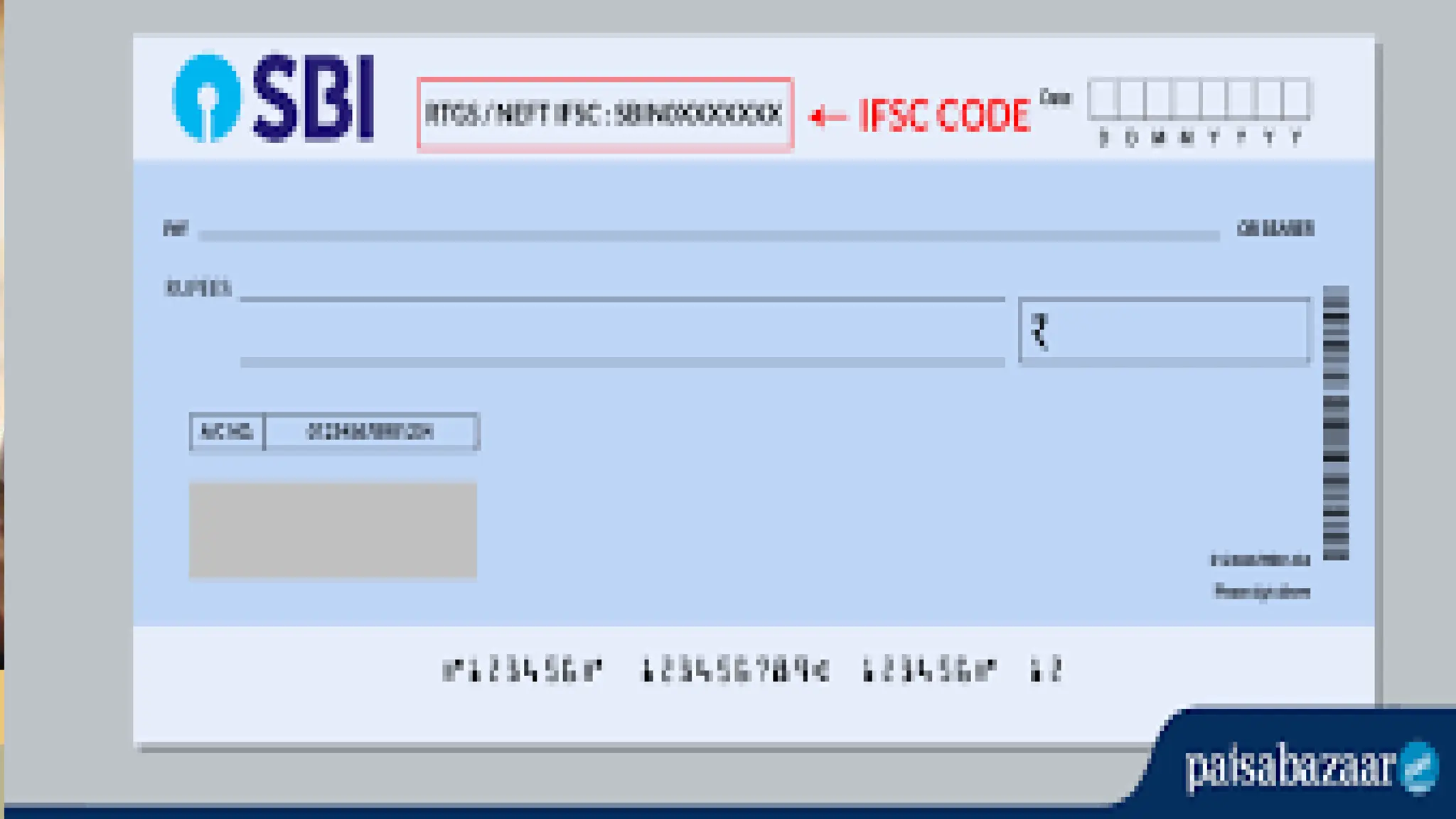

The document discusses the Indian Financial System Code (IFSC), which is a unique 11-character code used to identify specific bank branches in India for electronic fund transfers like NEFT and RTGS. It provides a brief history of IFSC, established by the Reserve Bank of India in 1935 and nationalized in 1949, along with its features and benefits for smoother and quicker banking transactions. The document also outlines how to find IFSC codes and gives an example to illustrate its structure.