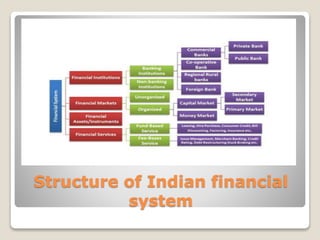

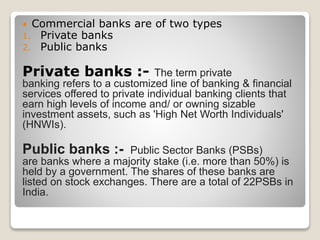

The document provides an overview of the Indian financial system, including its key components and functions. It describes the structure of the Indian financial system, the main types of financial institutions (banking and non-banking), financial markets (organized and unorganized), instruments, and services. The financial system bridges the gap between savings and investment, facilitates trading, aids economic development, and encourages both savings and investment in India.