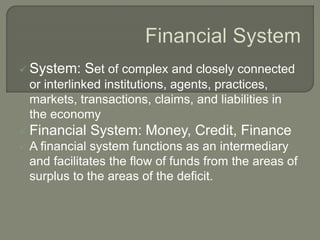

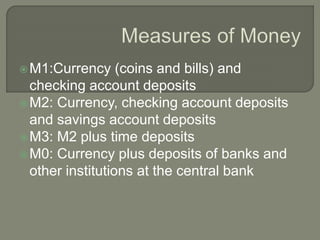

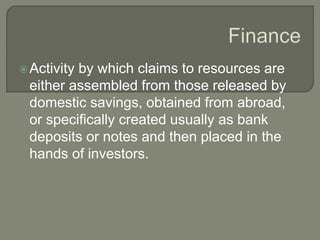

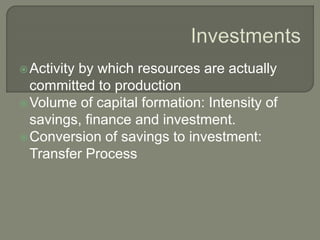

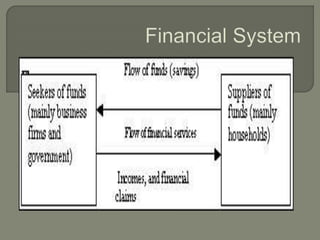

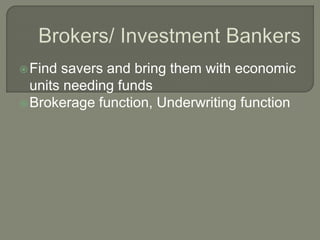

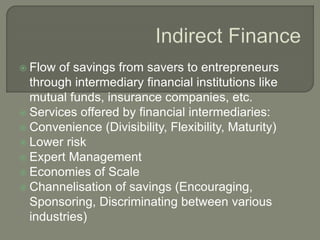

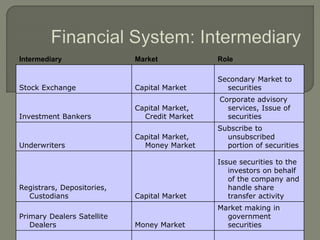

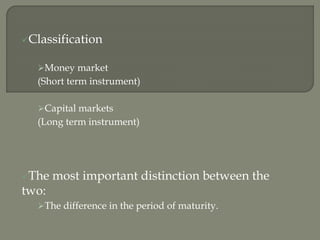

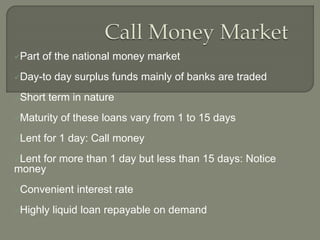

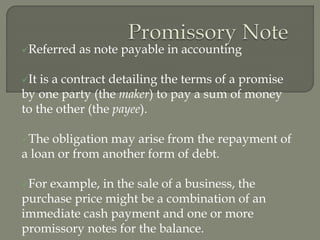

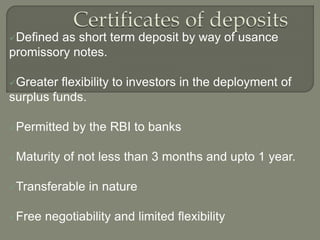

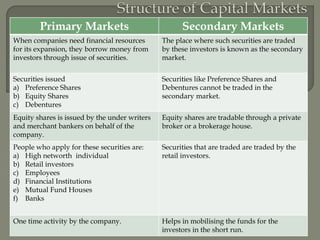

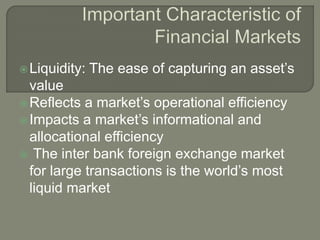

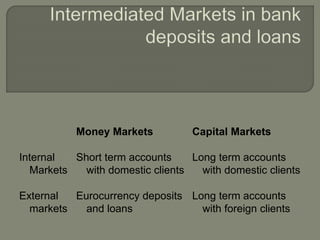

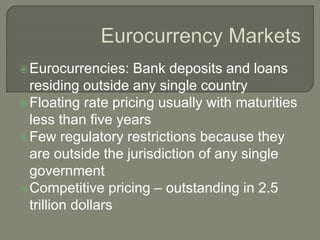

The document defines finance and financial systems. It discusses the functions of money, different measures of money supply, and the roles of money lending, capital formation, and investment in the financial system. It also describes the evolution of financial systems from more rudimentary to indirect systems, the key components and markets within financial systems, and the functions of financial intermediaries, markets, and instruments.