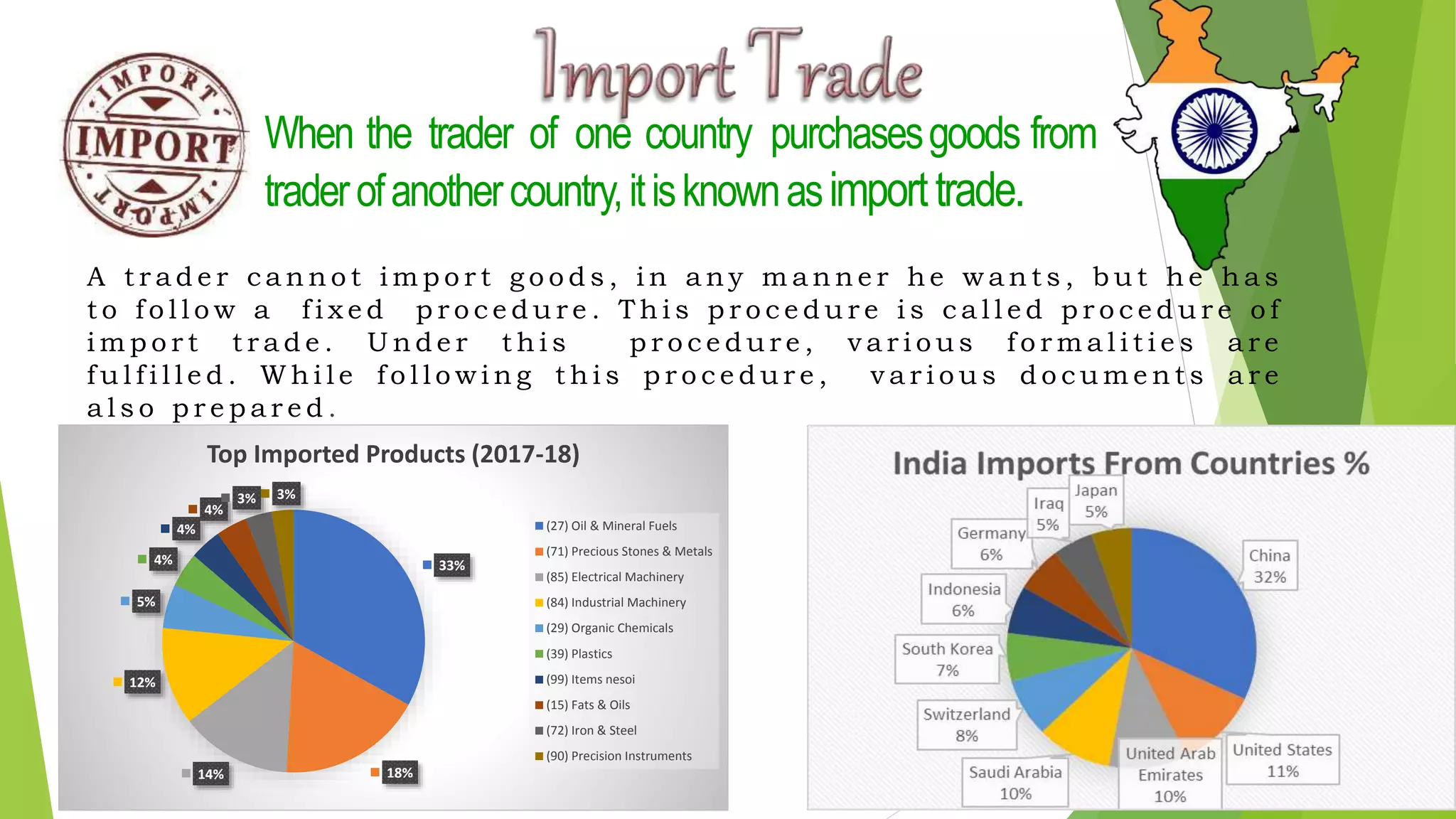

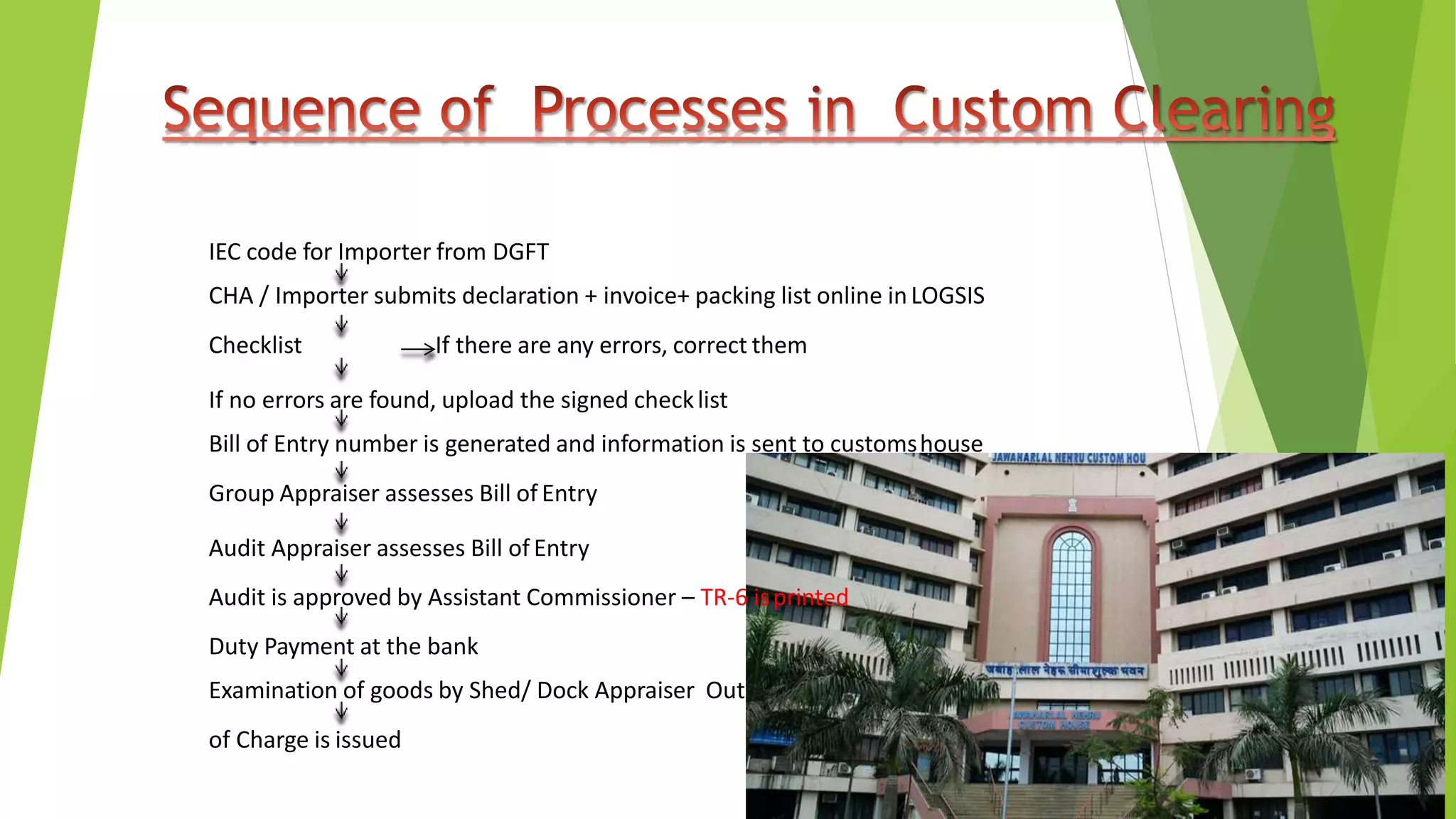

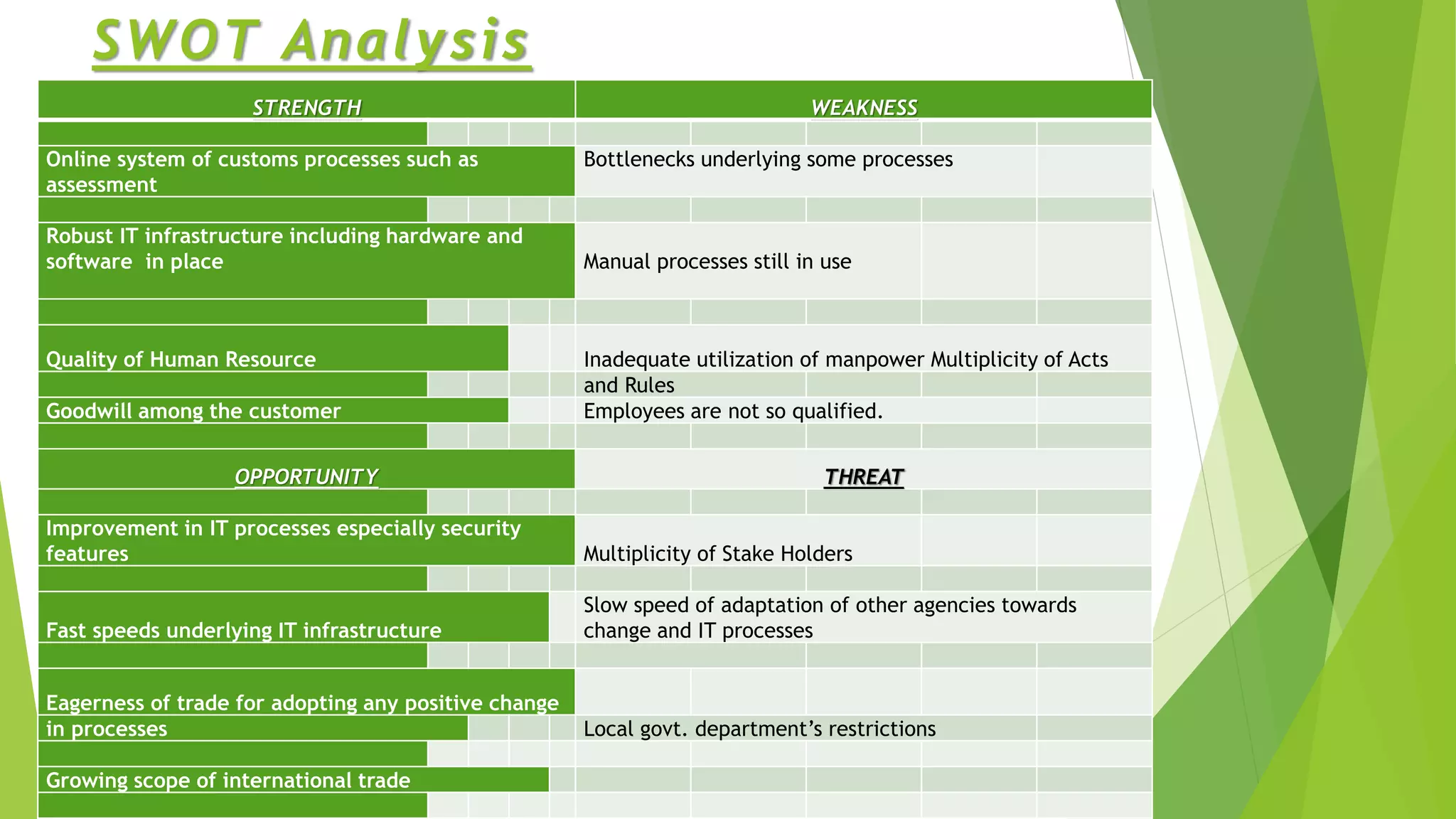

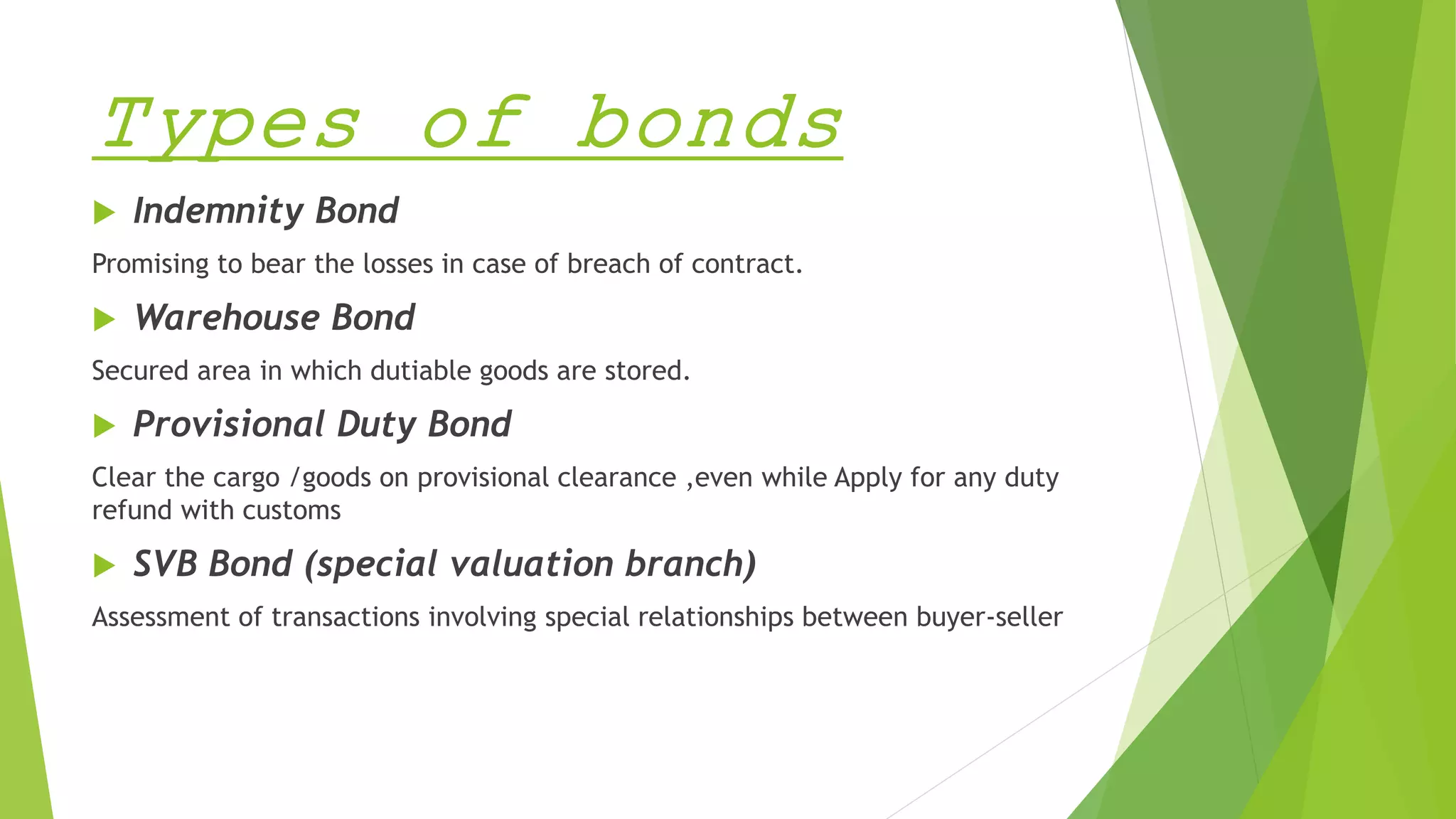

This document summarizes a summer internship presentation on the study of import procedures with an emphasis on the role of a custom house agent. It discusses the process of importing goods including required documents, assessing the bill of entry, duty payment, and goods examination. It also includes an overview of the company Ashapura Forwarders Pvt Ltd and its subsidiaries involved in transportation and logistics. SWOT and types of bonds related to import procedures are analyzed at the end.