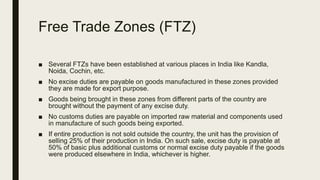

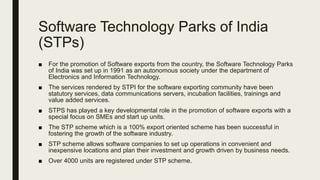

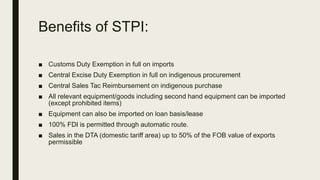

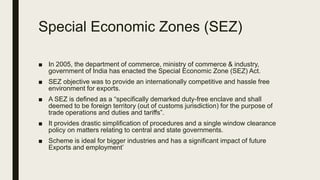

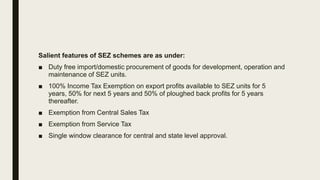

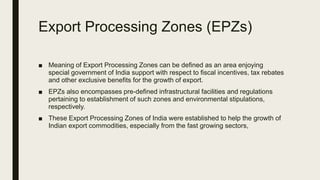

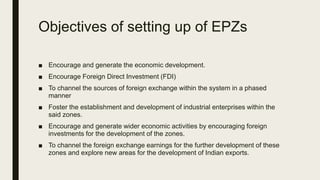

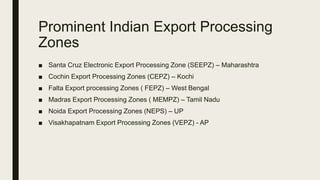

The EPCG (Export Promotion Capital Goods) scheme allows import of capital goods for manufacturing products for export without paying customs duty. Importers must export goods worth 6 times the duty saved within 6 years. Capital goods allowed include machinery, tools, and second-hand goods. The scheme promotes technological upgrades and exports. STPI (Software Technology Parks of India) and SEZ (Special Economic Zones) offer tax exemptions and infrastructure to boost software and overall exports. EPZs (Export Processing Zones) generate economic activity and jobs through fiscal incentives for export-oriented industries.