The document discusses the Conceptual Framework for Financial Reporting. It provides the following key points:

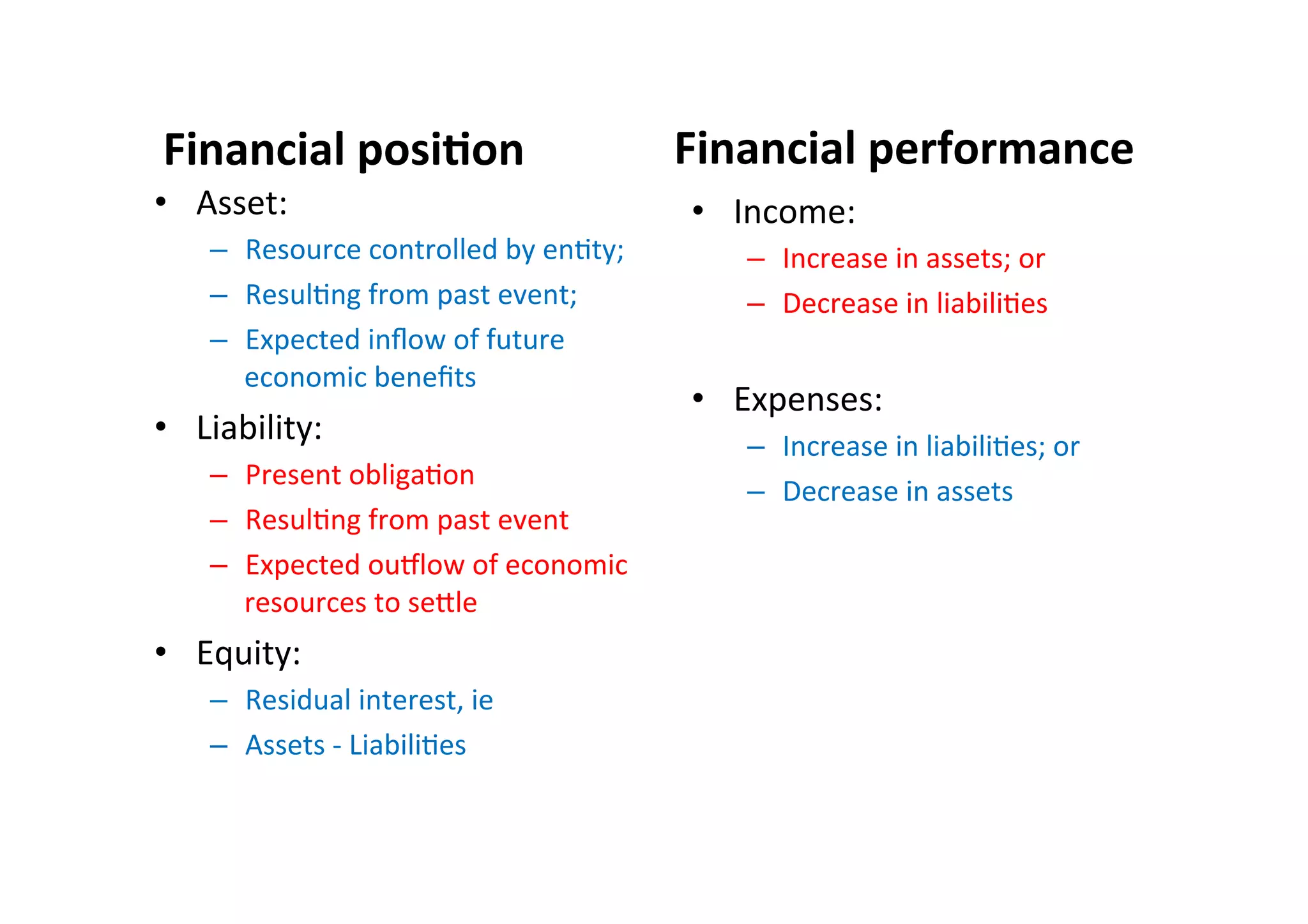

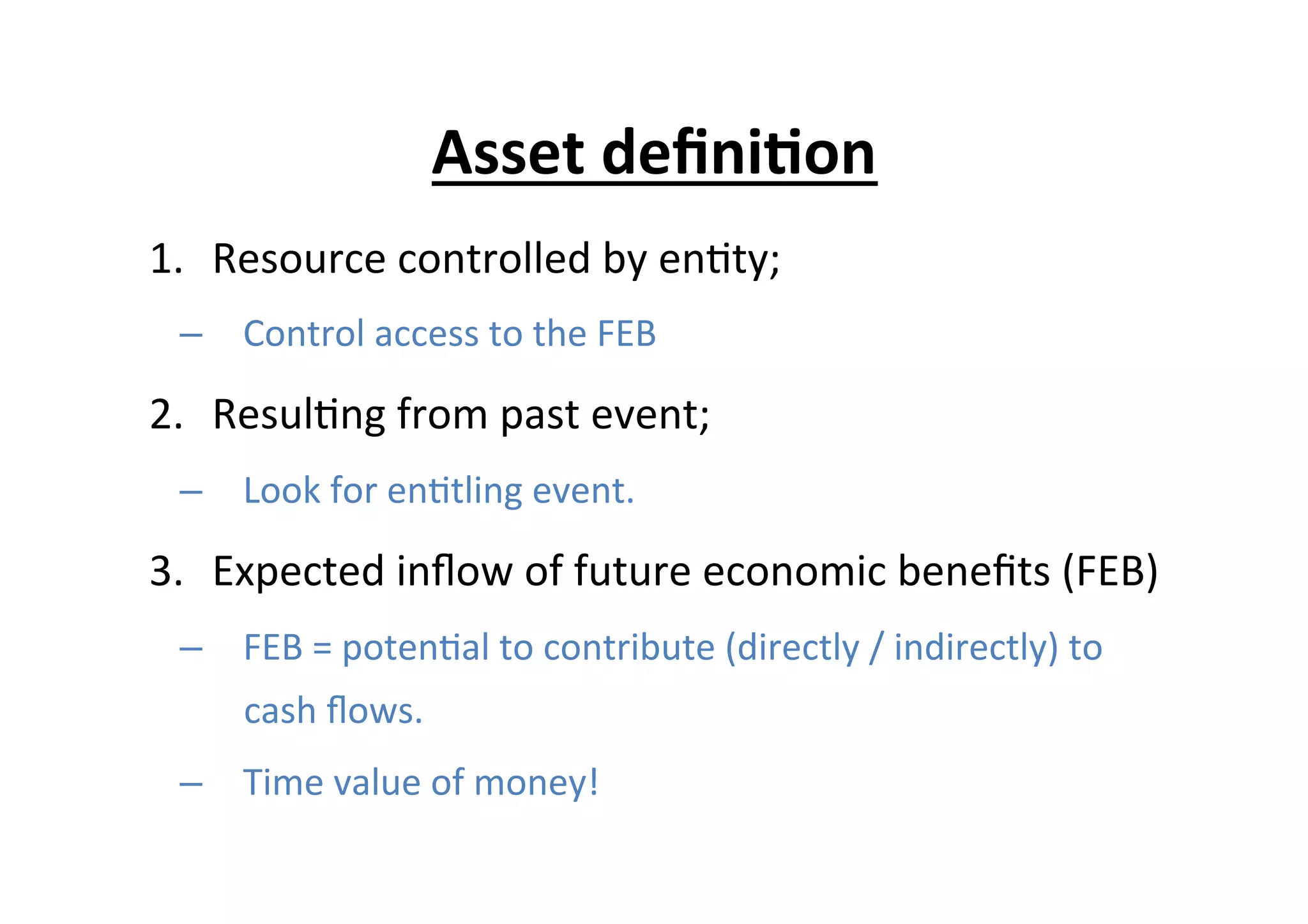

- The Framework sets out the objectives and concepts that underlie the preparation and presentation of general purpose financial statements for external users. It provides a theoretical background used by standard setters.

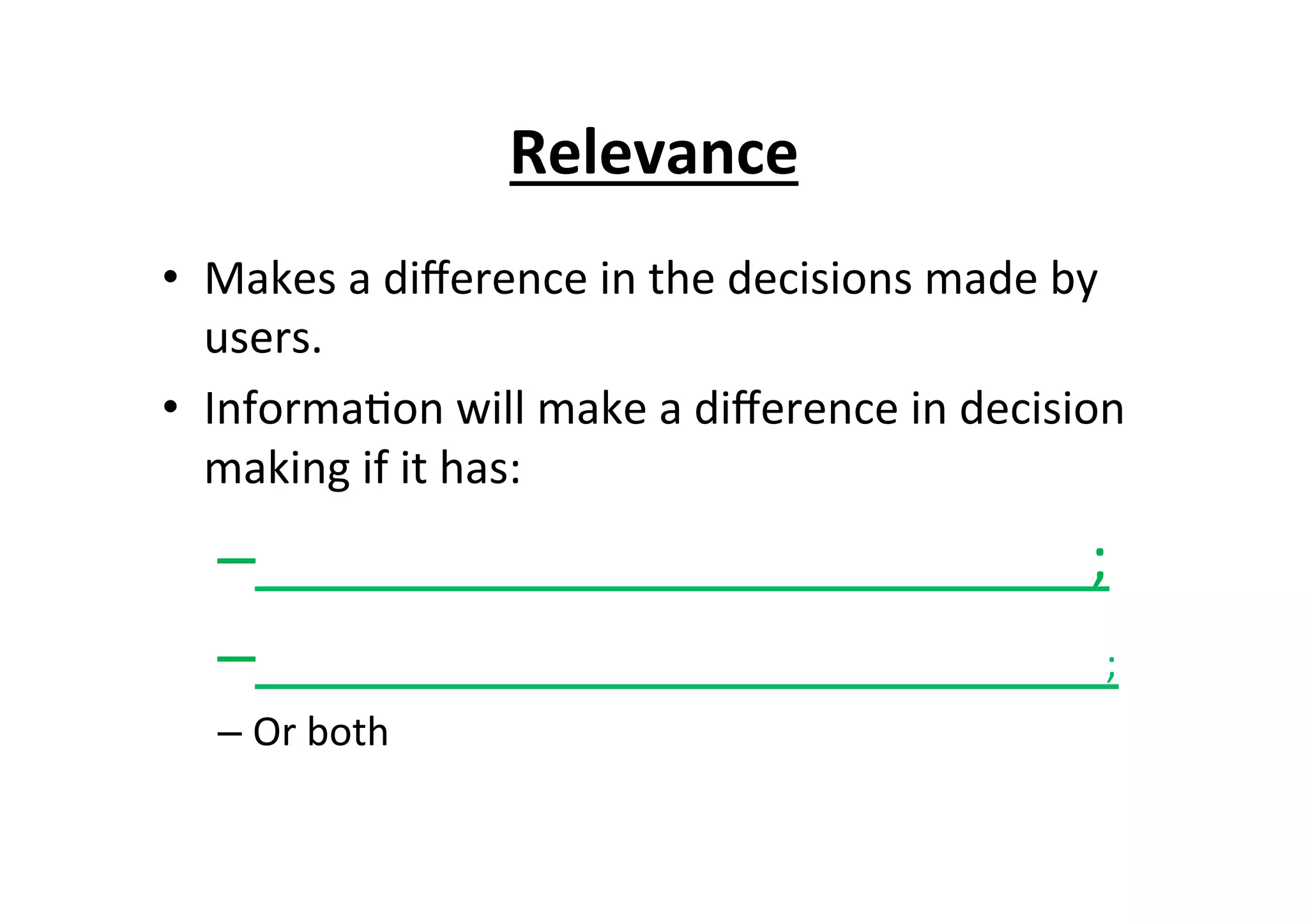

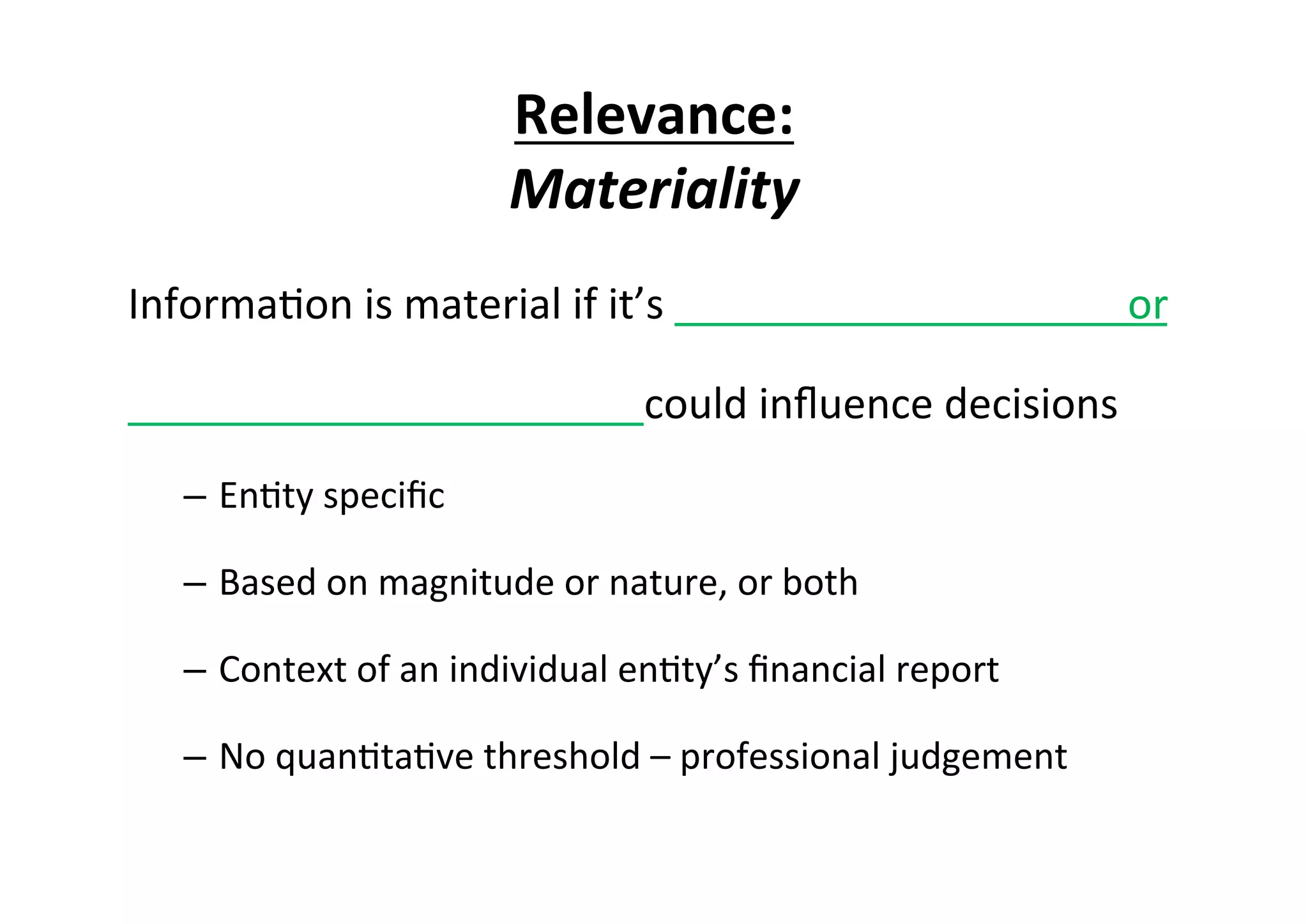

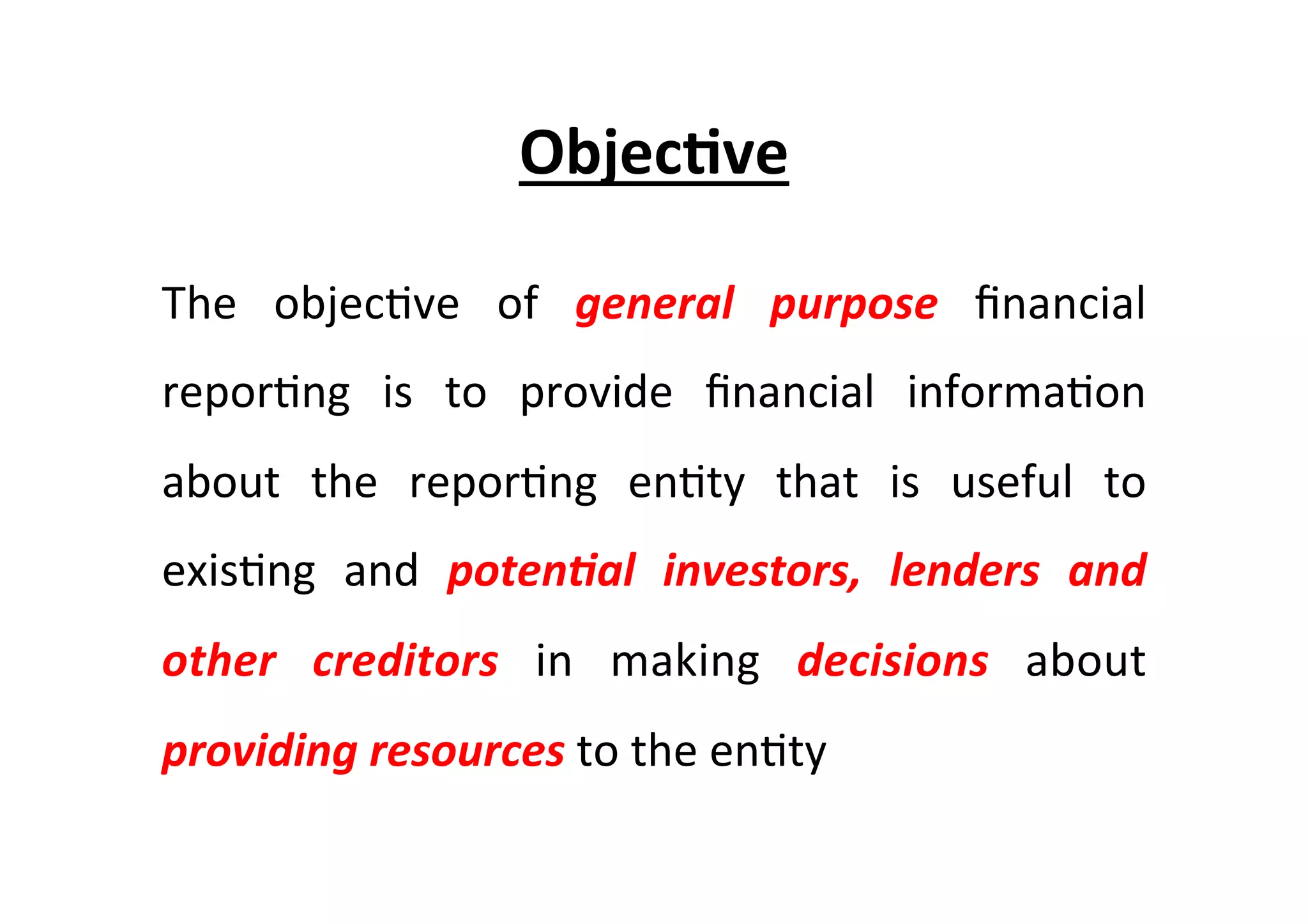

- The objective of general purpose financial reporting is to provide financial information that is useful to present and potential investors, creditors and others in making decisions about providing resources to the entity.

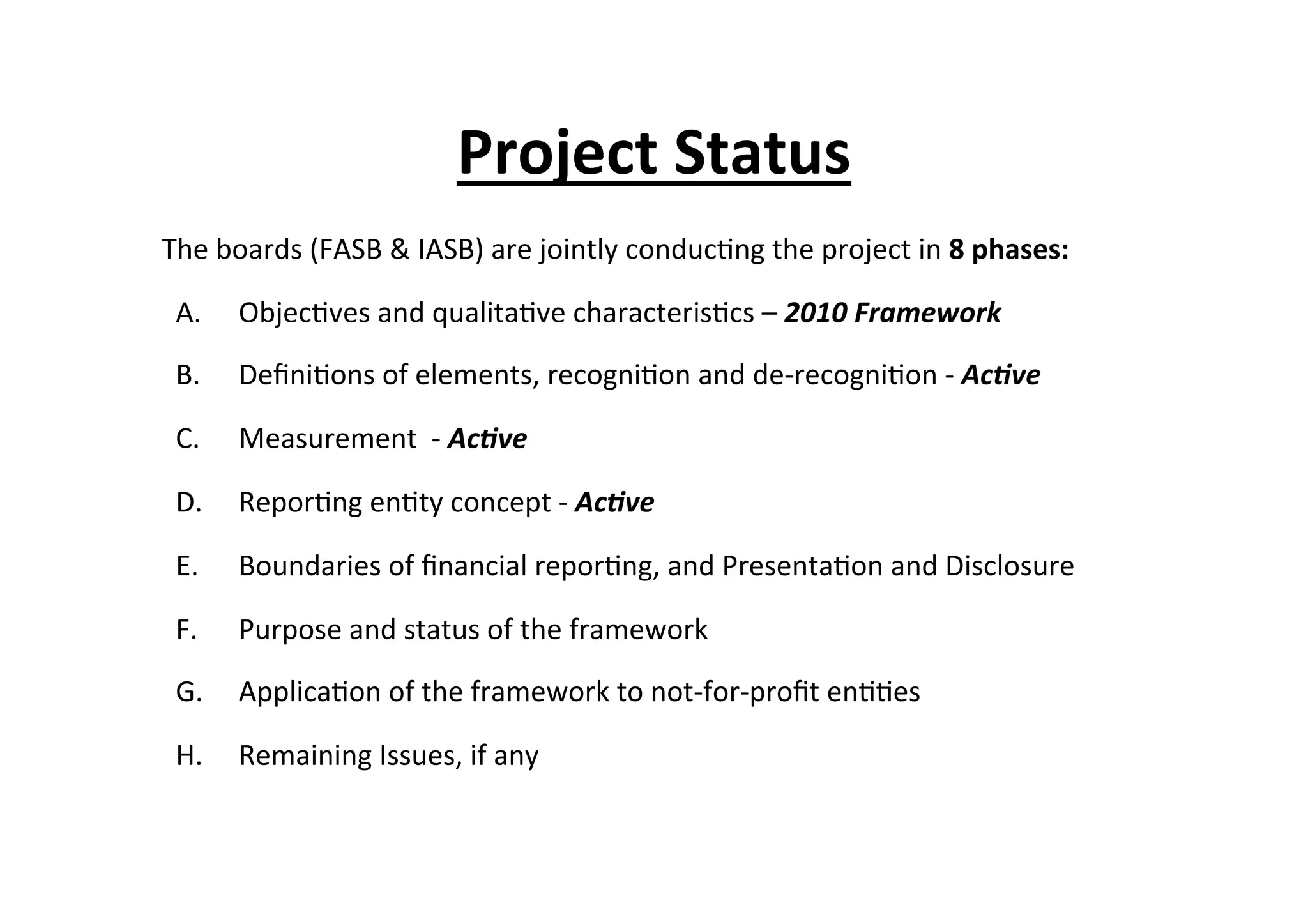

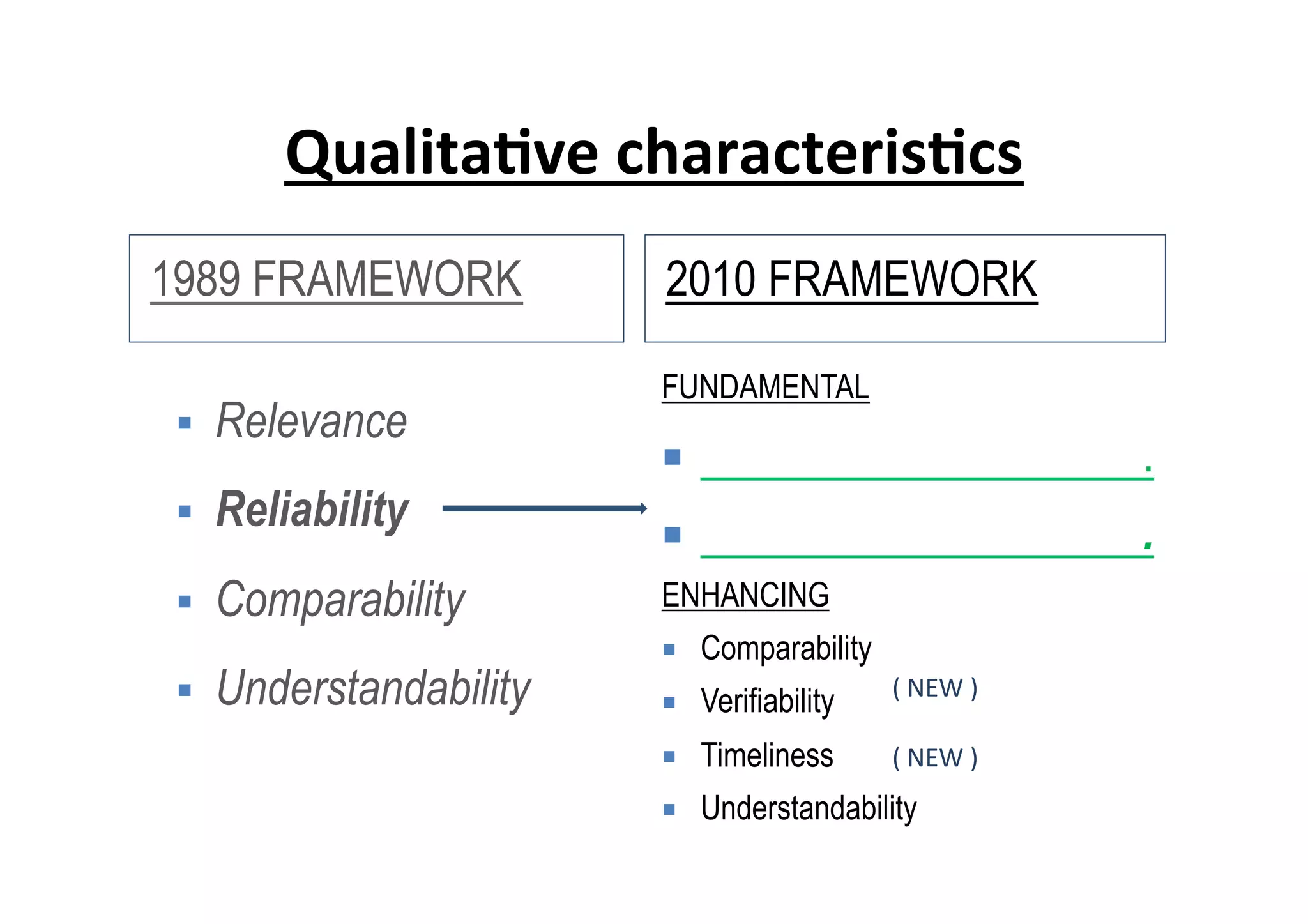

- The IASB and FASB are jointly developing an improved Conceptual Framework to replace the 1989 Framework through 8 phases of projects. The project aims to establish a consistent and comprehensive framework of concepts and definitions.