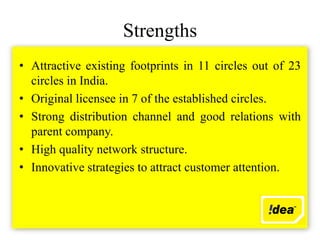

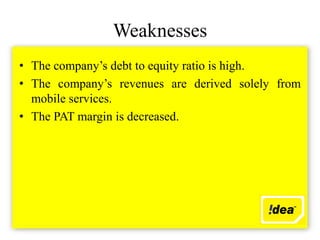

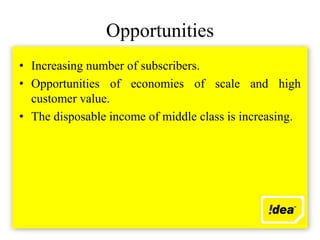

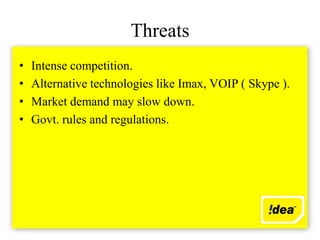

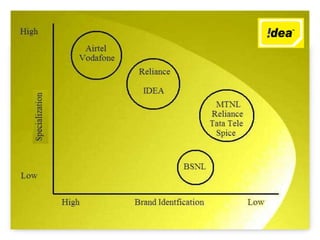

This document provides a case study analysis of Idea Cellular. It summarizes Idea Cellular's mission, strengths, weaknesses, opportunities, threats, and growth strategies. Idea Cellular has over 36 million customers and operates in 25 countries with over 100,000 employees. The analysis identifies Idea Cellular's attractive existing footprint in India and innovative strategies as strengths, and high debt and revenue reliance on mobile services as weaknesses. It also outlines opportunities for growth through increasing subscribers and disposable income. Threats include intense competition and changing regulations. The document then analyzes Idea Cellular's strategic positioning and growth through organic and inorganic strategies.