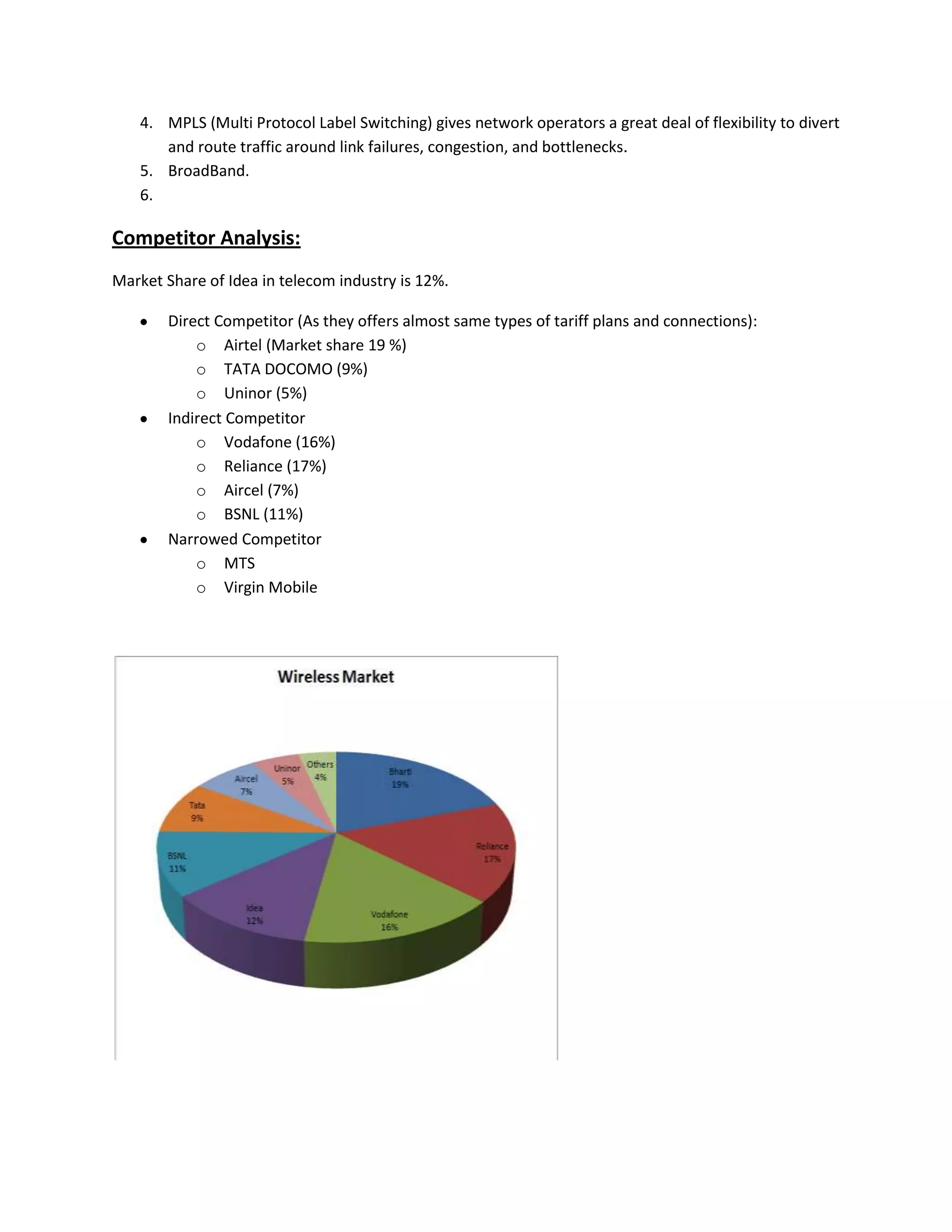

Idea Cellular is the 4th largest wireless carrier in India with 100 million customers and a 12% market share, though it faces bargaining power from customers and suppliers due to competition from other carriers offering cheaper services. New entrants like 4G and substitute technologies also pose threats. Direct competitors with similar service offerings and significant market share include Airtel, Tata Docomo, and Uninor.