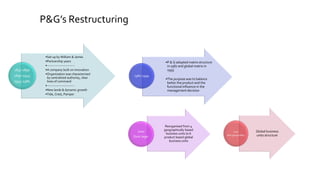

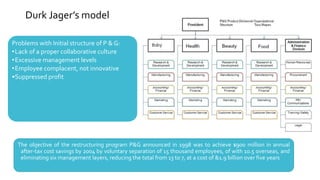

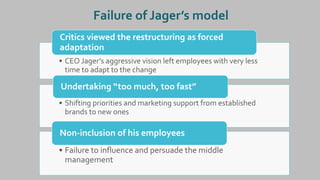

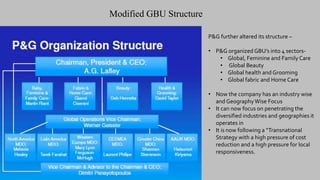

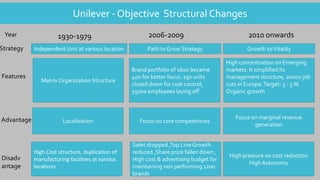

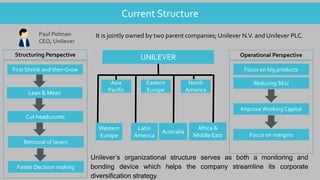

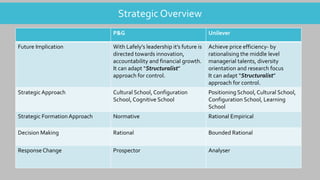

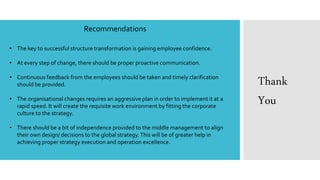

The document analyzes the organizational structure design and restructuring strategies of Procter & Gamble (P&G) and Unilever, highlighting changes such as P&G's transition from a matrix structure to a global and hybrid organizational model focused on consumer needs. It discusses the challenges faced during P&G's restructuring under CEO Durk Jager, leading to significant layoffs and criticism of forced adaptation, followed by a shift to a more localized and consumer-focused approach under Alan George Lafley. The analysis emphasizes the importance of employee confidence, proactive communication, and proper feedback mechanisms for successful organizational transformation.