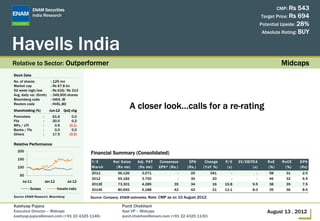

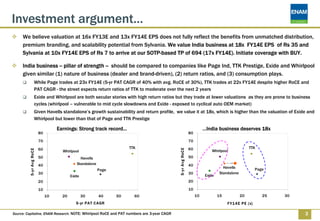

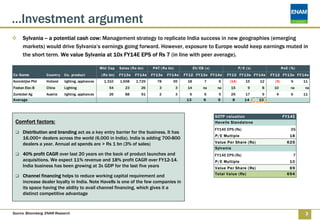

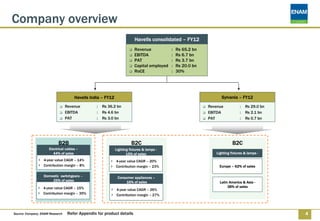

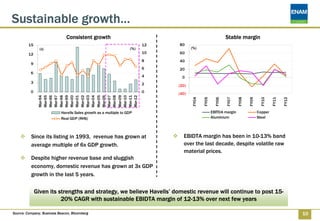

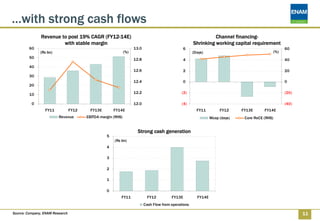

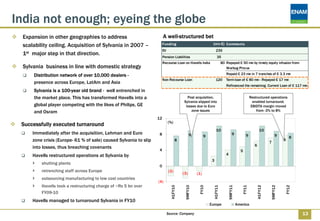

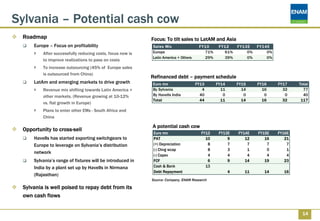

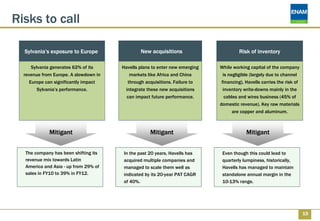

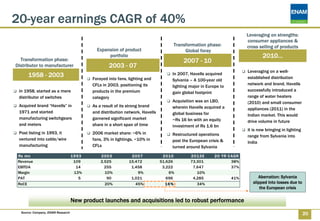

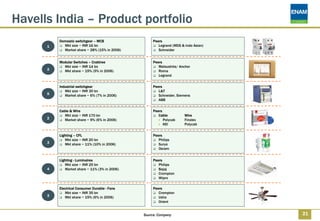

The report recommends buying Havells India with a target price of Rs 694, representing 28% upside potential. Havells has a strong distribution network and brands, and its India business deserves a higher valuation of 18x FY14 EPS compared to its peers due to stable growth and returns. The report also views Havells' Sylvania business positively, though near-term earnings will be muted in Europe; it values Sylvania at 10x FY14 EPS. The report's sum-of-the-parts valuation arrives at a target price of Rs 694 per share.