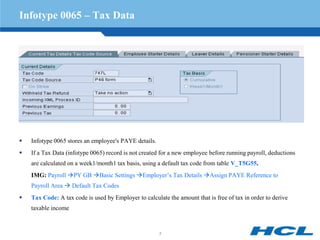

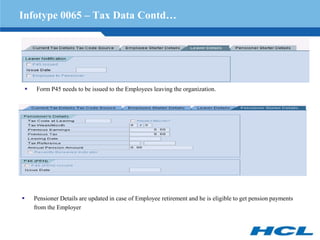

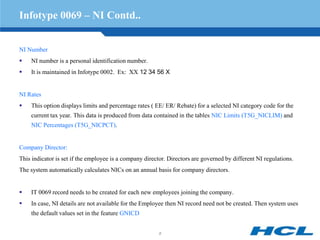

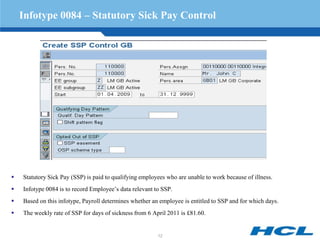

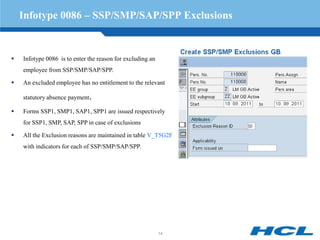

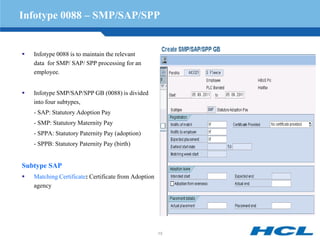

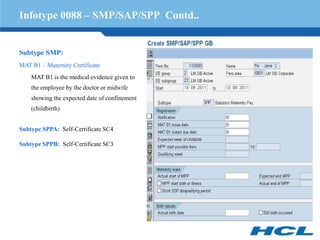

Infotypes 0065, 0069, 0070, 0071, 0084, 0086, 0088, 0442, 0570, 0571, 0757, and 0874 store different types of employee master data for payroll processing in the UK. Infotype 0065 stores tax data including the tax code, allowances, and basis. Infotype 0069 stores national insurance details like the category and rates. Court orders are recorded in infotype 0070. Pension contributions are managed in infotype 0071. Statutory sick pay details and exclusions are held in infotypes 0084 and 0086. Maternity, paternity and adoption payments are configured in infotype 0088. Company car information and benefits are