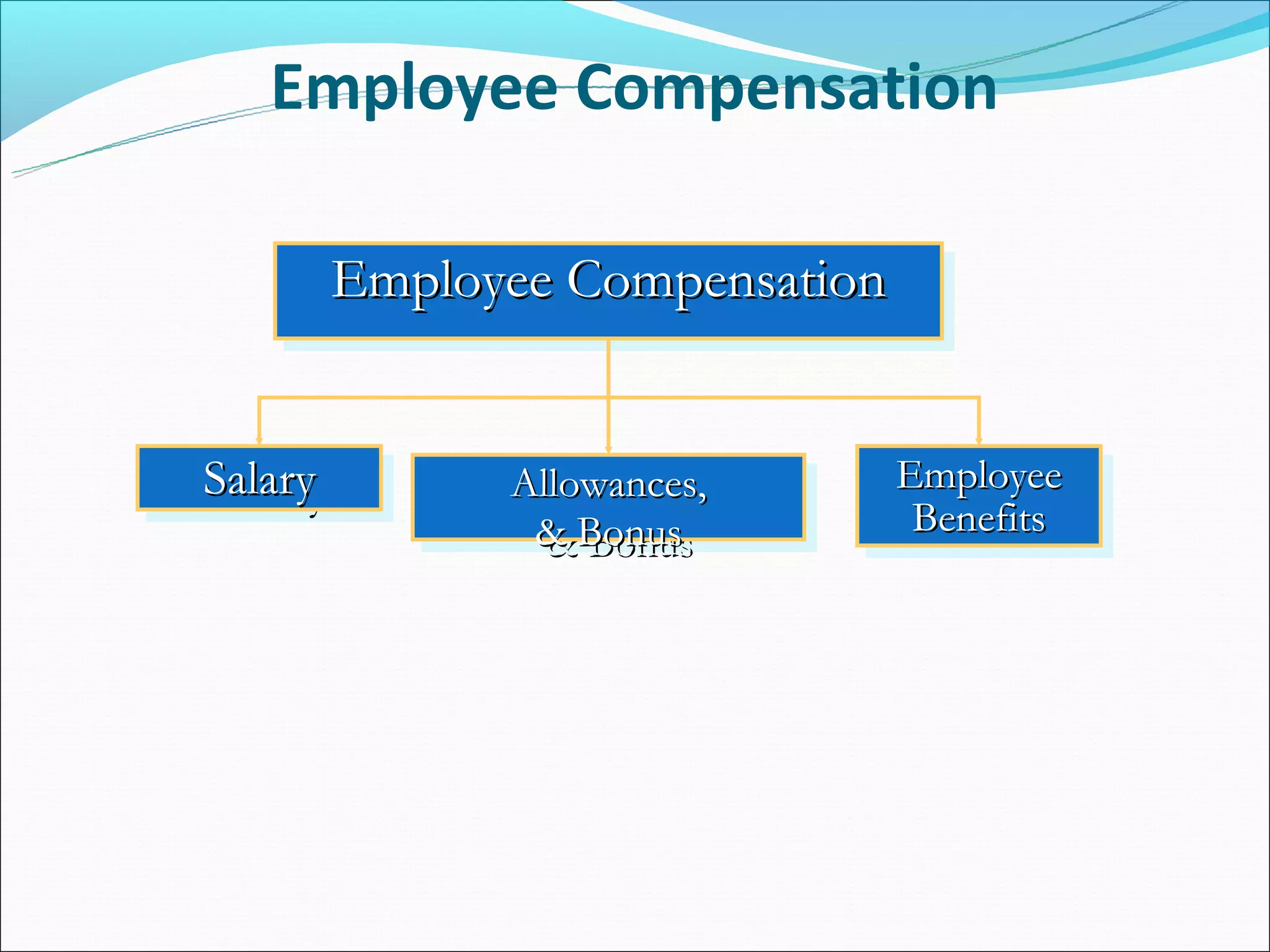

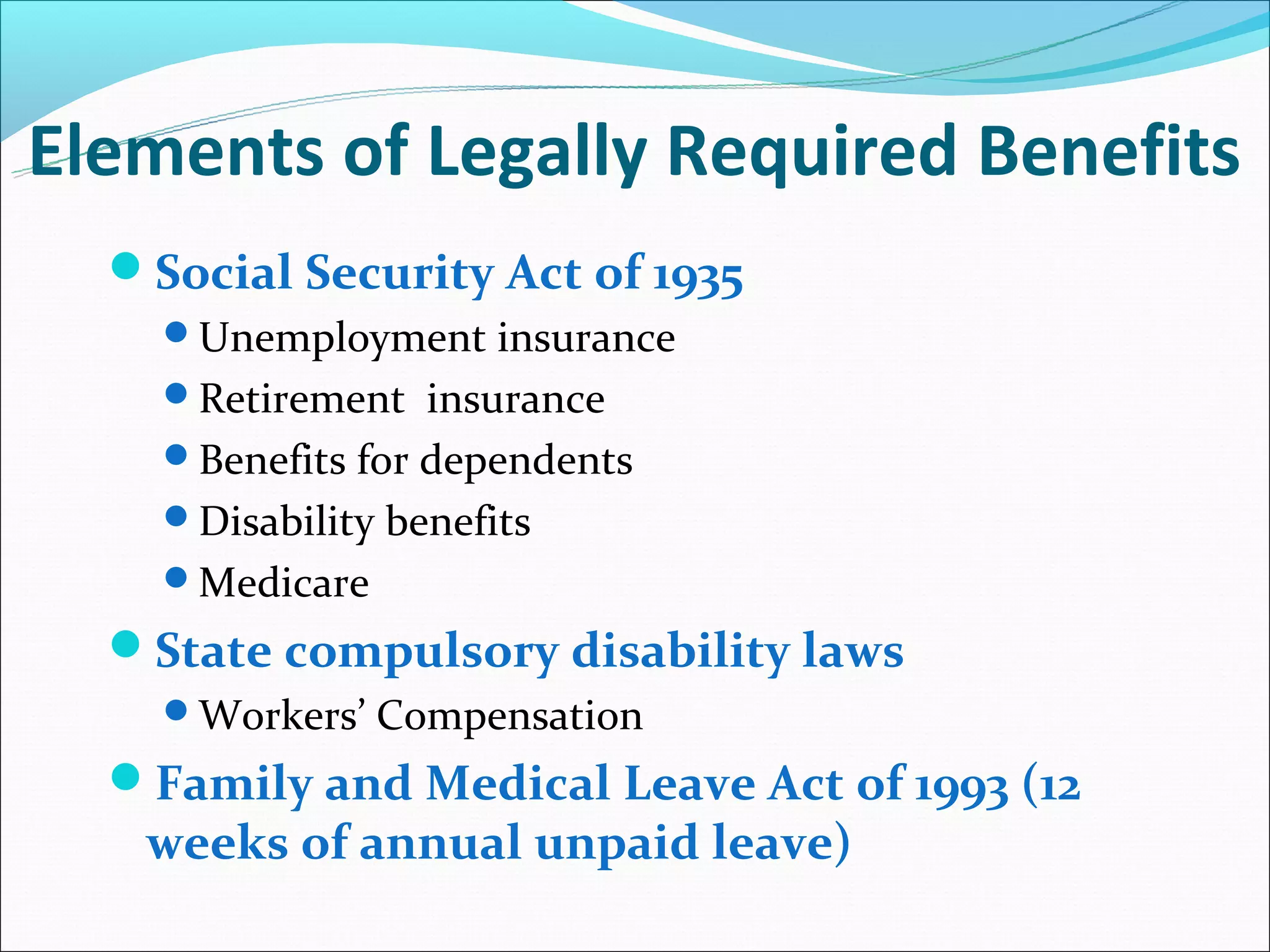

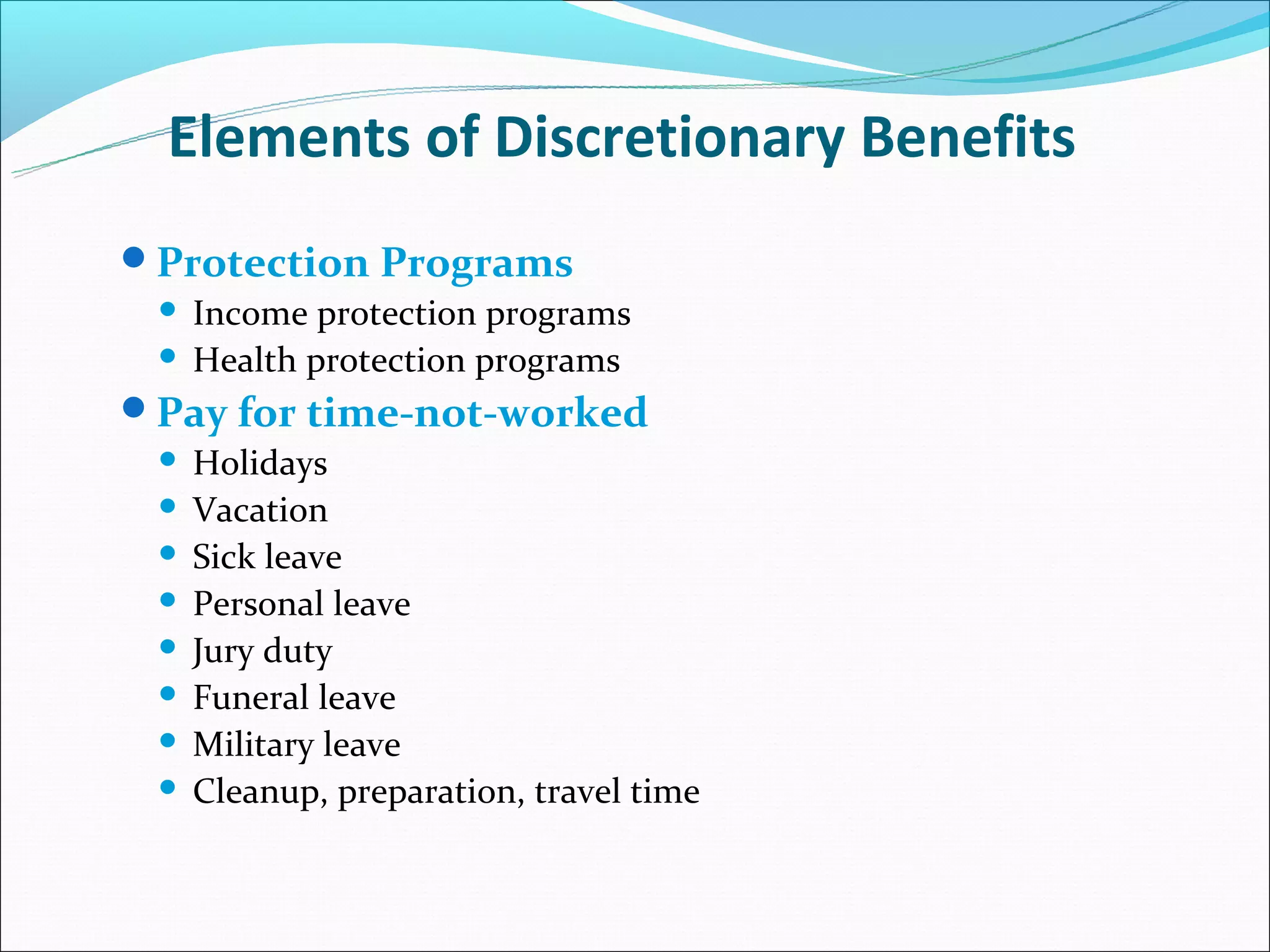

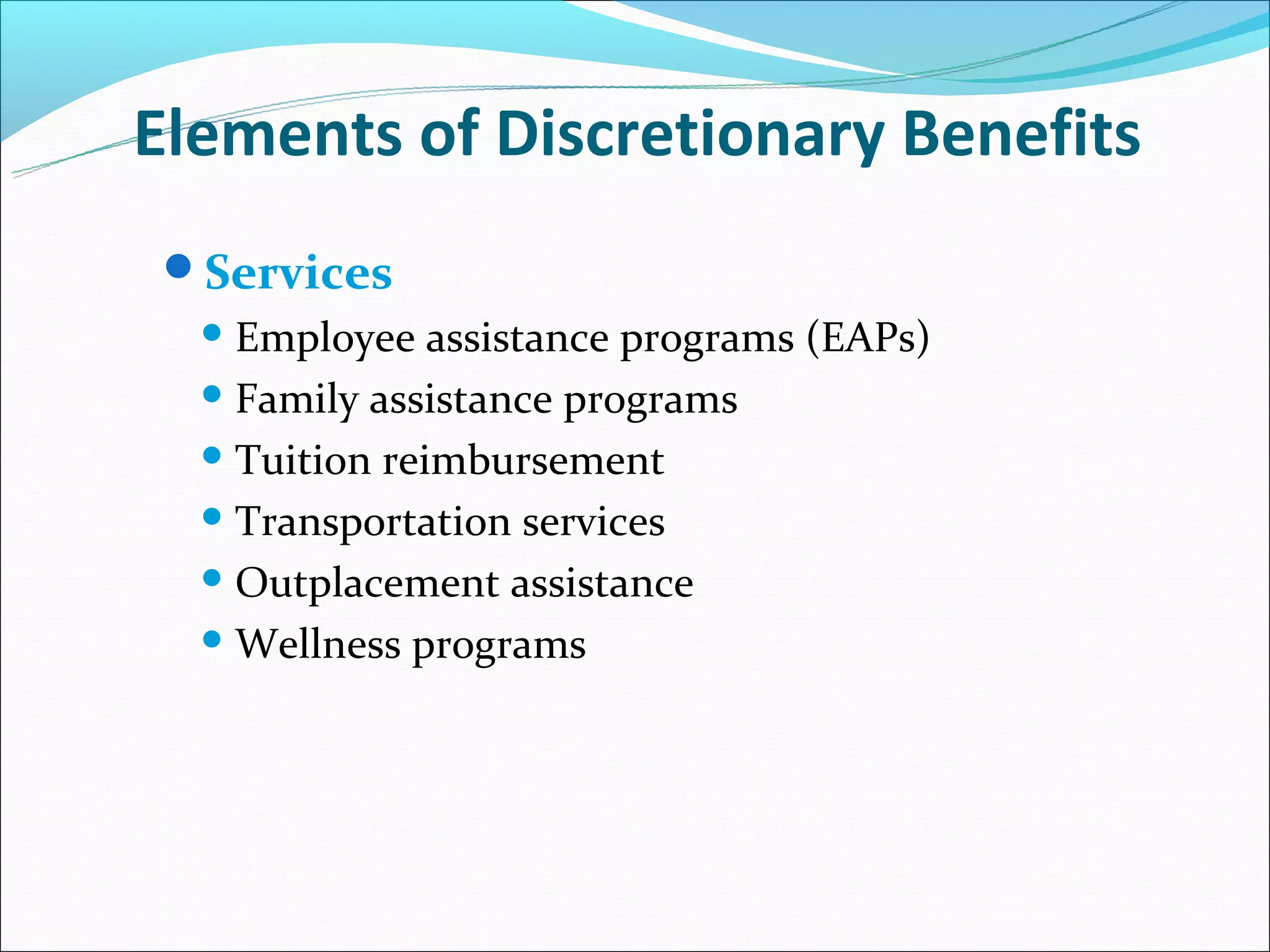

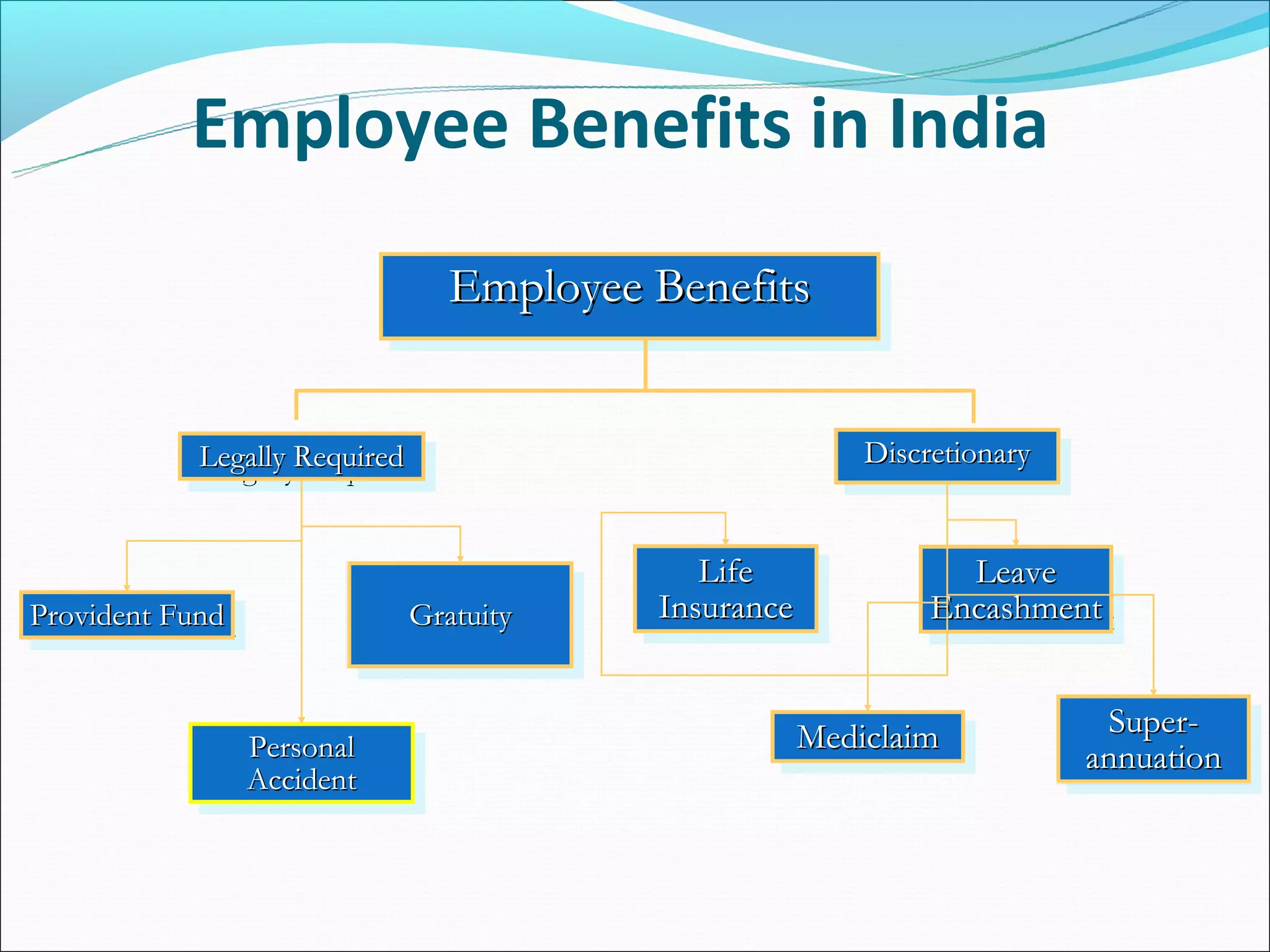

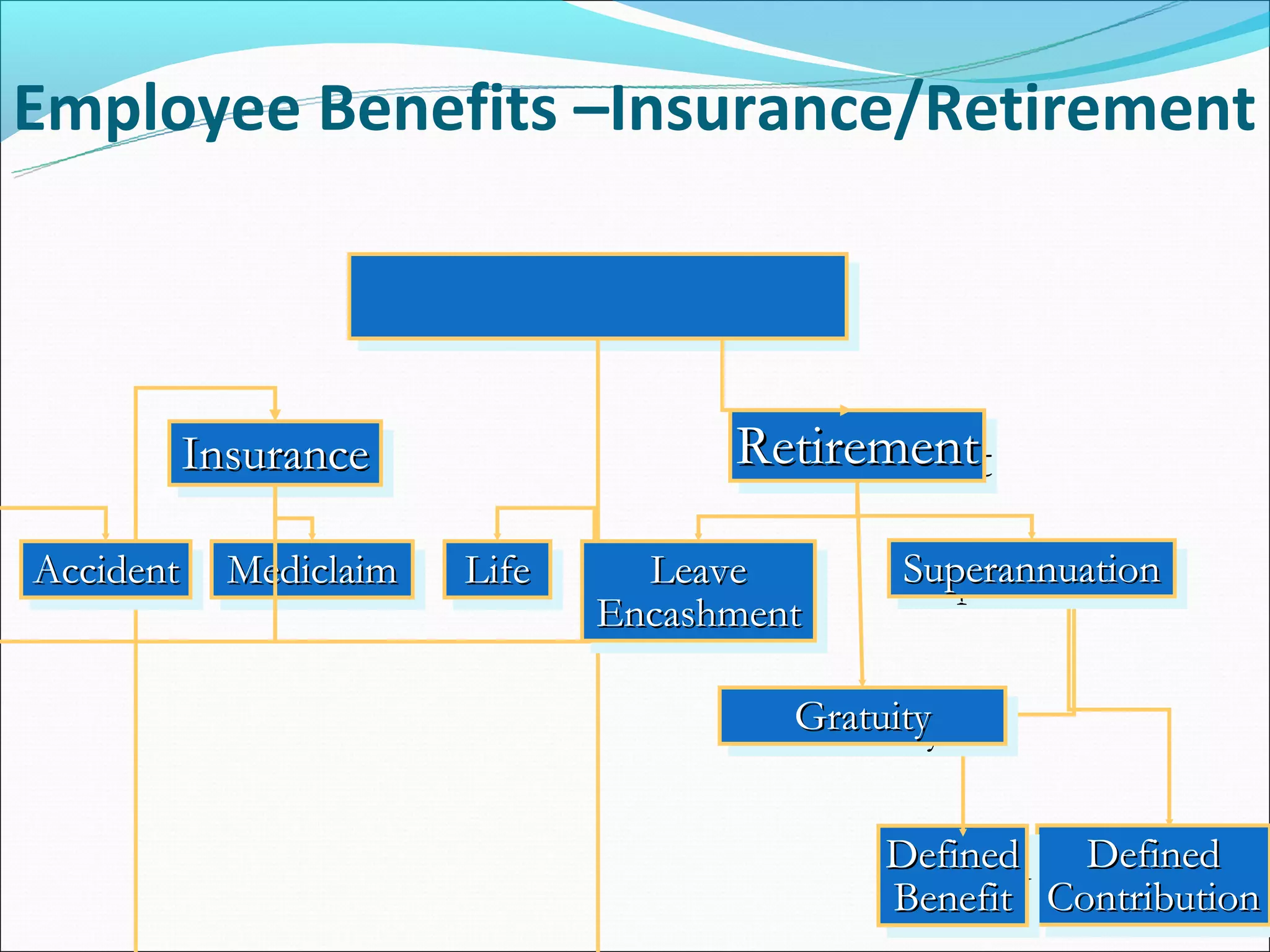

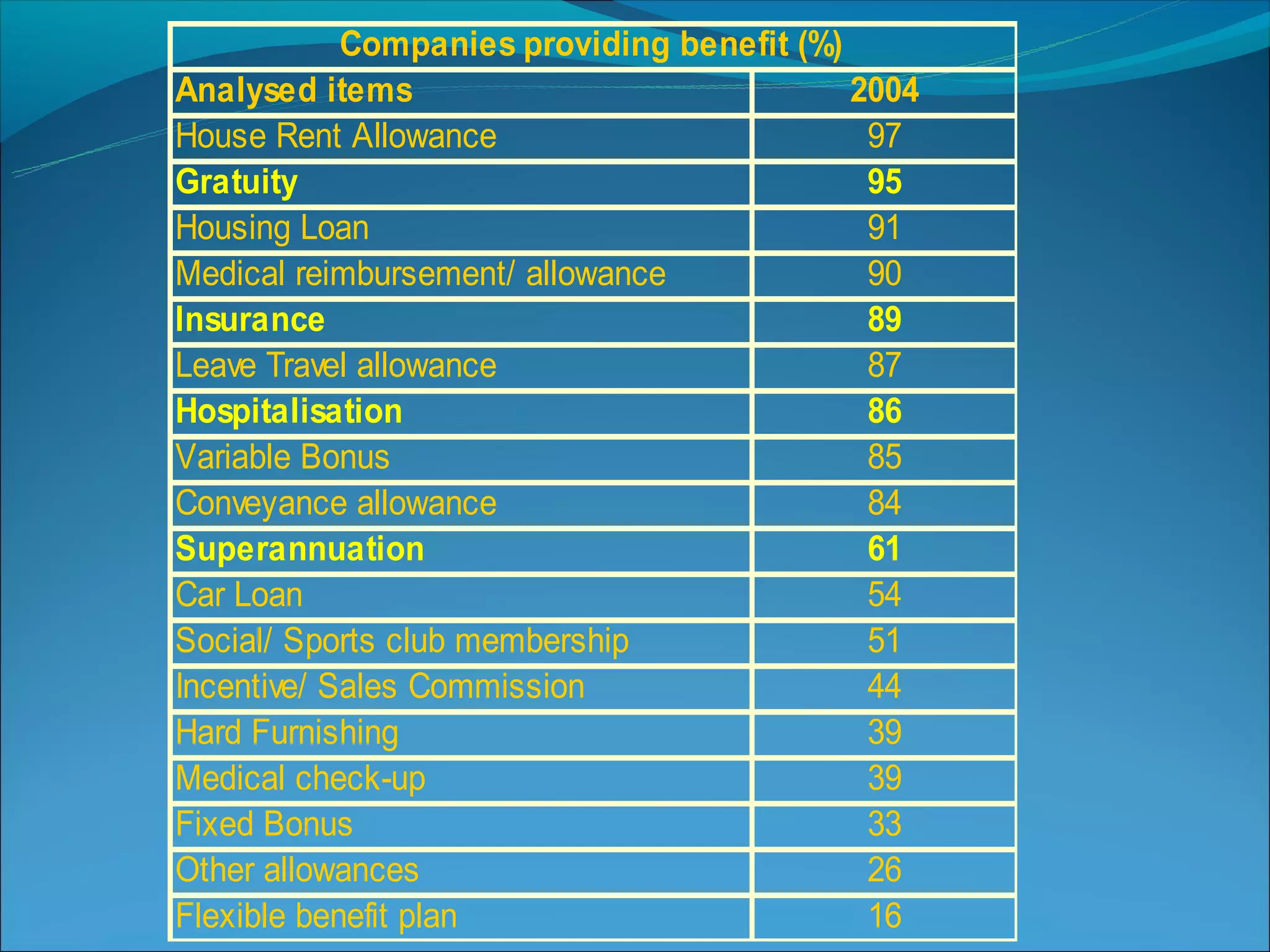

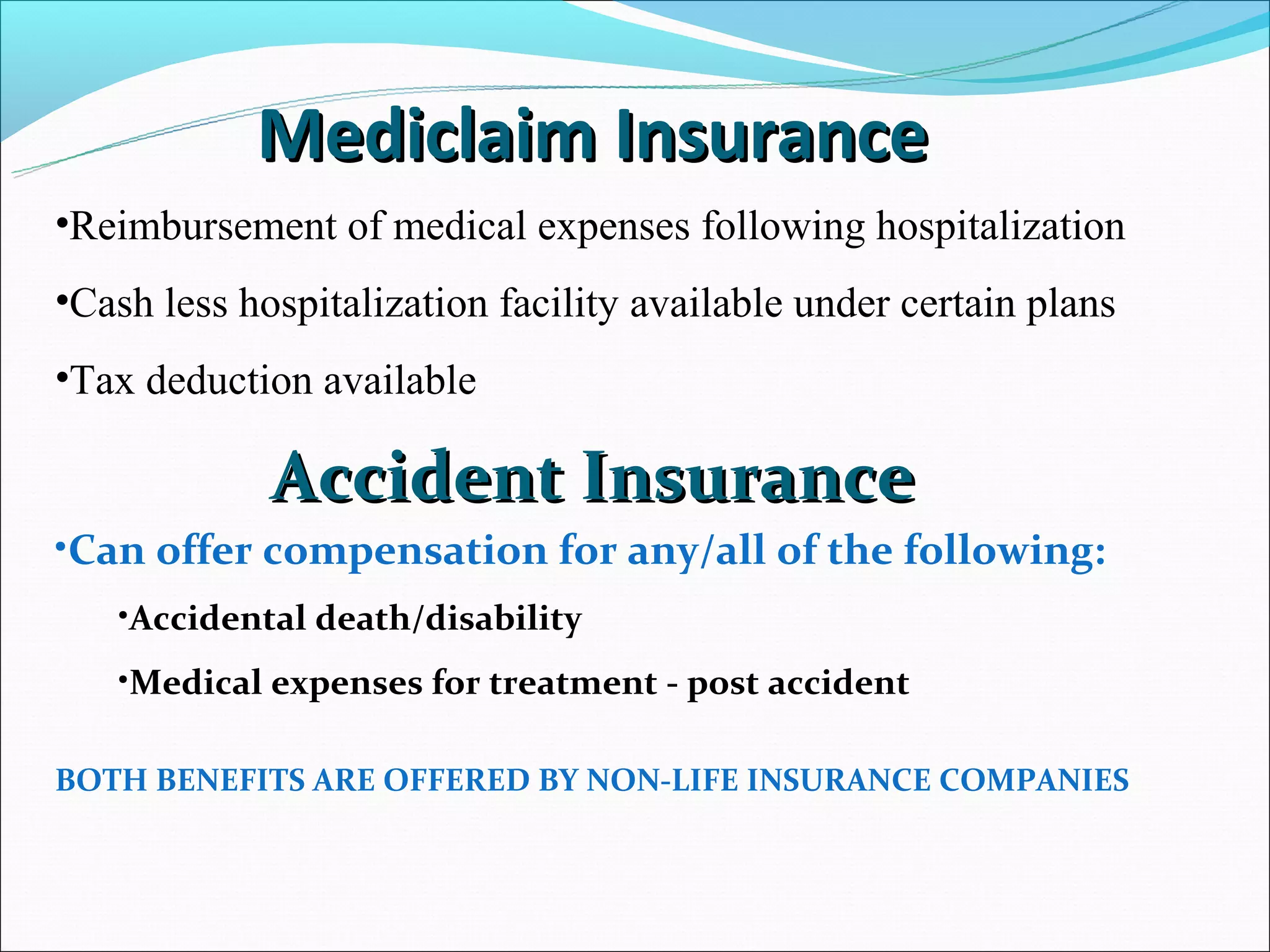

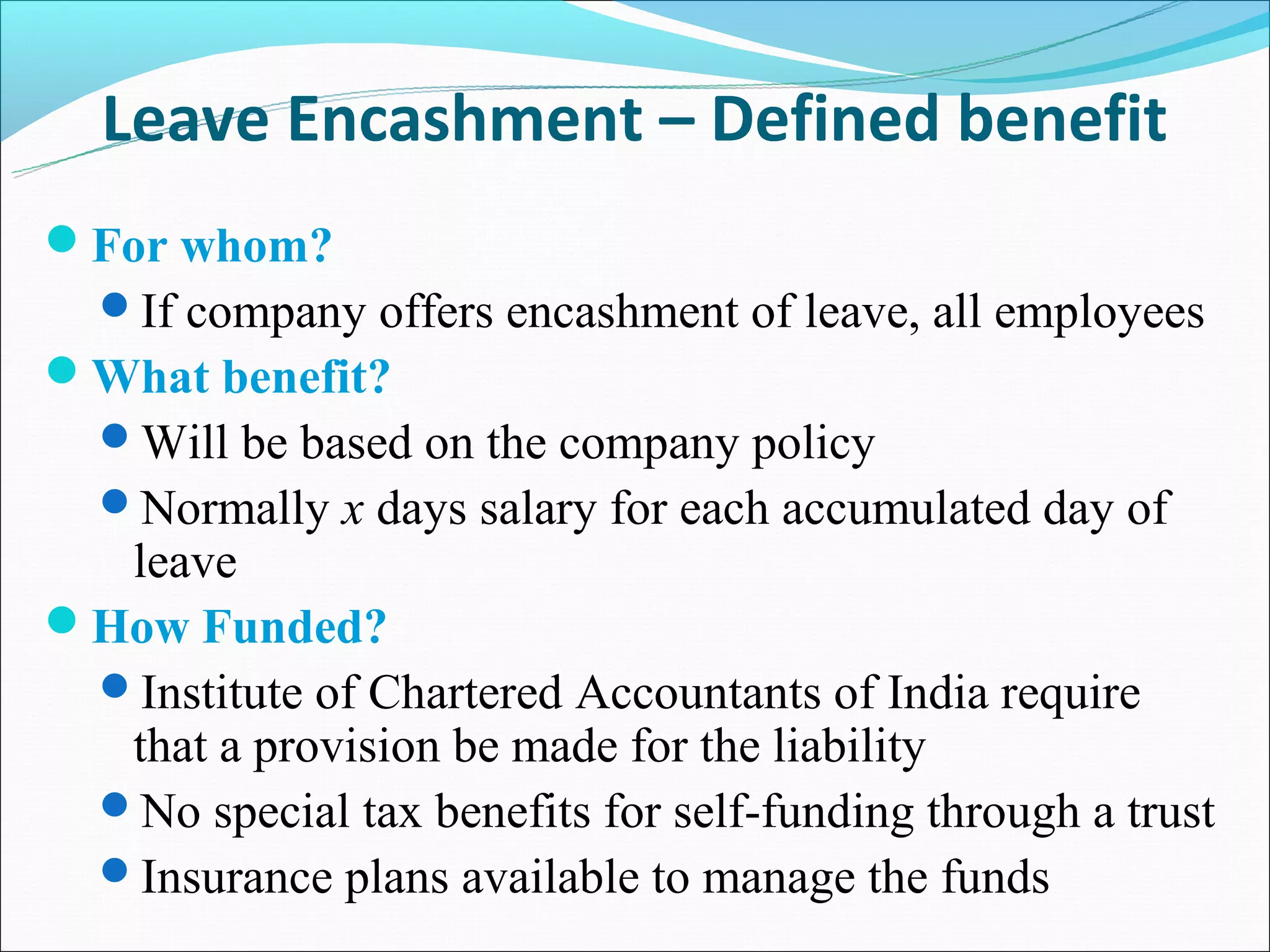

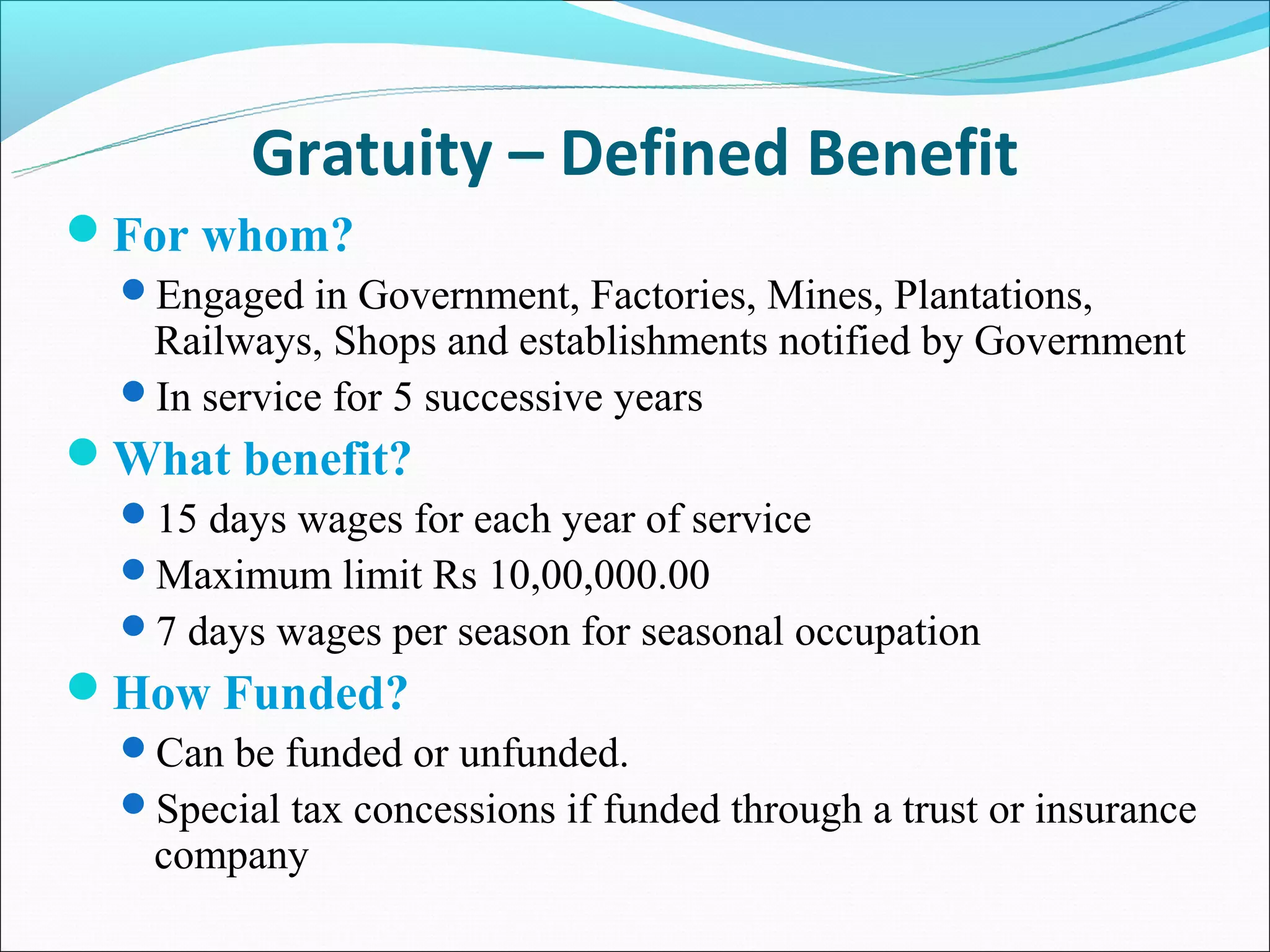

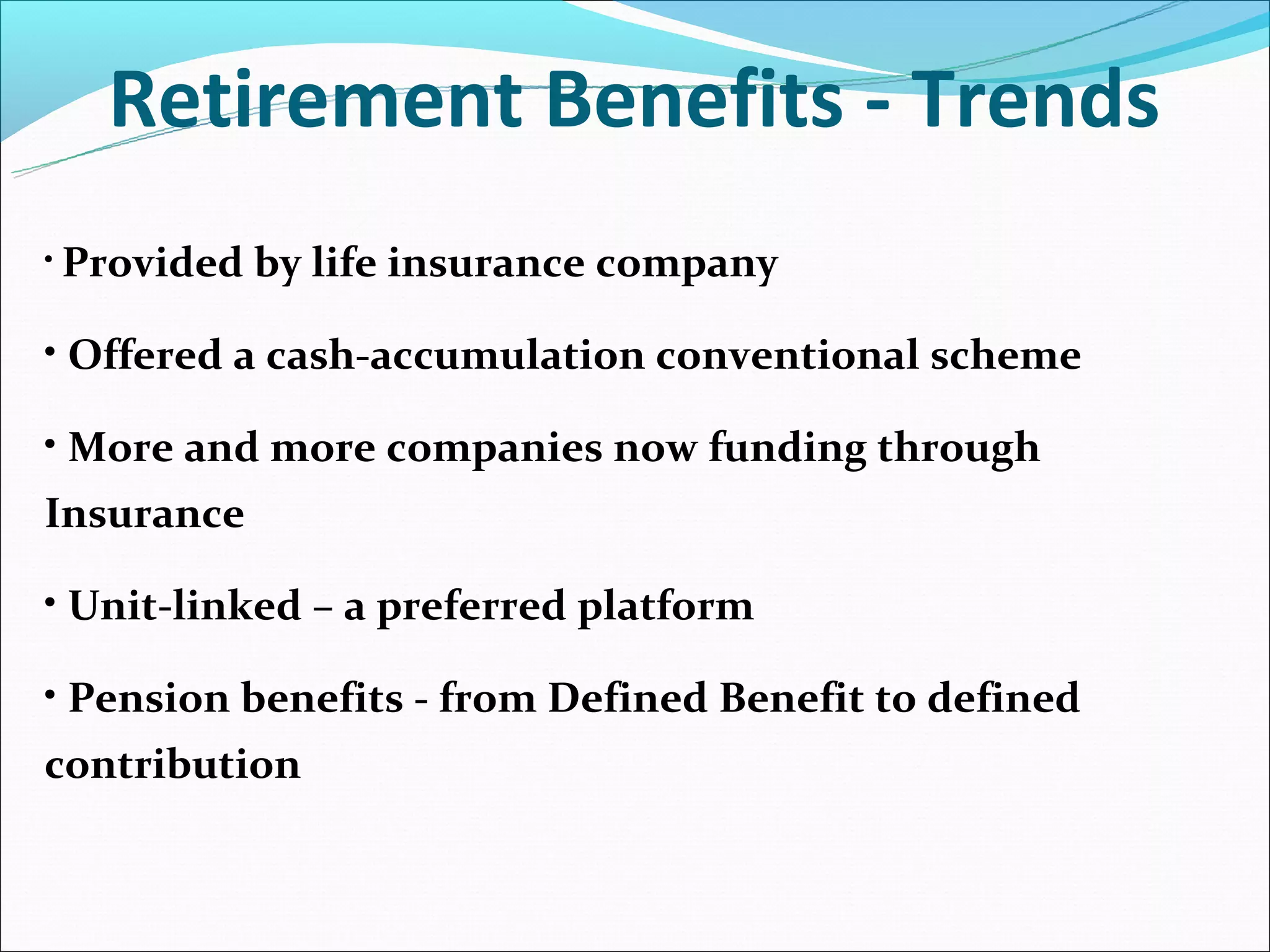

The document discusses various components of employee benefits including core compensation like salary, allowances, and bonuses. It describes legally required benefits such as social security programs and family leave. Discretionary benefits are also outlined and include health insurance, retirement plans, paid time off, tuition reimbursement, and employee assistance programs. Specific benefits commonly offered in India are then detailed such as provident funds, gratuity, life and medical insurance, leave encashment, and superannuation plans. The trends in retirement benefits moving from defined benefit to defined contribution plans are also summarized.