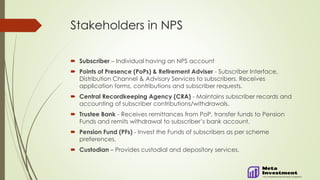

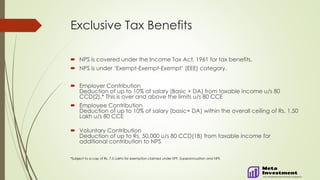

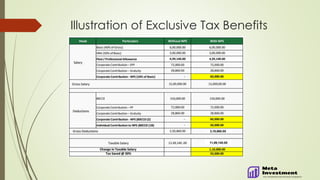

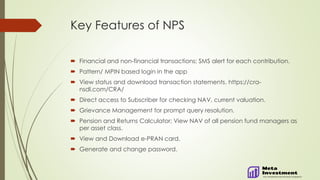

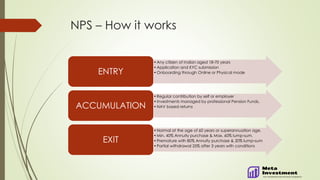

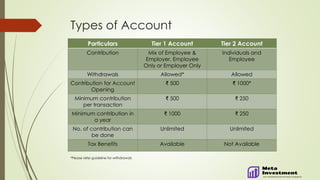

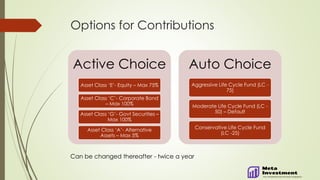

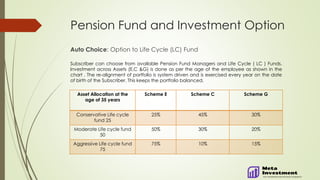

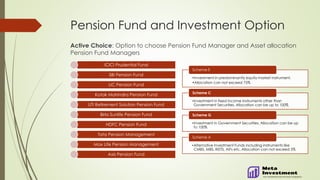

The National Pension Scheme (NPS) is a low-cost, tax-efficient retirement savings account available to Indian citizens aged 18-70 that combines individual and employer contributions to a pension fund. It allows participants to choose their fund managers and investment options, with various tax benefits under the Income Tax Act. The scheme offers flexibility in terms of withdrawals, portability, and online management while ensuring regulated investments by the Pension Fund Regulatory and Development Authority (PFRDA).