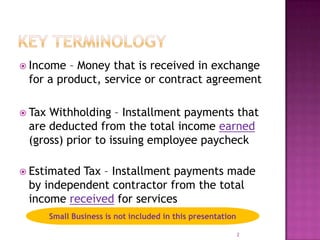

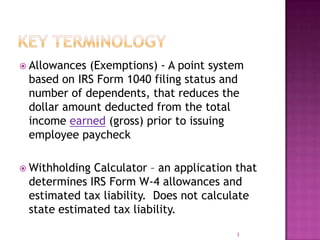

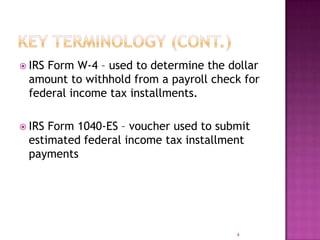

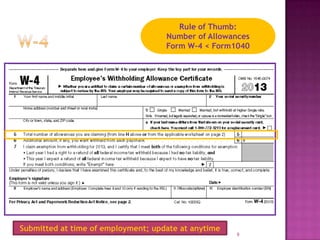

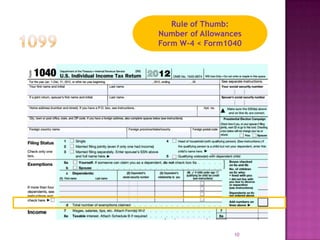

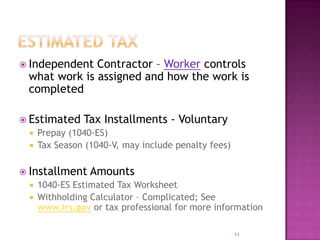

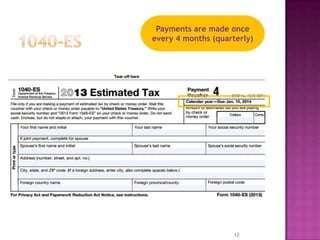

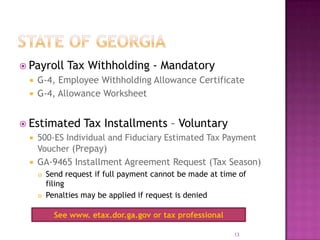

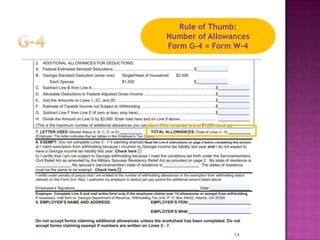

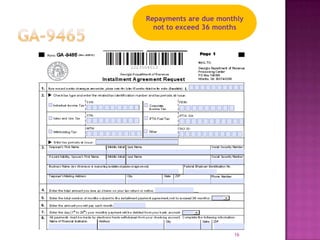

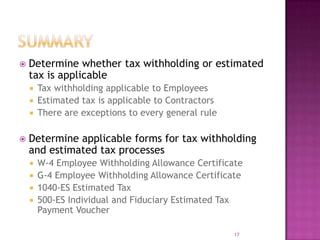

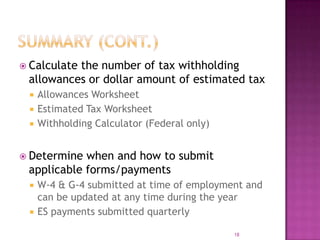

This document summarizes tax withholdings and estimated payments for employees and independent contractors. It defines key terms like income, tax withholding, and estimated tax. It outlines the applicable forms for federal (IRS Form W-4, 1040-ES) and state of Georgia (GA Form G-4, 500-ES) tax withholdings and payments. It provides guidance on calculating withholdings and estimated tax amounts, as well as determining when and how to submit the applicable forms and payments.