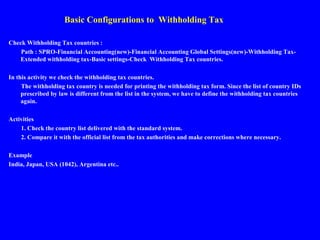

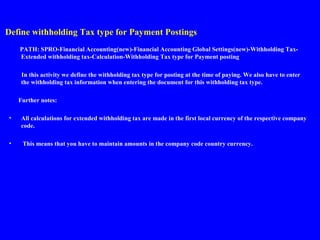

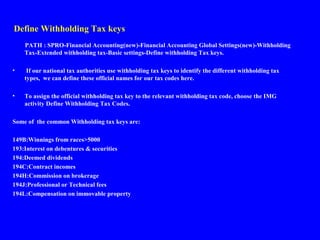

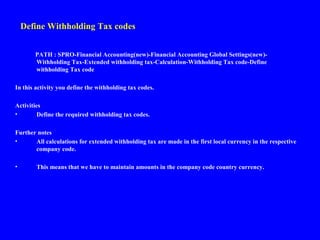

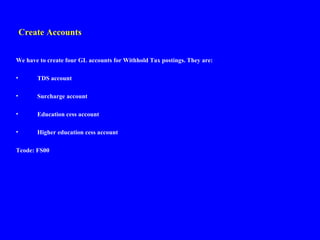

Withholding tax is a tax deducted at the source of payment and paid to the tax authority on behalf of the recipient. There are two types: classical and extended. It typically applies to employment income, interest, dividends, and some other types of income when paid to recipients in other jurisdictions. Governments use it to combat tax evasion. The amount withheld is usually a fixed percentage of the payment amount but can vary based on the recipient's estimated tax liability. Proper configuration in SAP involves defining tax codes, accounts, minimum/maximum amounts, due dates, and more based on the tax regulations of each country.