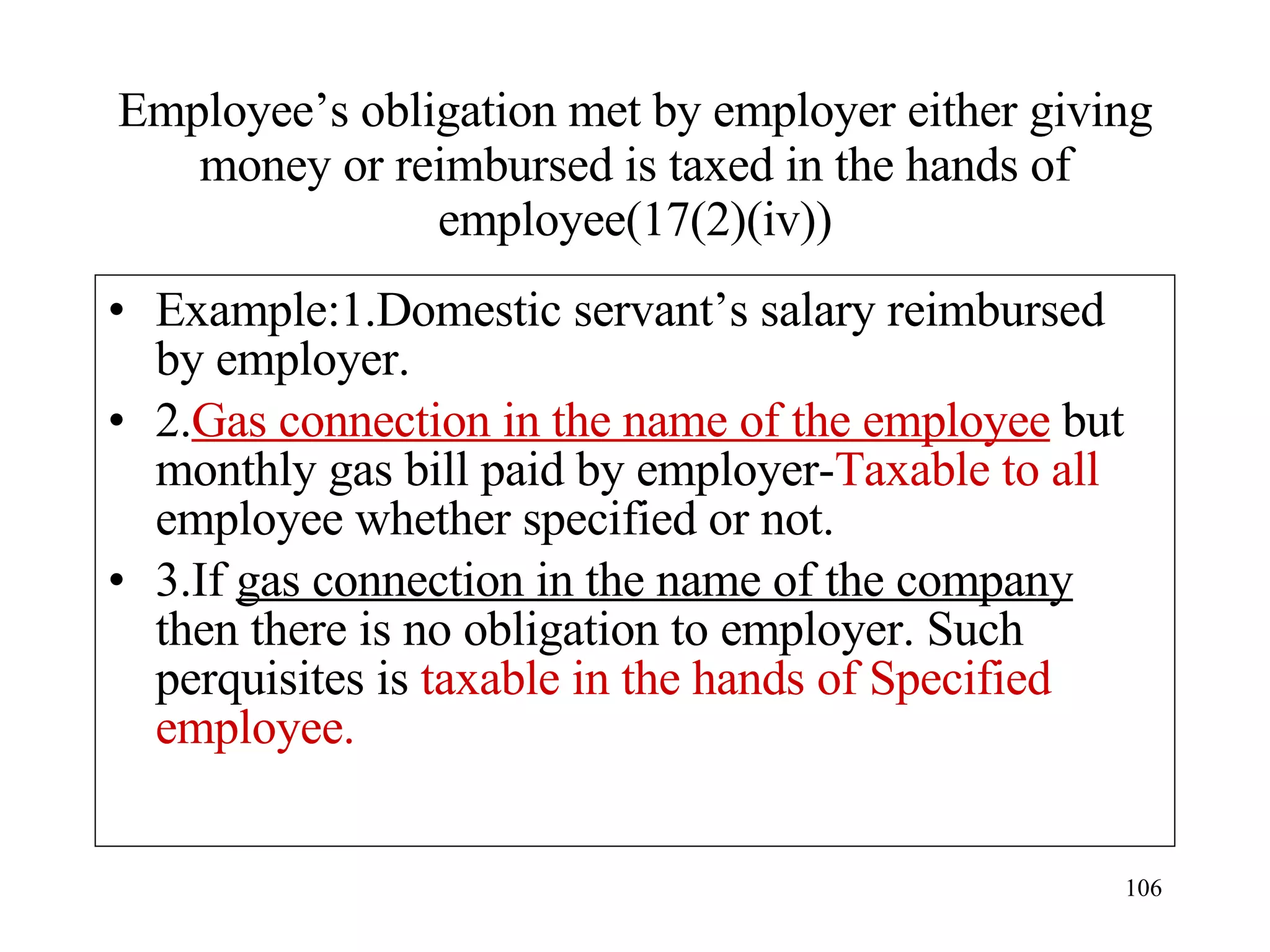

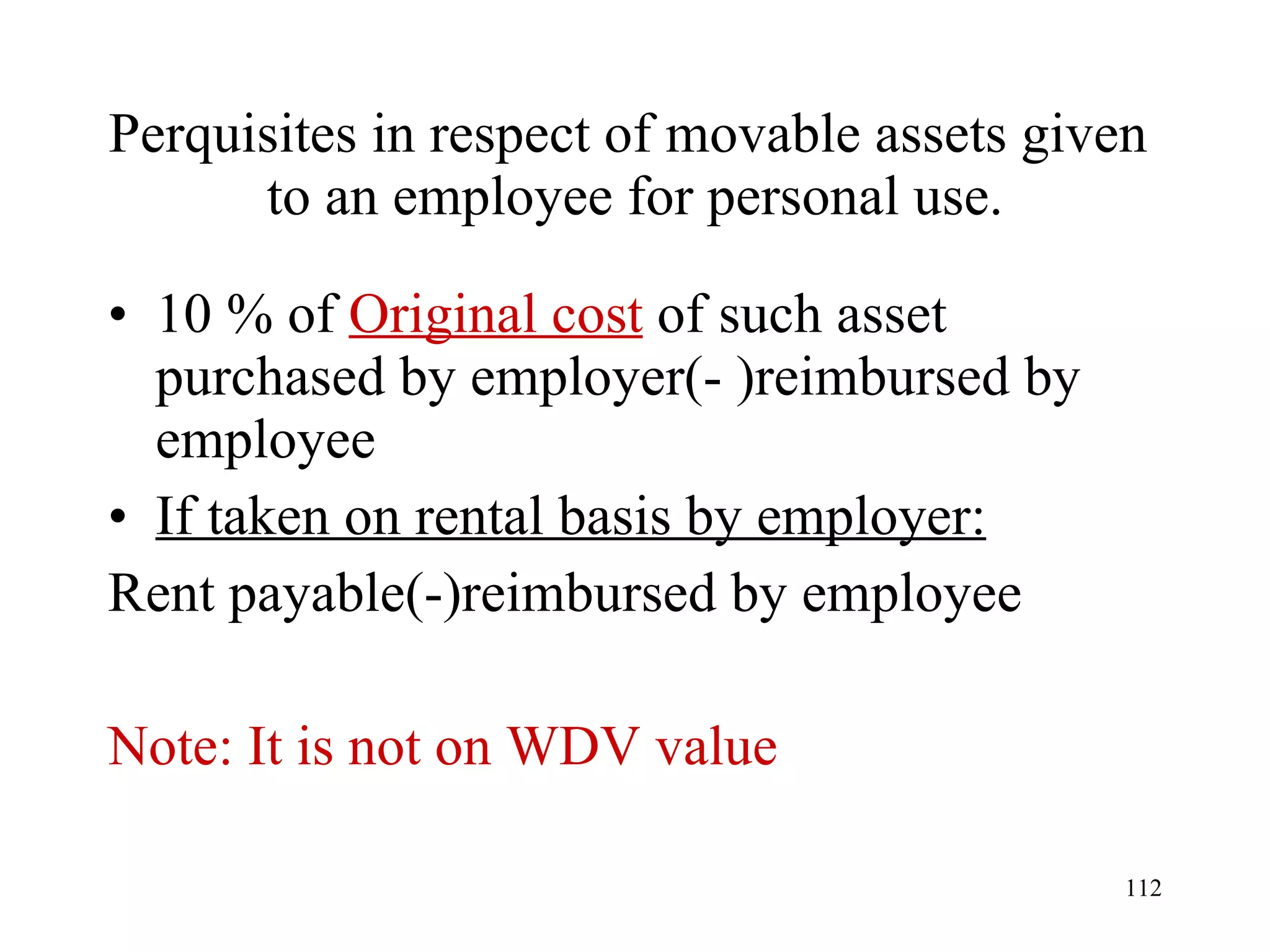

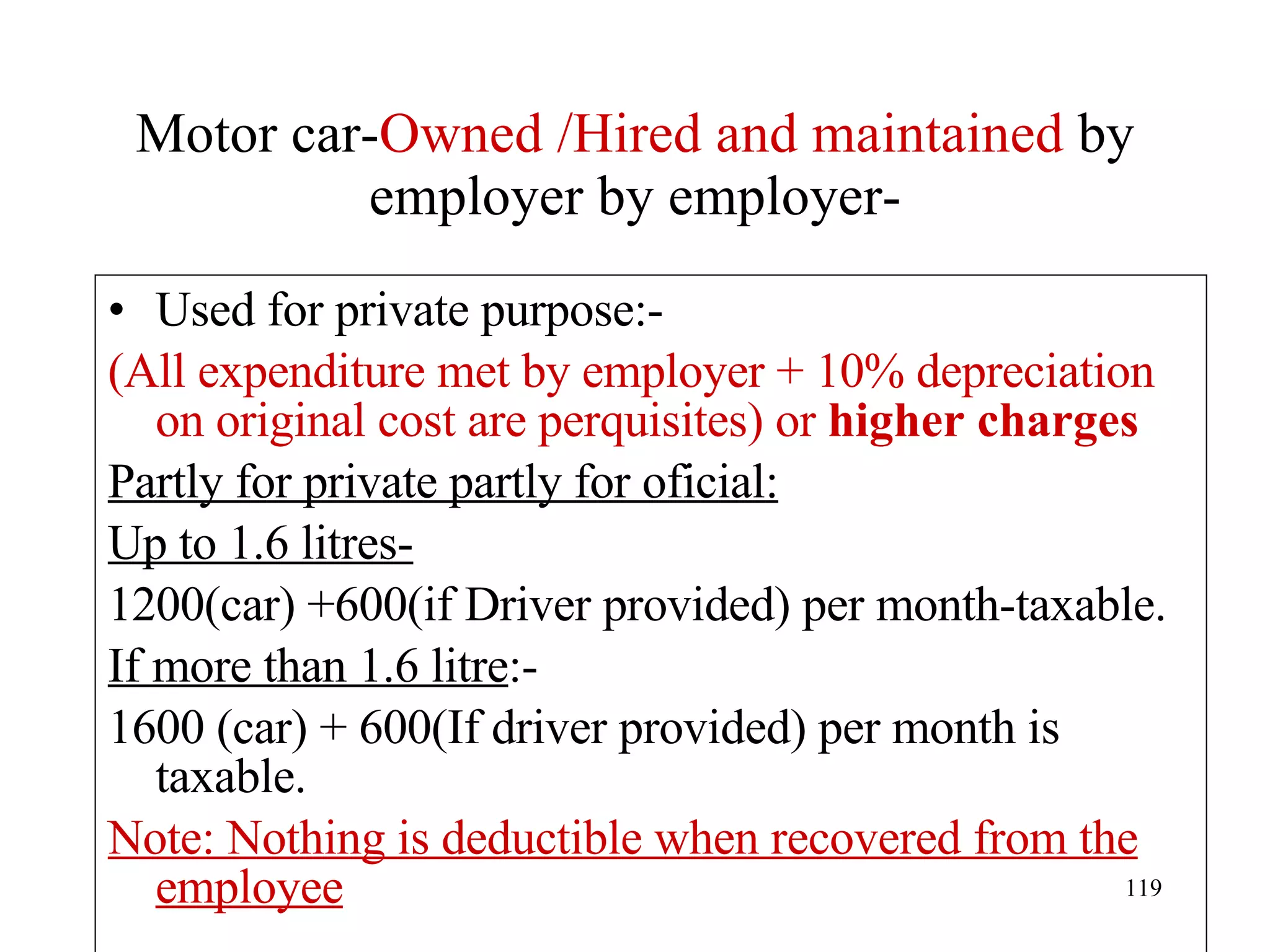

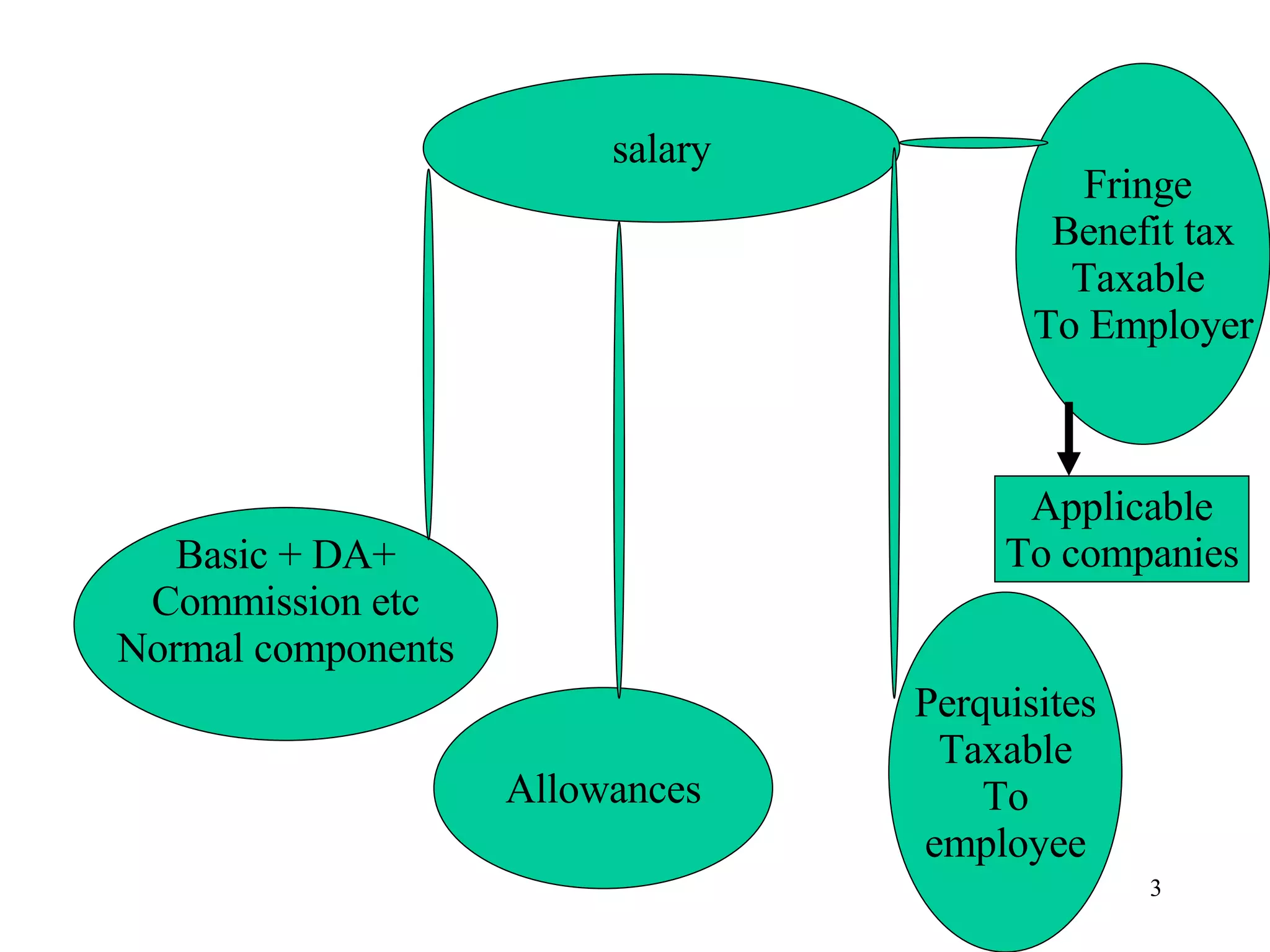

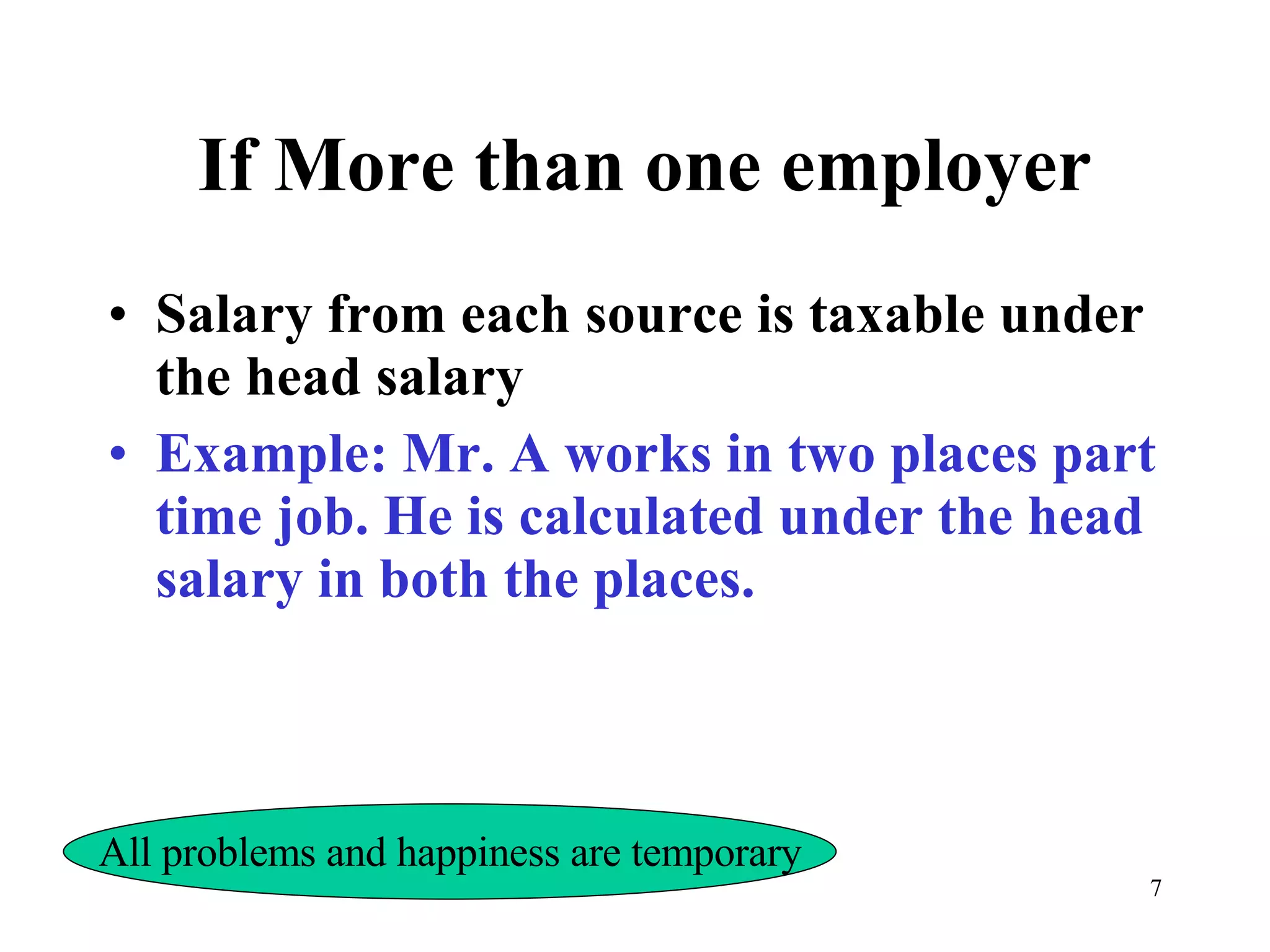

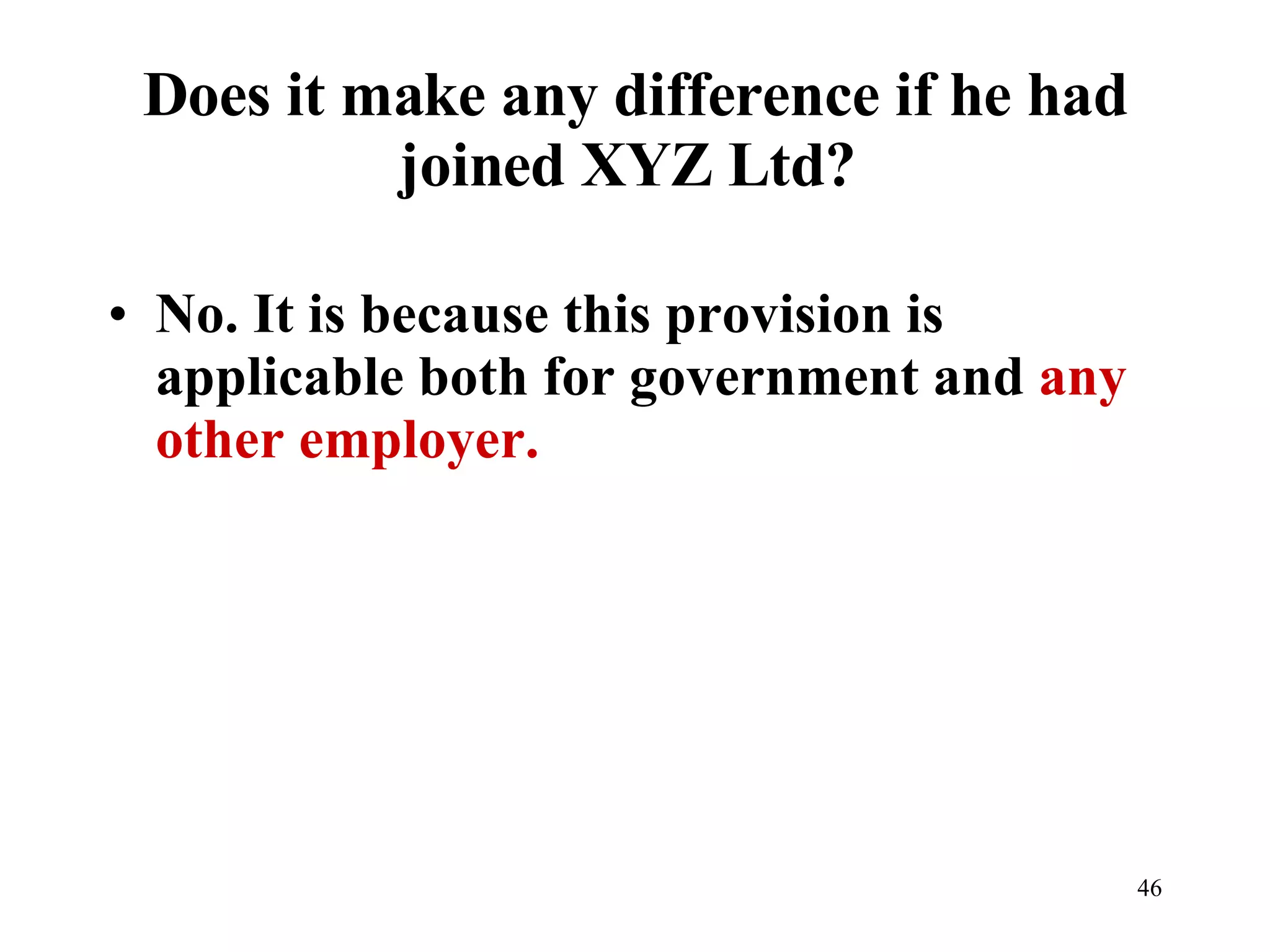

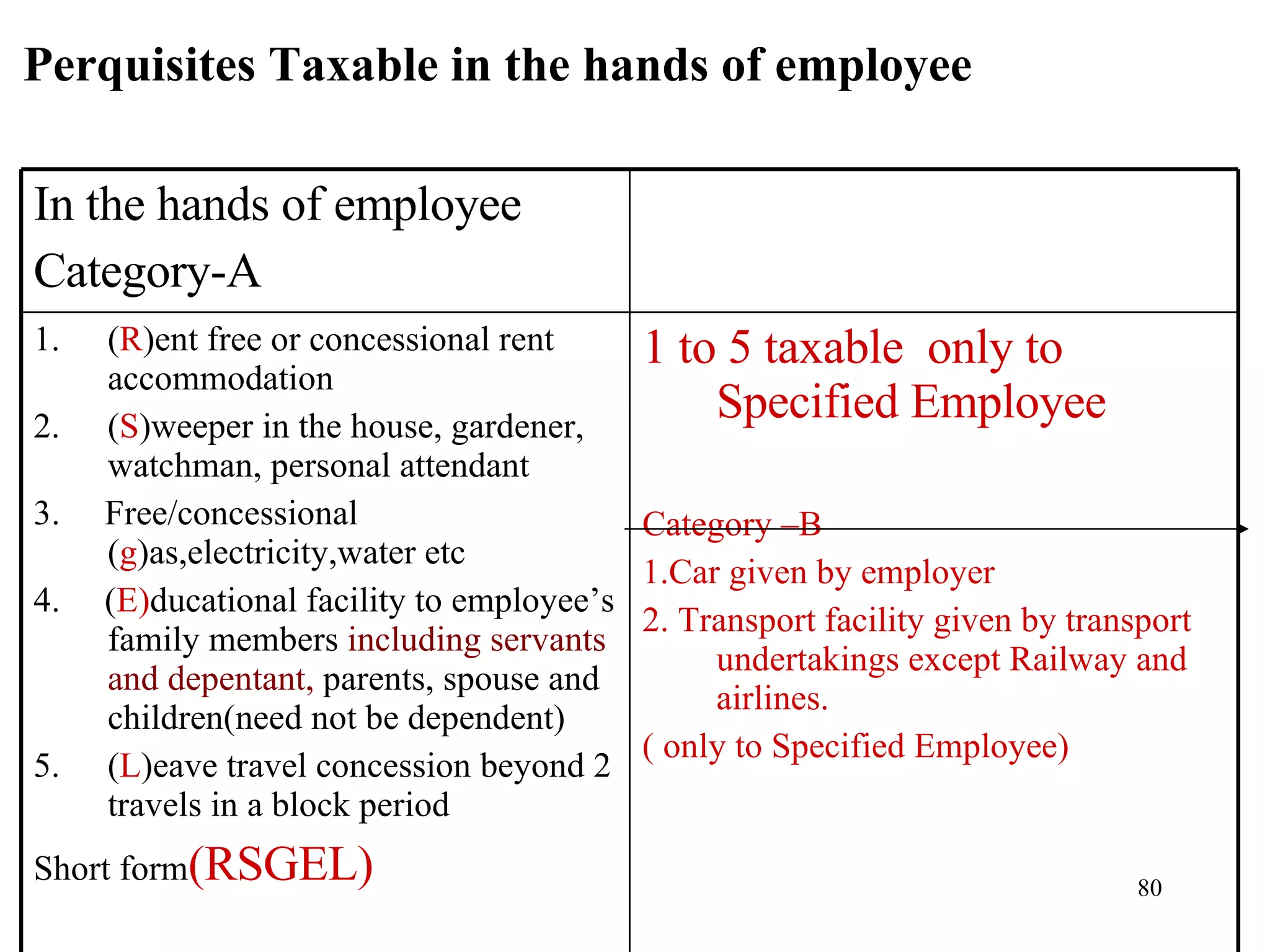

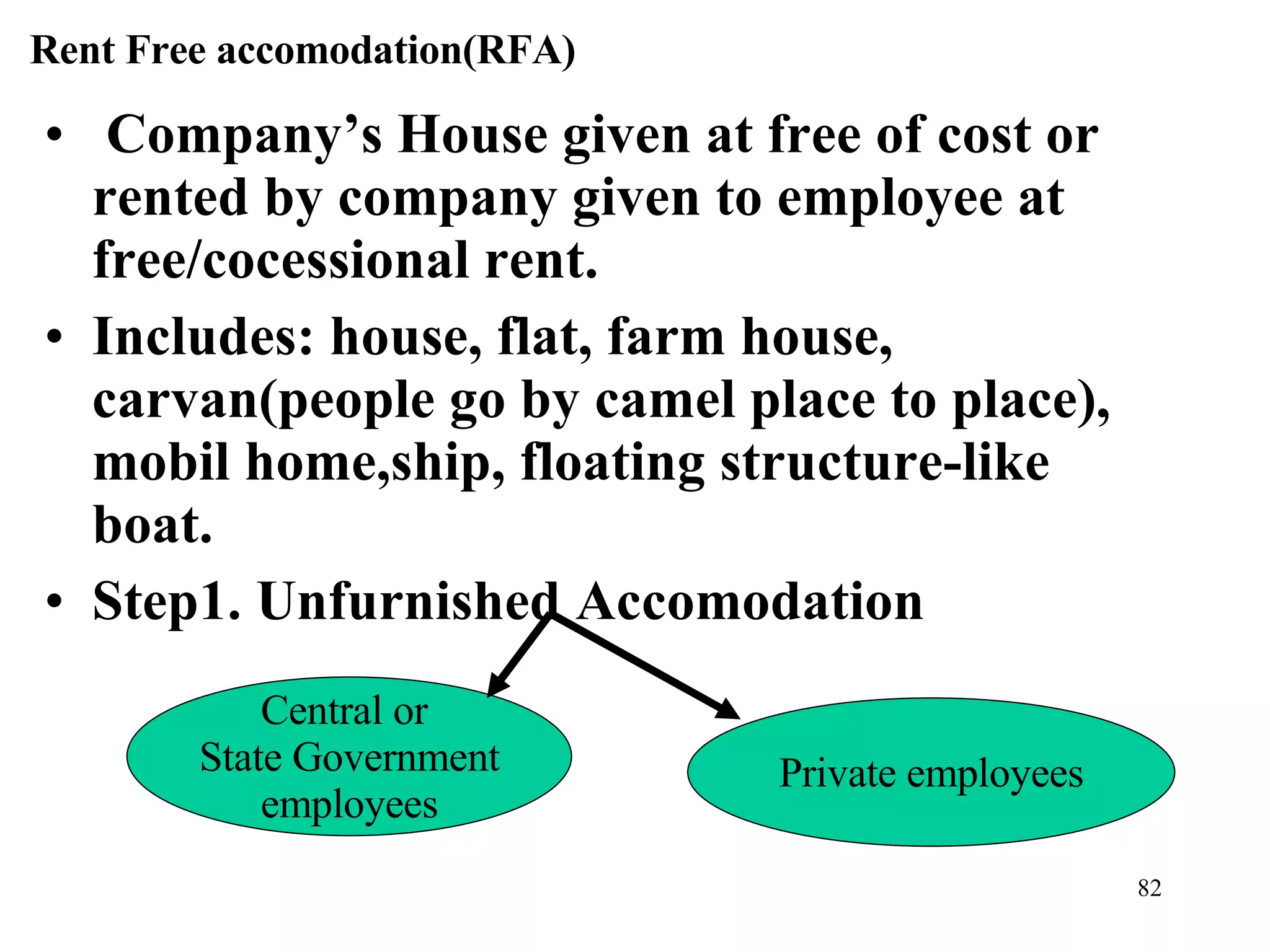

- The document discusses various types of income that are taxed as salary under the Income Tax Act, including regular salary, bonuses, commissions, pensions, gratuity, and leave encashment.

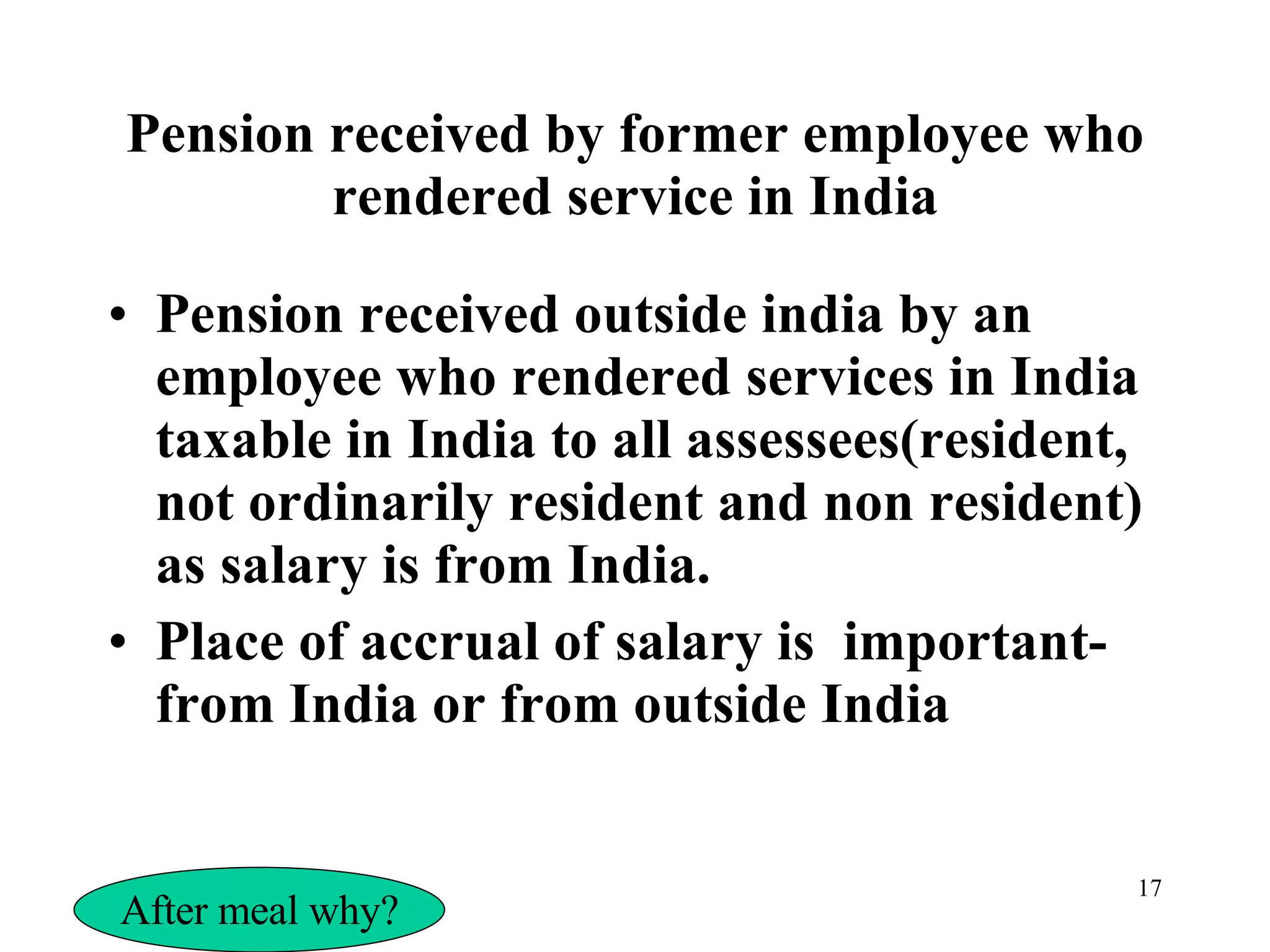

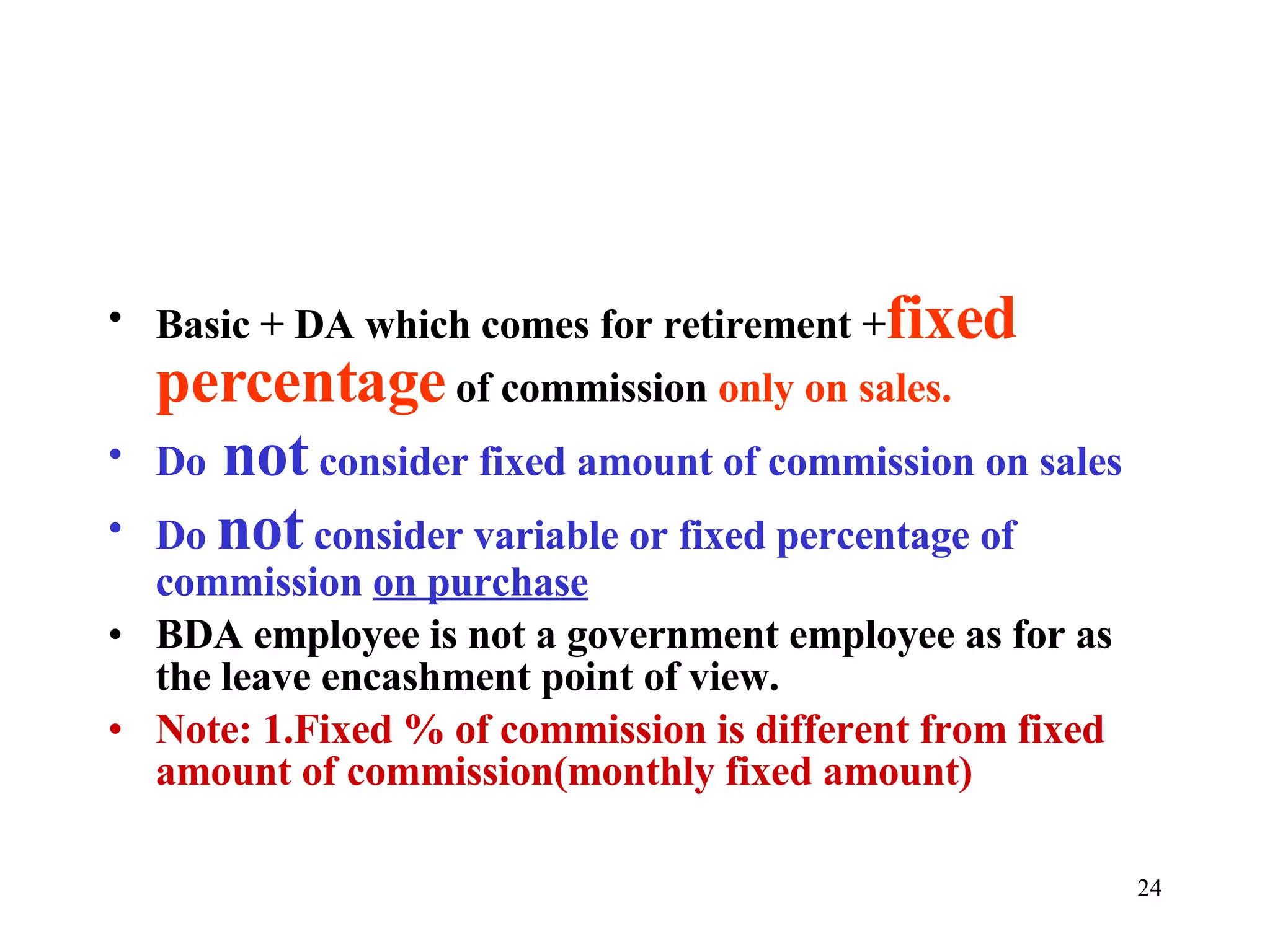

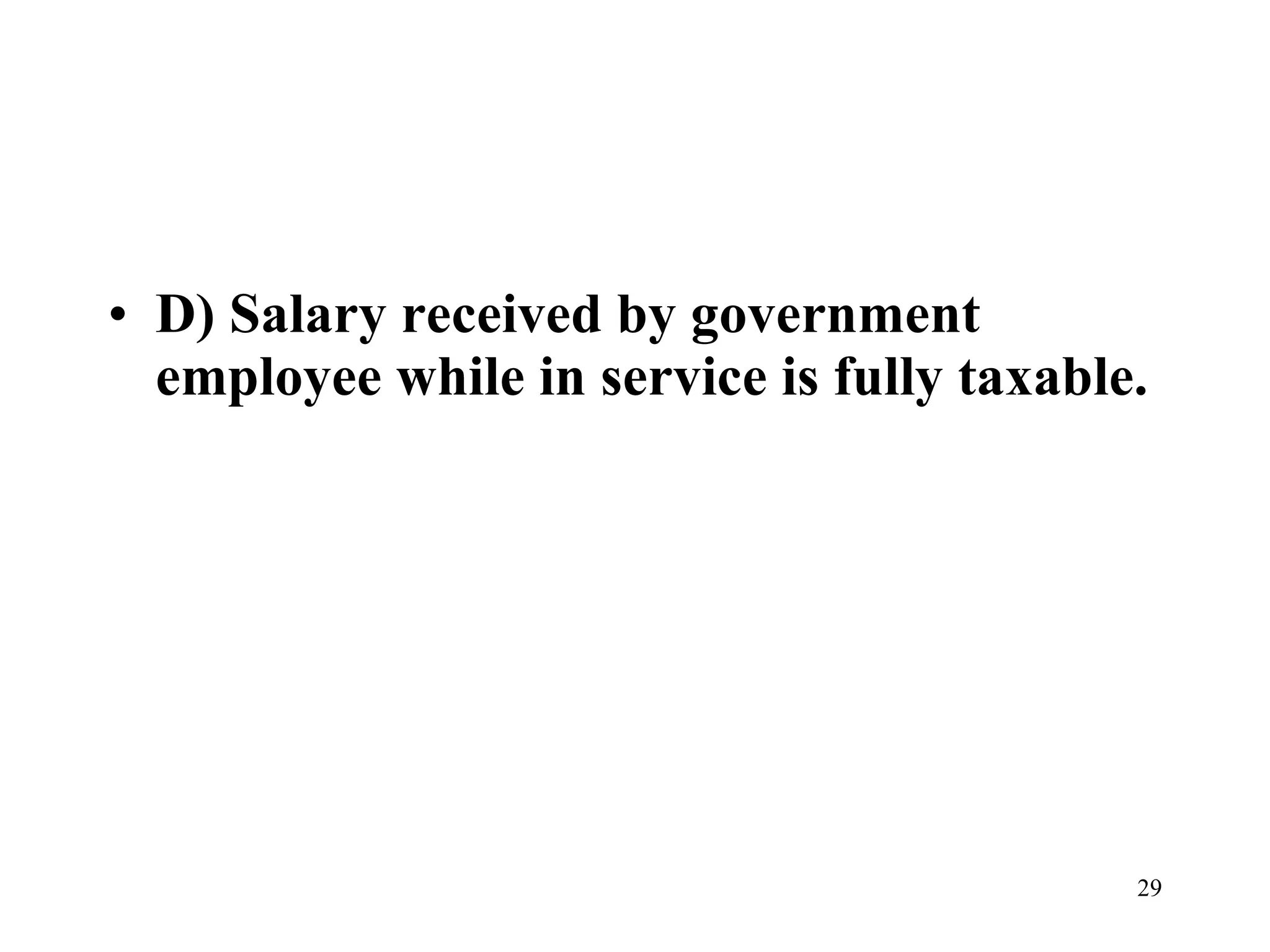

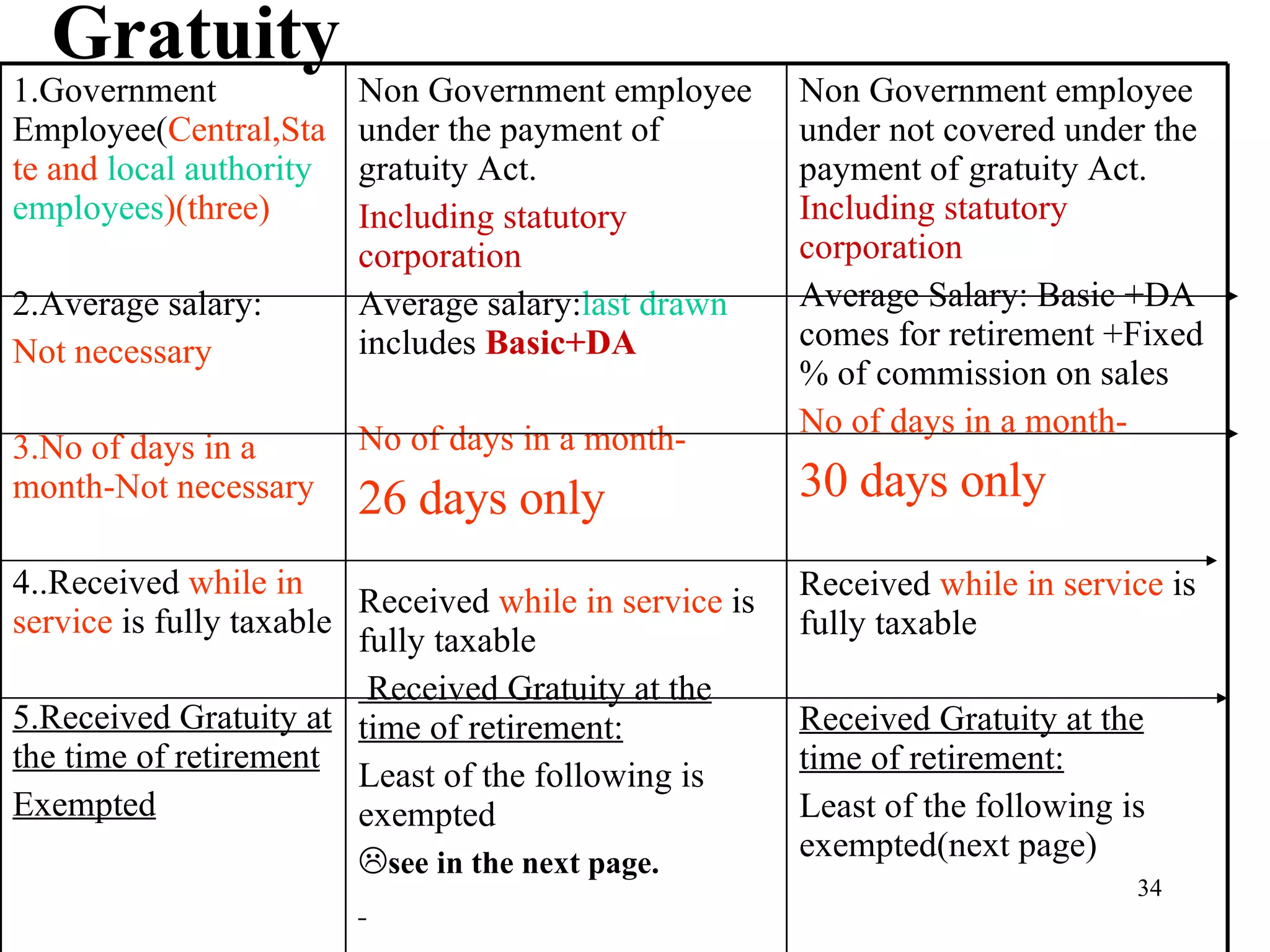

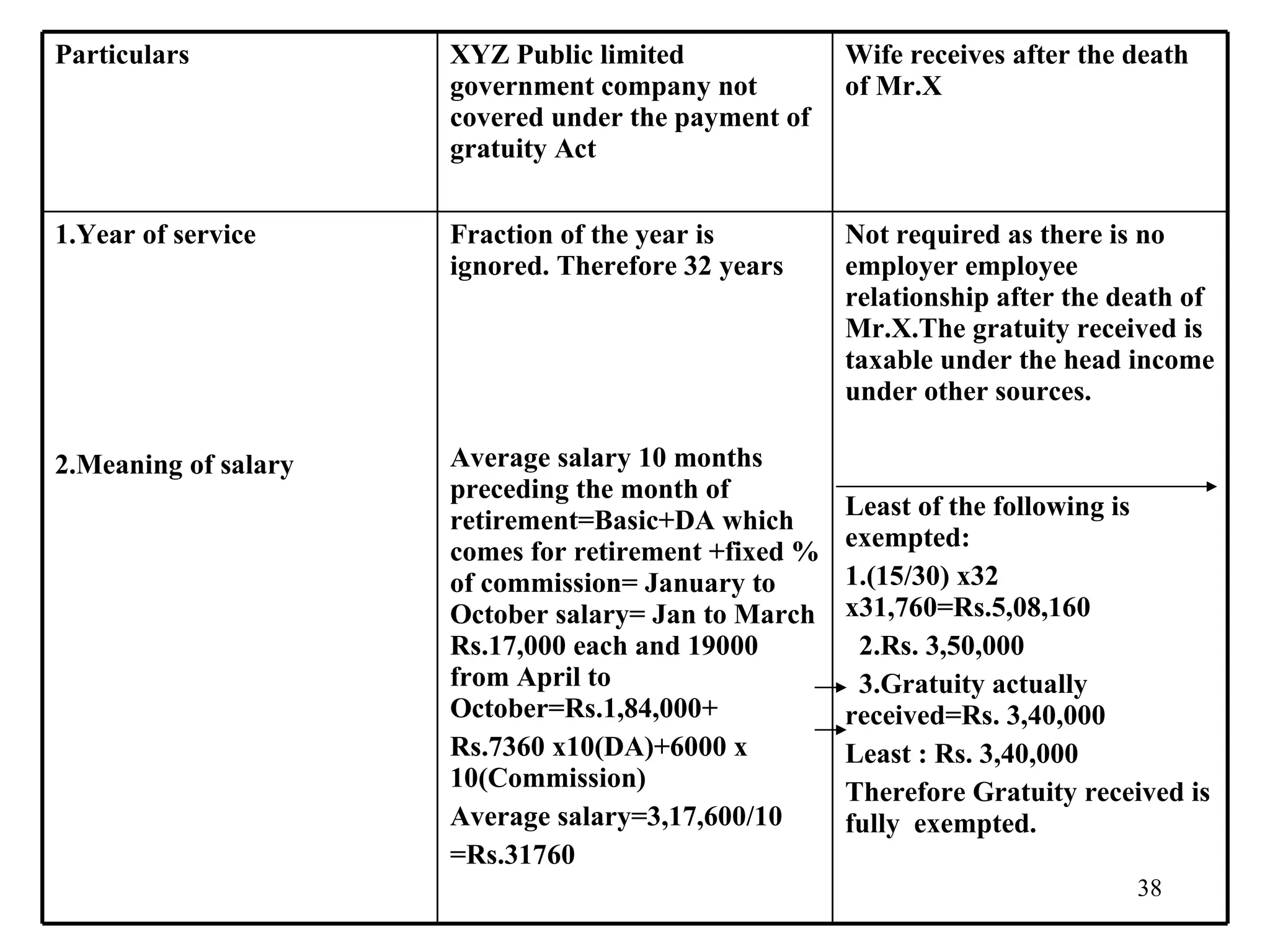

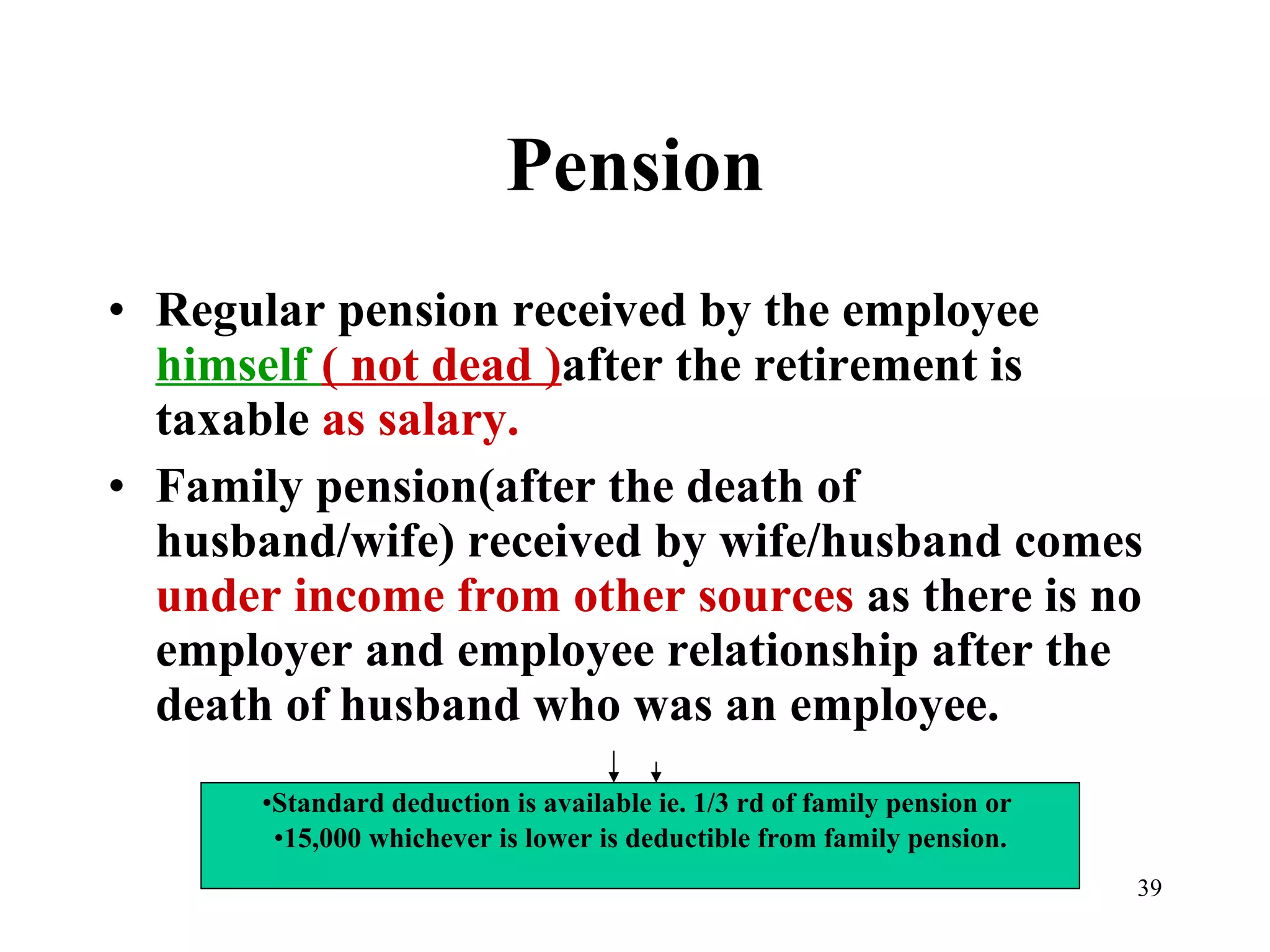

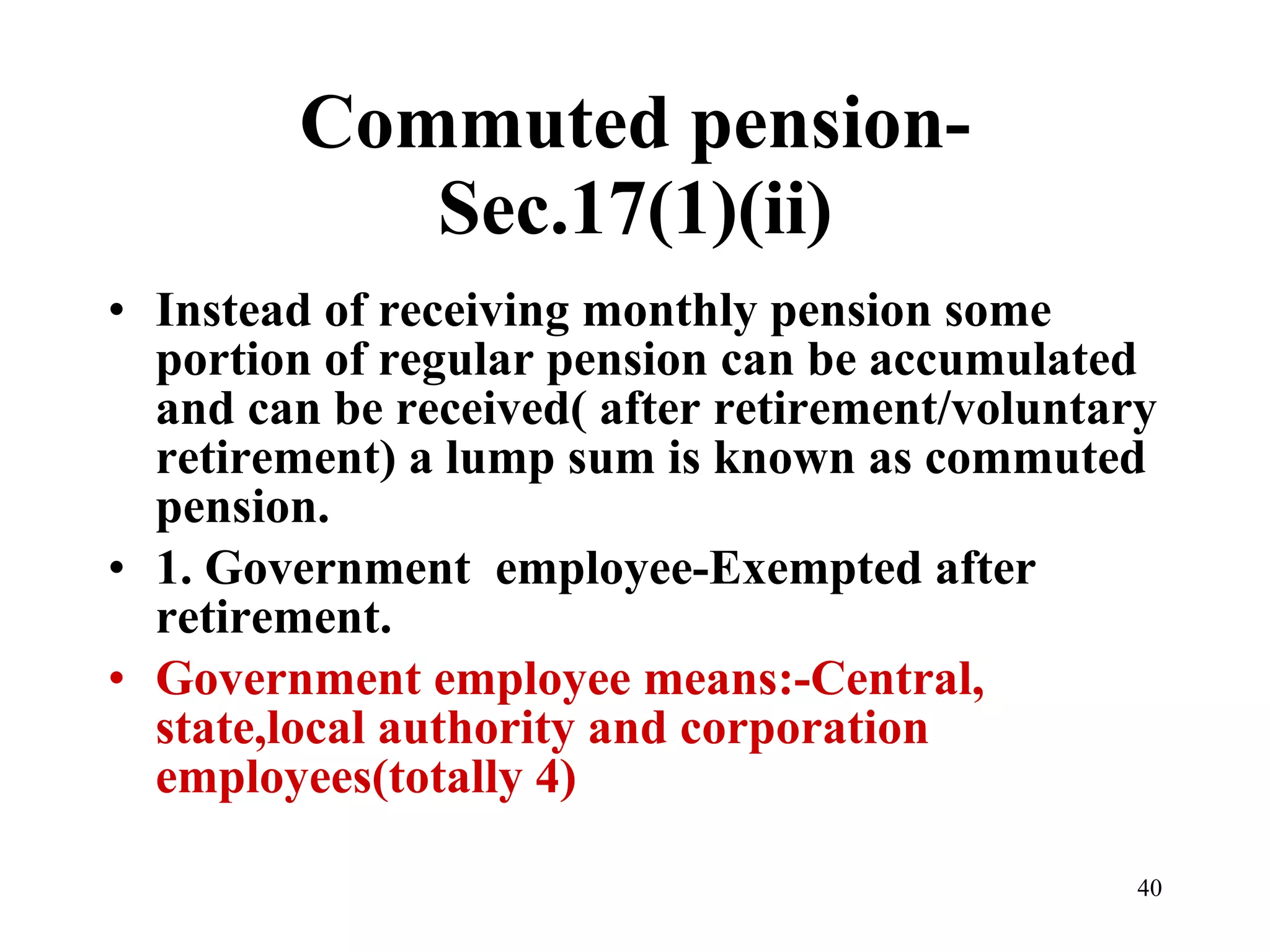

- It provides details on what is considered salary and the tax treatment of items like leave encashment, gratuity, and pensions for government employees versus non-government employees.

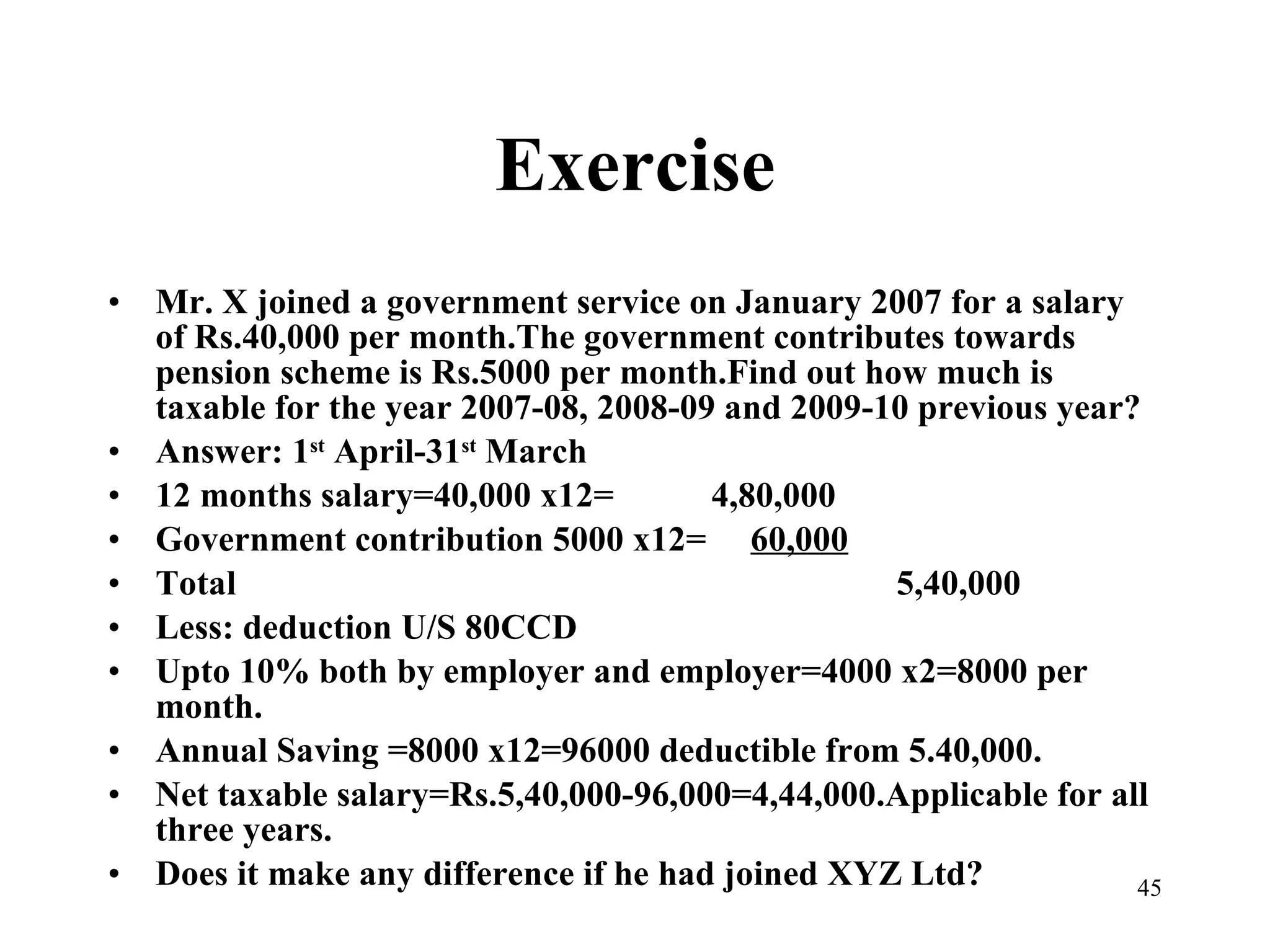

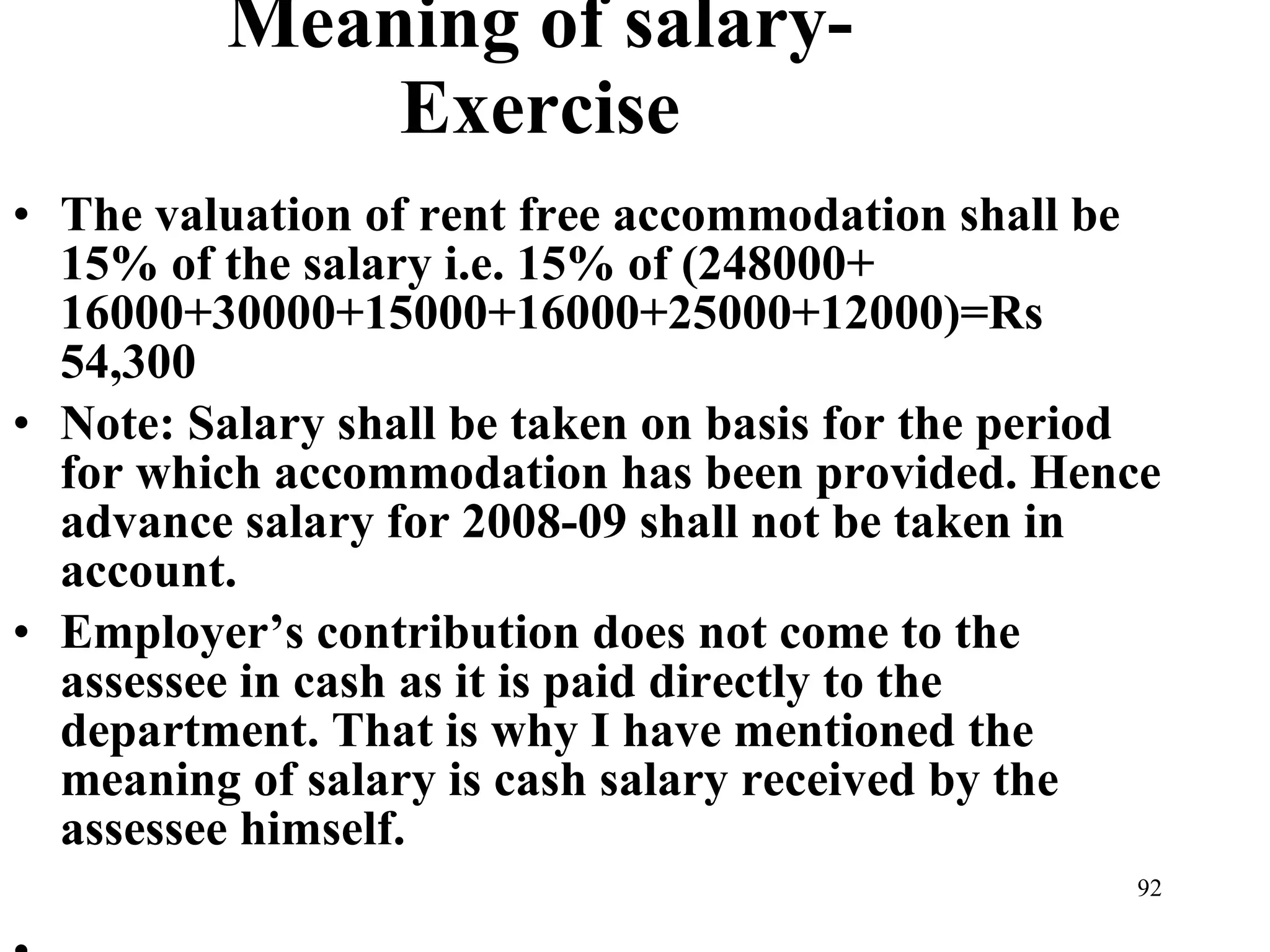

- Examples are given to illustrate how to calculate the taxable and non-taxable portions of retirement benefits like gratuity and leave encashment received by employees.

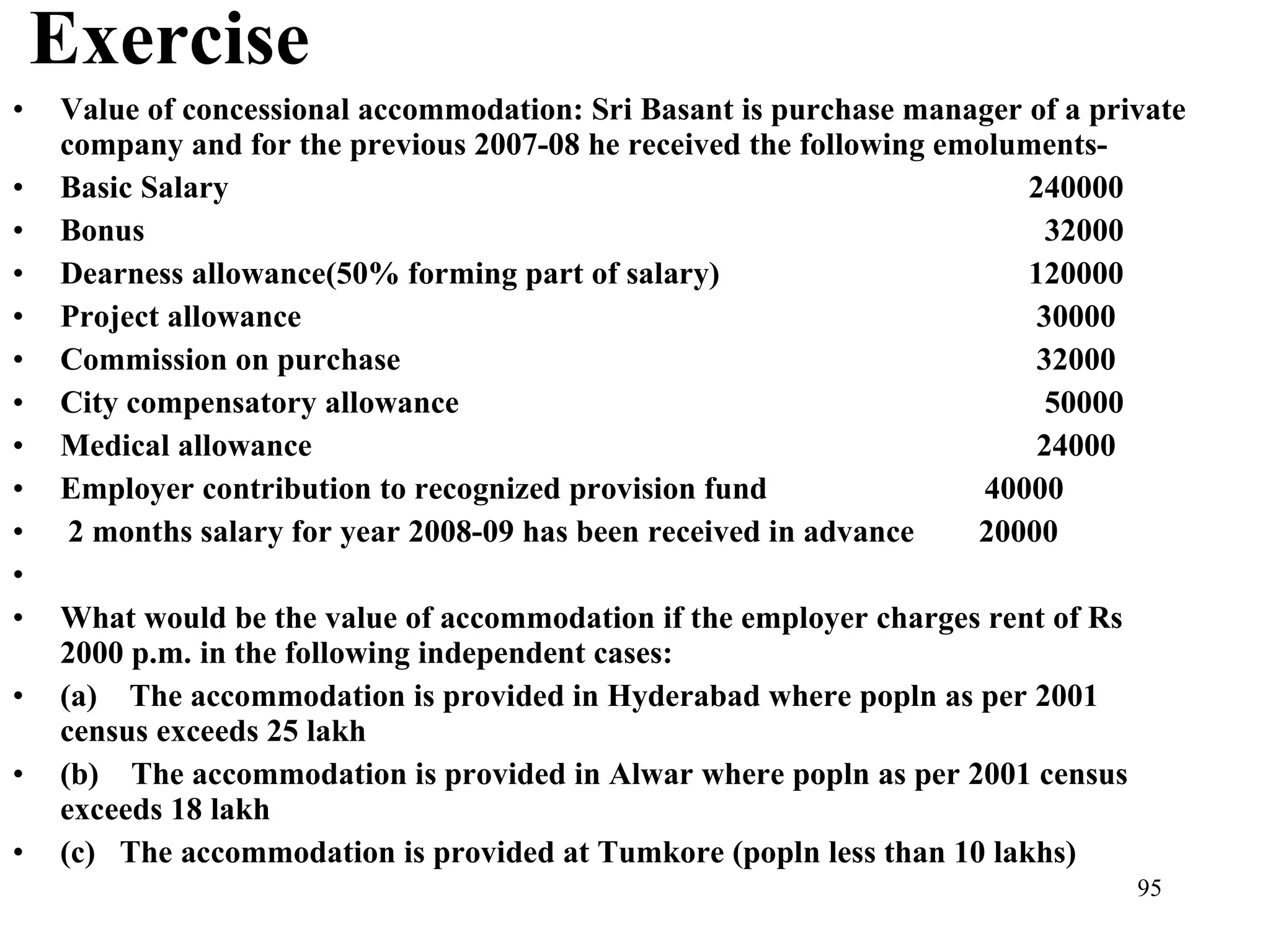

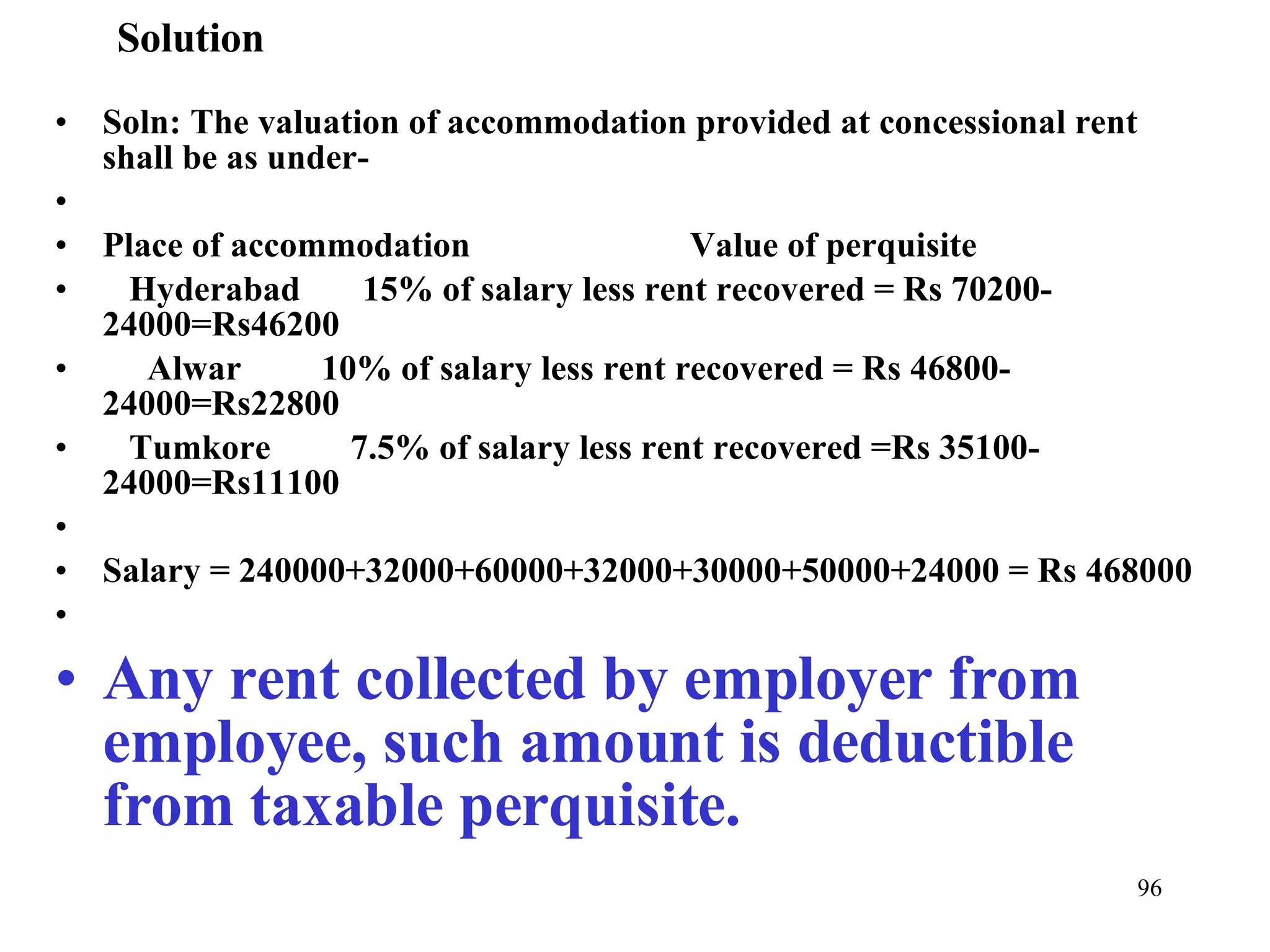

![Income from Salary By Prof. Augustin Amaladas and Prof.Amala shanthi St. Joseph’s College of Commerce and Jyoti Nivas college respectively, Bangalore M.Com., AICWA.,PGDFM., B.Ed. 09845844319 [email_address] What do you mean by rest? Casually sit back and relax and enjoy your Income tax It is so simplified in such a way that you can easily understand Players!! Now you Do some Exercise Even not Studied So far. This slides are Prepared for Any one who Had not Attended classes regularly Or do not have Time or money. Education for all B. Com, BBM, M.Com, ICWA CA CS M B As](https://image.slidesharecdn.com/income-from-salary-1221281394573324-9/75/Income-From-Salary-1-2048.jpg)

![Different forms of salary-Retirement benefits 1. Leave encashment salary 2.Gratuity 3.Pension 4.Retrenchment compensation 5.Provident Fund [Examination point of view these five items are very important]](https://image.slidesharecdn.com/income-from-salary-1221281394573324-9/75/Income-From-Salary-20-2048.jpg)

![Non-government employee (including local authority and corporation employees) Least of the following Exempted out of leave cash received 10 months average salary* Amount specified by the government-3,50,000 Actually received at the time of retirement [Period of leave on 30 days basis (if more than 30 days as per service rules)for every completed year of service( -) leave availed while in service(-)leave encashed while in service] x (average salary)* * Average salary Basic + % DA comes only for retirement + fixed % of commission on sales. Note: Immediately before the The retirement](https://image.slidesharecdn.com/income-from-salary-1221281394573324-9/75/Income-From-Salary-23-2048.jpg)

![Annuity[17(1)(ii)] Annual payment constantly paid by employer to employee. Even paid voluntarily it is taxable Annuity received from ex employer is taxed as profit in lieu of salary-taxed as salary.](https://image.slidesharecdn.com/income-from-salary-1221281394573324-9/75/Income-From-Salary-47-2048.jpg)

![Retrenchment compensation[10(10B)] The Least of the following is exempted: 1. Amount calculated as per Industrial dispute act. (15 days salary for every completed year of service and fraction beyond 6 months ie. 25 years and 7 months=26 years.) 2. Rs. 5,00,000 notified by Government 3.The amount received Exercise:-next page Note: If approved by government, under any scheme, such amount is fully exempted.](https://image.slidesharecdn.com/income-from-salary-1221281394573324-9/75/Income-From-Salary-48-2048.jpg)

![VRS[10(10C)] Voluntary Retirement scheme Maximum amount of exemption is Rs.5,00,000. Up to Rs. 5,00,000 is exempted Conditions: The same employee can not be re-employed in the same or any other company comes under the same management. Salary means the last salary drawn for computation of compensation Basic+ DA which comes for retirement + fixed % of commission on sales.](https://image.slidesharecdn.com/income-from-salary-1221281394573324-9/75/Income-From-Salary-53-2048.jpg)

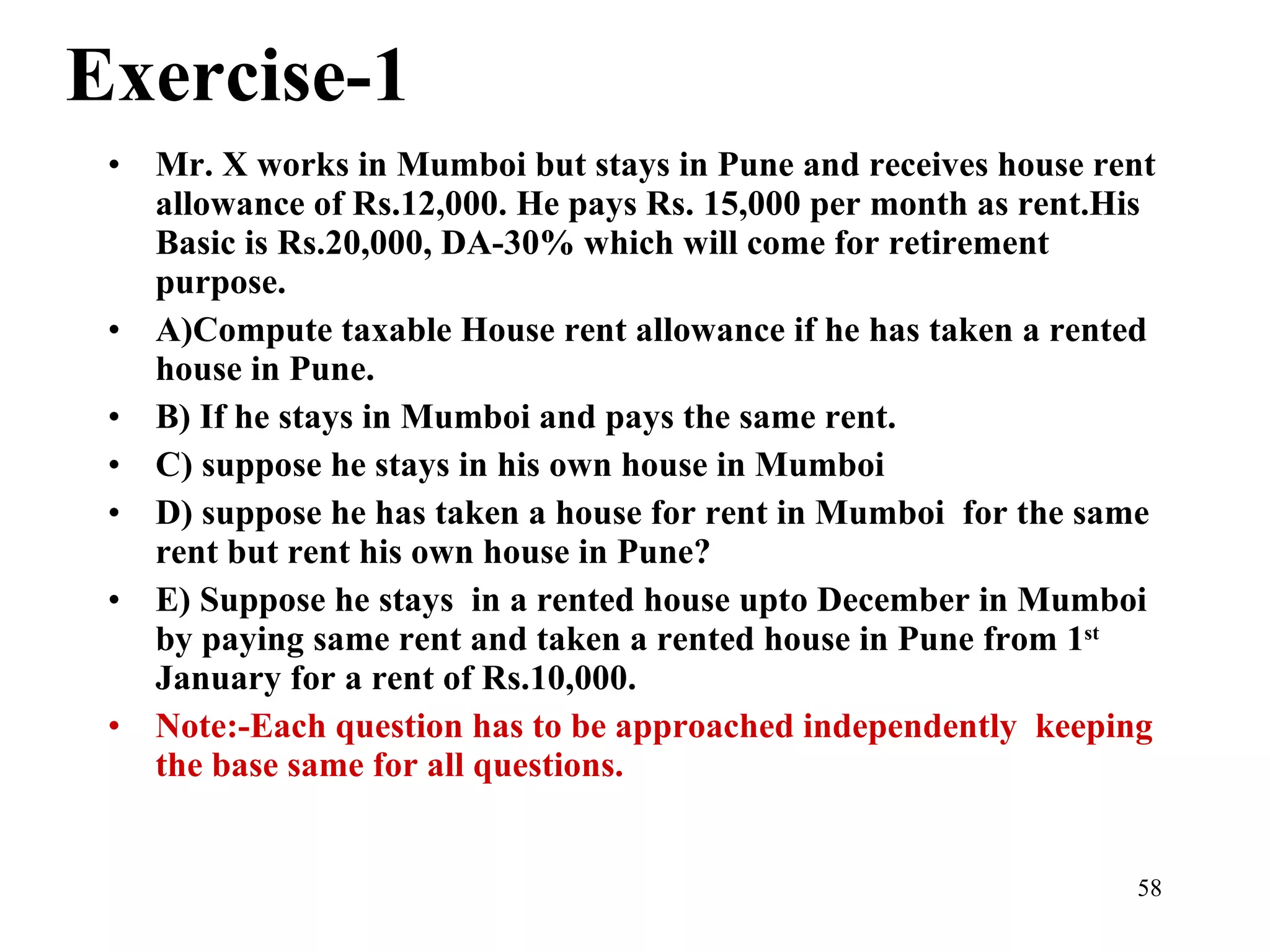

![House rent allowance(10[13A]) There will be no tax exemption if the residential accommodation is self occupied (not taken house for rent by employee or employee has not paid any rent for residential accommodation used by him [section 10(13A) of Income Tax Act and rule 2A] Salary means basic plus DA (if forming part of retirement benefits) plus commission (if fixed as a percentage of turnover). Exemption will be lowest of (a) 50% of salary where residential accommodation is in Mumbai, Kolkata, Delhi or Chennai and 40% of at other place (b)(Rent paid minus 10% of salary) (c) Actual allowance paid.](https://image.slidesharecdn.com/income-from-salary-1221281394573324-9/75/Income-From-Salary-56-2048.jpg)

![Answer-HRA A) Rented house in Pune: Since salary, place of stay, HRA and rent paid are same throughout the year we can calculate for the whole financial year. House rent Allowance received (12,000x12) Rs.1,44,000 Least of the following is exempted: 1.40% of salary*=26000 x 12 x40% 1,24,800 2.Rent paid-10% of salary* 1,48,800 [(15000-10% x26000) x 12] 3.Actually received 1,44,000 The Least is Rs.1,24,800 which is exempted out of HRA received.There fore taxable HRA is Rs.19,200 ie (1,44,000-1,24,800) *Salary means: 20,000+(30% x20,000)=26,000](https://image.slidesharecdn.com/income-from-salary-1221281394573324-9/75/Income-From-Salary-59-2048.jpg)

![Answer-HRA A) Rented house in Mumboi Since salary, place of stay, HRA and rent paid are same throughout the year we can calculate for the whole financial year. House rent Allowance received (12,000x12) Rs.1,44,000 Least of the following is exempted: 1.40% of salary*=26000 x 12 x50% 1,56,800 2.Rent paid-10% of salary* 1,48,800 [(15000-10% x26000) x 12] 3.Actually received 1,44,000 The Least is Rs.1,44,000 which is exempted out of HRA received.There fore taxable HRA is Zero ie (1,44,000-1,44,000) *Salary means: 20,000+(30% x20,000)=26,000](https://image.slidesharecdn.com/income-from-salary-1221281394573324-9/75/Income-From-Salary-60-2048.jpg)

![E. Up to December in Mumboi in a rented house and thereafter in Pune in a rented house Exempted HRA in Mumboi Nine months Meaning of salary:Rs.26,000 HRA received Rs.1,08,000 Least of the following is exempted: 1. 50% of salary=26000 x50% x9 Rs.1,17,000 2. Rent paid – 10% of salary Rs.1,11,600 [(15000-10% x26000) x 9] 3.Actually received 1,08,000 The least is 1,08,000. There fore for the 9 months entire HRA is exempted. Nothing is taxable. Exempted HRA in Pune :-Next slide](https://image.slidesharecdn.com/income-from-salary-1221281394573324-9/75/Income-From-Salary-62-2048.jpg)

![3 Months HRA in Pune in a rented house Meaning of salary:Rs.26,000 HRA received Rs.36,000 Least of the following is exempted: 1. 40% of salary=26000 x40% x3 Rs.31,200 2. Rent paid – 10% of salary Rs.22,200 [(10000-10% x26000) x 3] 3.Actually received 36,000 The least is Rs.22,200 which is exempted. There fore for the3 months the taxable HRA is Rs.13,800[ 36000-22200] Therefore HRA taxable for the previous year is Rs. 13,800 .](https://image.slidesharecdn.com/income-from-salary-1221281394573324-9/75/Income-From-Salary-63-2048.jpg)

![Entertainment allowance[16(ii)] In case of *government employees:Least of the following is deductible: 1. Rs. 5,000; 2. 20% of salary**; 3.Amount of entertainment allowance granted during the previous year. Non government employees are not exempted *Government employee Central and State government employees **Salary excludes any allowance Benefit or other perquisites](https://image.slidesharecdn.com/income-from-salary-1221281394573324-9/75/Income-From-Salary-64-2048.jpg)

![Special allowances[10(14)] For official duties (after Reaching office) Not directly relate to Official duty (General) 1.Official travel/transfer Allowance to meet the cost 2.Conveyance allowance to meet customers 3.daily allowance on official Tour/journey 4.Helper allowance to carry Official documents 5. Research allowance 6. Uniform allowance to do Official duty To be Spent Fully Other Wise, amount not Spent taxable See in the Next slide](https://image.slidesharecdn.com/income-from-salary-1221281394573324-9/75/Income-From-Salary-65-2048.jpg)

![Tiffin allowance, fixed medical allowance Any amount received in cash is always taxable before the expenditure incurred . [email_address]](https://image.slidesharecdn.com/income-from-salary-1221281394573324-9/75/Income-From-Salary-68-2048.jpg)

![Answer: Computation of gross salary of Mr. Amal for the assessment year 2008-09: Taxable allowances 1. Basic pay Rs. 8,000 x 12 96,000 . DA –40% of basic pay(8000 x 40% x12) 38 400 3. City compensatory allowance-10% x 8000 x12 9,600 4.Medical allowance –Rs.800 x 12 9,600 5. Children educational allowance-[ (Rs. 200-100)2 x 12+ 200 x 12] 4,800 6. Hostel expenditure allowance-(Rs. 400-300) 2 x 12 2,400 7. Tribal area allowance – (Rs. 500-200) x 12 3,600 8. Travelling allowance – (Rs. 12000-8000) official duties 4,000 9. Conveyance allowance –Rs. 500 –500) 12 Nil 10. Transport allowance- Rs. 18,600-(800 x 12) 9,000 11. Overtime allowance-Rs. 4000 4,000 Gross salary 1,81,400 Children education –Rs. 100 per month per child for two children allowed. Hostel expenditure Rs. 300 per child per month for two children allowed](https://image.slidesharecdn.com/income-from-salary-1221281394573324-9/75/Income-From-Salary-70-2048.jpg)

![solution Computation of taxable salary of Sri Mohan for assessement Year 2008-09 Basic Salary 120000 Bonus 16000 Dearness allowance(50% forming part of salary) 60000 Project allowance 15000 Commission on purchase 16000 City compensatory allowance 25000 Medical allowance 12000 Employer contribution to RPF in excess of 12% of salary 2000 [20000- 12% of (120000+ 50% of 60000)] Salary from B ltd 80000 Advance of salary 20000 Value of housing facility[10% of (120000+16000+30000+ 31400 15000+16000+25000+12000+80000)] Taxable Salary 397400](https://image.slidesharecdn.com/income-from-salary-1221281394573324-9/75/Income-From-Salary-94-2048.jpg)