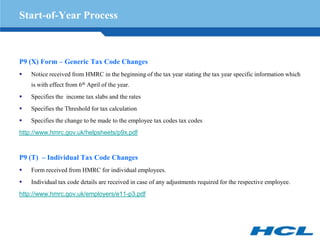

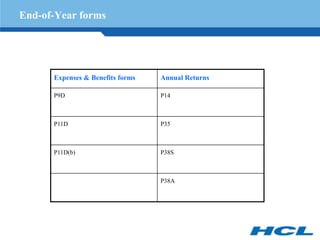

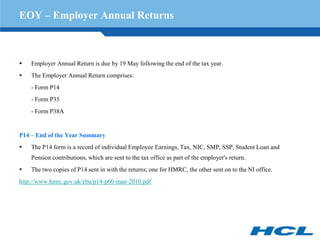

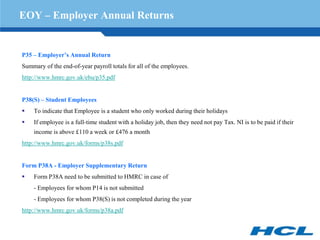

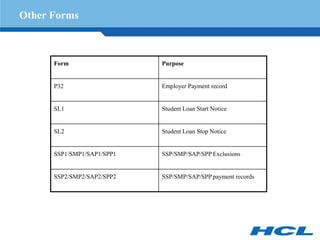

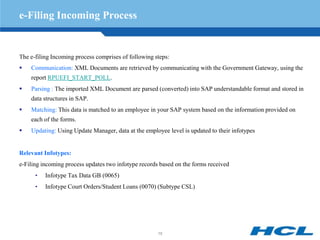

This document provides an overview of statutory reporting and processing in Great Britain, which can be categorized into three phases: start of year, in-year, and end of year. It describes the various statutory forms used at each phase, including P9(X), P9(T), P45, P46, P11D, P35, and P60. It also discusses the e-filing processes for incoming statutory forms from the government gateway and outgoing submissions to government departments. Key aspects covered include payroll reporting timelines, purpose of each form, and how forms are used to update employee records.