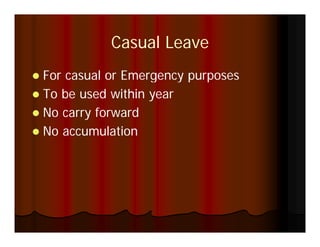

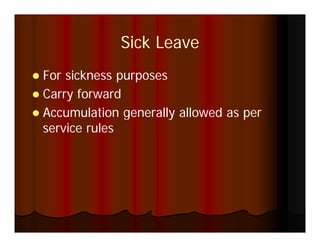

1. Defined benefit plans allow employees to earn various types of leaves including casual, sick, and privilege leaves.

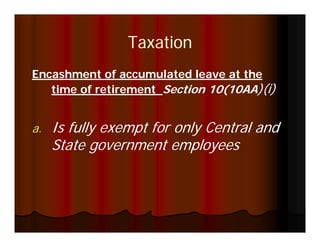

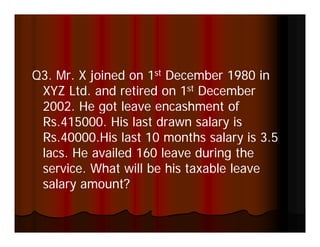

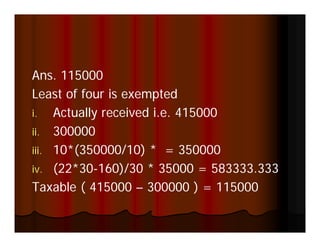

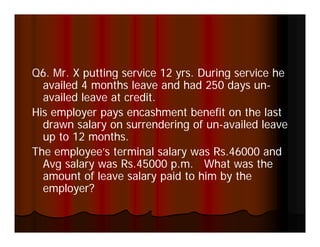

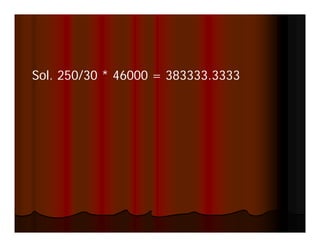

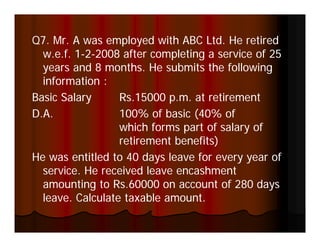

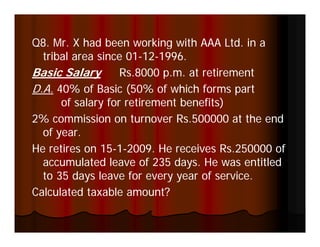

2. Employees can encash unused leaves either during employment or at retirement. Leave encashment during employment is fully taxable while encashment at retirement is partially tax exempt under Section 10(10AA).

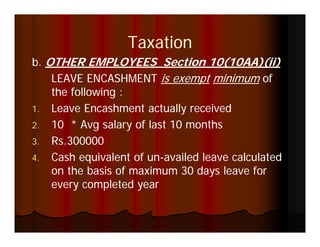

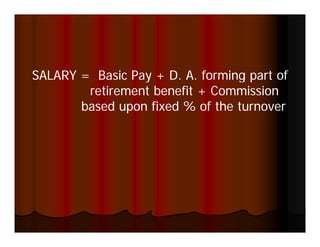

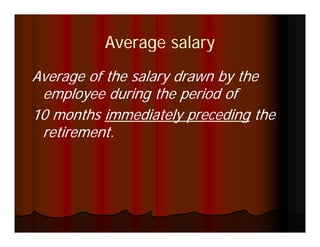

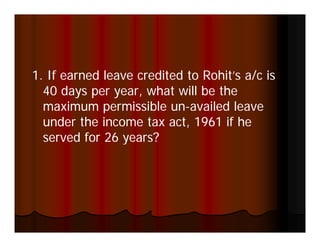

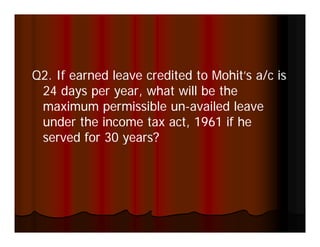

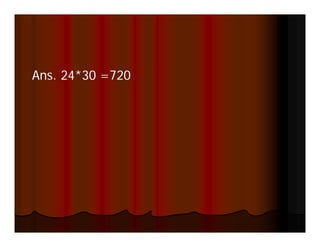

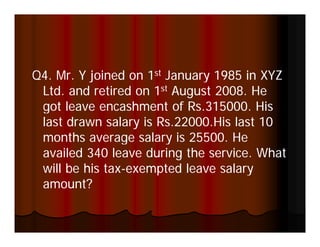

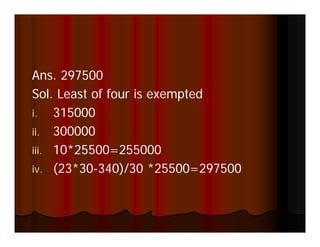

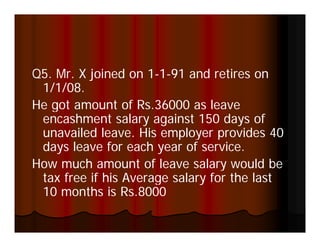

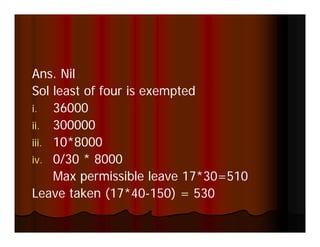

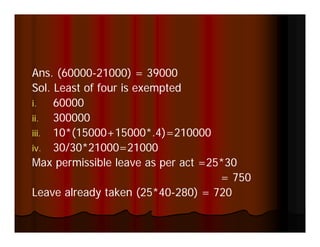

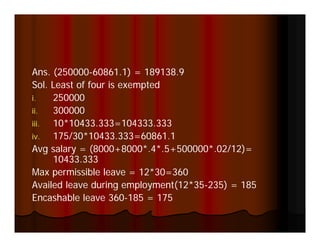

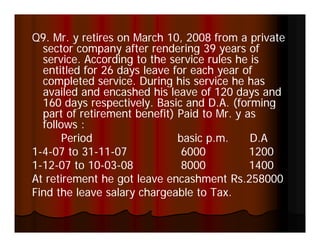

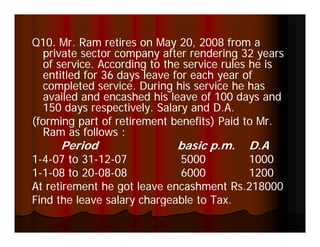

3. For other employees, leave encashment at retirement is exempt up to the minimum of actual encashment, 10 times average salary of last 10 months, Rs. 300,000, or cash equivalent of 30 days unavailed leave per completed year of service calculated on maximum salary.