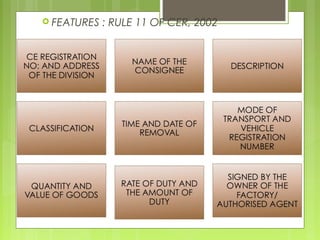

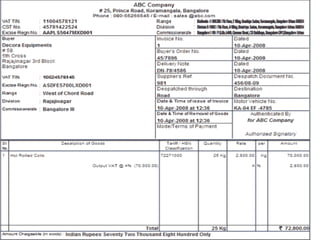

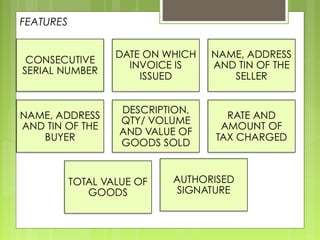

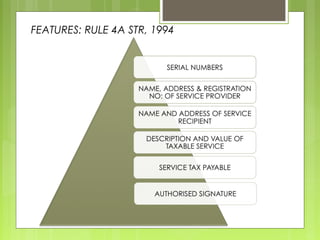

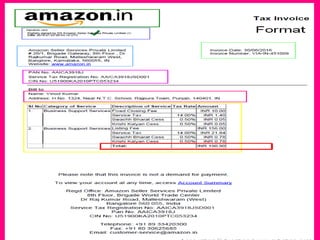

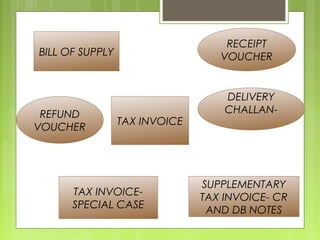

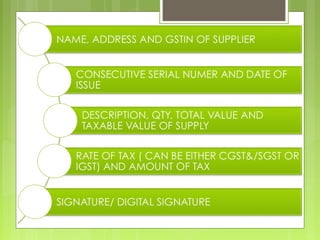

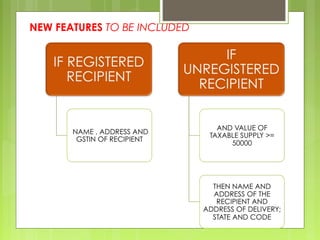

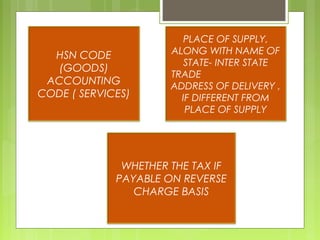

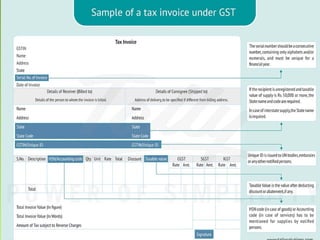

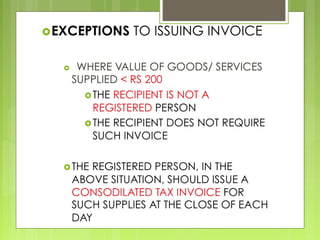

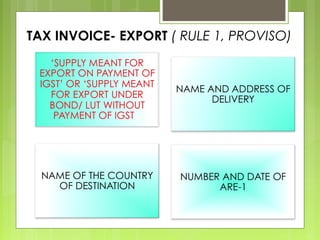

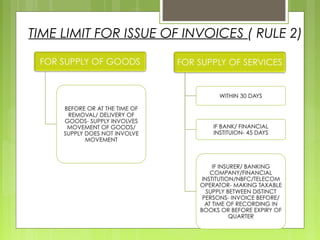

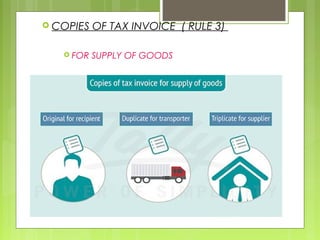

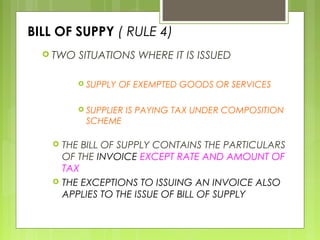

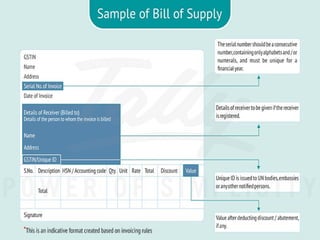

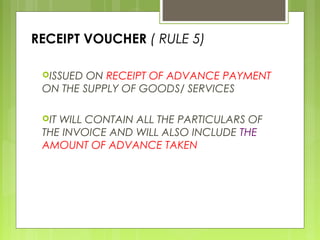

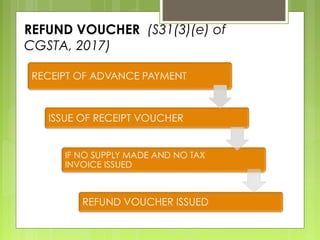

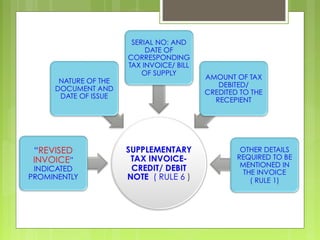

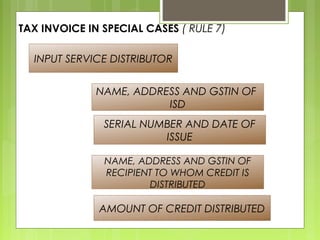

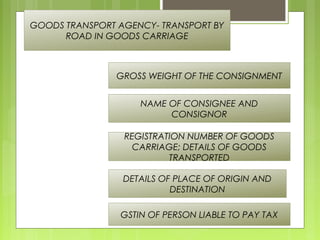

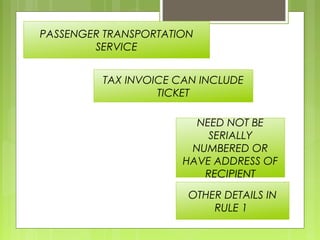

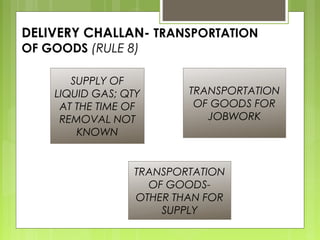

This document compares tax invoice rules and requirements under the current tax regime to those under the new GST regime. Key changes under GST include requiring place of supply and HSN/accounting codes on invoices. The GST regime introduces provisions for bill of supply, receipt vouchers, refund vouchers, and delivery challans. Special cases like input service distributors and transport agencies have their own invoice requirements. Overall, the GST invoice rules aim to standardize and simplify compliance for taxpayers.