GST- Refund process under GST brief

•Download as PPTX, PDF•

1 like•547 views

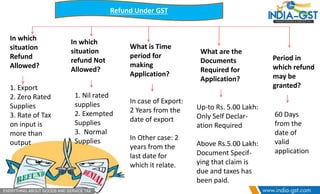

Refunds under GST are allowed for exports, zero-rated supplies, and when input tax is greater than output tax. Refunds are not allowed for nil-rated, exempted, or normal supplies. The time period for applying for a refund is 2 years from the date of export or the last date of the filing period the refund relates to. For refunds up to Rs. 5 lakh, only a self-declaration is required, while for larger refunds documents showing tax payment are needed. The refund will be granted within 60 days of filing a valid application.

Report

Share

Report

Share

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

Procedures to claim refund, rebate and duty drawback under customs

Procedures to claim refund, rebate and duty drawback under customs

Concept of Input Service Distributor (ISD) in GST-PPT

Concept of Input Service Distributor (ISD) in GST-PPT

Viewers also liked

Viewers also liked (9)

GST Simplified Series#1: Concept, Scope, Levy & Applicability

GST Simplified Series#1: Concept, Scope, Levy & Applicability

Recently uploaded

Contact with Dawood Bhai Just call on +92322-6382012 and we'll help you. We'll solve all your problems within 12 to 24 hours and with 101% guarantee and with astrology systematic. If you want to take any personal or professional advice then also you can call us on +92322-6382012 , ONLINE LOVE PROBLEM & Other all types of Daily Life Problem's.Then CALL or WHATSAPP us on +92322-6382012 and Get all these problems solutions here by Amil Baba DAWOOD BANGALI

#vashikaranspecialist #astrologer #palmistry #amliyaat #taweez #manpasandshadi #horoscope #spiritual #lovelife #lovespell #marriagespell#aamilbabainpakistan #amilbabainkarachi #powerfullblackmagicspell #kalajadumantarspecialist #realamilbaba #AmilbabainPakistan #astrologerincanada #astrologerindubai #lovespellsmaster #kalajaduspecialist #lovespellsthatwork #aamilbabainlahore#blackmagicformarriage #aamilbaba #kalajadu #kalailam #taweez #wazifaexpert #jadumantar #vashikaranspecialist #astrologer #palmistry #amliyaat #taweez #manpasandshadi #horoscope #spiritual #lovelife #lovespell #marriagespell#aamilbabainpakistan #amilbabainkarachi #powerfullblackmagicspell #kalajadumantarspecialist #realamilbaba #AmilbabainPakistan #astrologerincanada #astrologerindubai #lovespellsmaster #kalajaduspecialist #lovespellsthatwork #aamilbabainlahore #blackmagicforlove #blackmagicformarriage #aamilbaba #kalajadu #kalailam #taweez #wazifaexpert #jadumantar #vashikaranspecialist #astrologer #palmistry #amliyaat #taweez #manpasandshadi #horoscope #spiritual #lovelife #lovespell #marriagespell#aamilbabainpakistan #amilbabainkarachi #powerfullblackmagicspell #kalajadumantarspecialist #realamilbaba #AmilbabainPakistan #astrologerincanada #astrologerindubai #lovespellsmaster #kalajaduspecialist #lovespellsthatwork #aamilbabainlahore #Amilbabainuk #amilbabainspain #amilbabaindubai #Amilbabainnorway #amilbabainkrachi #amilbabainlahore #amilbabaingujranwalan #amilbabainislamabad

NO1 Uk Divorce problem uk all amil baba in karachi,lahore,pakistan talaq ka m...

NO1 Uk Divorce problem uk all amil baba in karachi,lahore,pakistan talaq ka m...Amil Baba Dawood bangali

Resume

• Real GDP growth slowed down due to problems with access to electricity caused by the destruction of manoeuvrable electricity generation by Russian drones and missiles.

• Exports and imports continued growing due to better logistics through the Ukrainian sea corridor and road. Polish farmers and drivers stopped blocking borders at the end of April.

• In April, both the Tax and Customs Services over-executed the revenue plan. Moreover, the NBU transferred twice the planned profit to the budget.

• The European side approved the Ukraine Plan, which the government adopted to determine indicators for the Ukraine Facility. That approval will allow Ukraine to receive a EUR 1.9 bn loan from the EU in May. At the same time, the EU provided Ukraine with a EUR 1.5 bn loan in April, as the government fulfilled five indicators under the Ukraine Plan.

• The USA has finally approved an aid package for Ukraine, which includes USD 7.8 bn of budget support; however, the conditions and timing of the assistance are still unknown.

• As in March, annual consumer inflation amounted to 3.2% yoy in April.

• At the April monetary policy meeting, the NBU again reduced the key policy rate from 14.5% to 13.5% per annum.

• Over the past four weeks, the hryvnia exchange rate has stabilized in the UAH 39-40 per USD range.

Monthly Economic Monitoring of Ukraine No. 232, May 2024

Monthly Economic Monitoring of Ukraine No. 232, May 2024Інститут економічних досліджень та політичних консультацій

Recently uploaded (20)

Introduction to Economics II Chapter 28 Unemployment (1).pdf

Introduction to Economics II Chapter 28 Unemployment (1).pdf

The new type of smart, sustainable entrepreneurship and the next day | Europe...

The new type of smart, sustainable entrepreneurship and the next day | Europe...

where can I sell pi coins at the best rate (Market Price)

where can I sell pi coins at the best rate (Market Price)

Isios-2024-Professional-Independent-Trustee-Survey.pdf

Isios-2024-Professional-Independent-Trustee-Survey.pdf

Introduction to Economics II Chapter 25 Production and Growth.pdf

Introduction to Economics II Chapter 25 Production and Growth.pdf

Greek trade a pillar of dynamic economic growth - European Business Review

Greek trade a pillar of dynamic economic growth - European Business Review

NO1 Uk Divorce problem uk all amil baba in karachi,lahore,pakistan talaq ka m...

NO1 Uk Divorce problem uk all amil baba in karachi,lahore,pakistan talaq ka m...

when officially can i withdraw my pi Network coins.

when officially can i withdraw my pi Network coins.

Falcon Invoice Discounting: Optimizing Returns with Minimal Risk

Falcon Invoice Discounting: Optimizing Returns with Minimal Risk

Can a Pi network coin ever be sold out: I am ready to sell mine.

Can a Pi network coin ever be sold out: I am ready to sell mine.

Monthly Economic Monitoring of Ukraine No. 232, May 2024

Monthly Economic Monitoring of Ukraine No. 232, May 2024

GST- Refund process under GST brief

- 1. Refund Under GST In which situation Refund Allowed? In which situation refund Not Allowed? What is Time period for making Application? What are the Documents Required for Application? Period in which refund may be granted?1. Export 2. Zero Rated Supplies 3. Rate of Tax on input is more than output 1. Nil rated supplies 2. Exempted Supplies 3. Normal Supplies In case of Export: 2 Years from the date of export In Other case: 2 years from the last date for which it relate. Up-to Rs. 5.00 Lakh: Only Self Declar- ation Required Above Rs.5.00 Lakh: Document Specif- ying that claim is due and taxes has been paid. 60 Days from the date of valid application

- 2. CA Nikhil Malaiya Cell: 9545727818 E-mail: canikhilmalaiya@gmail.com CA Mayur Zanwar Cell: 9422855595 E-mail: cazanwar@gmail.com