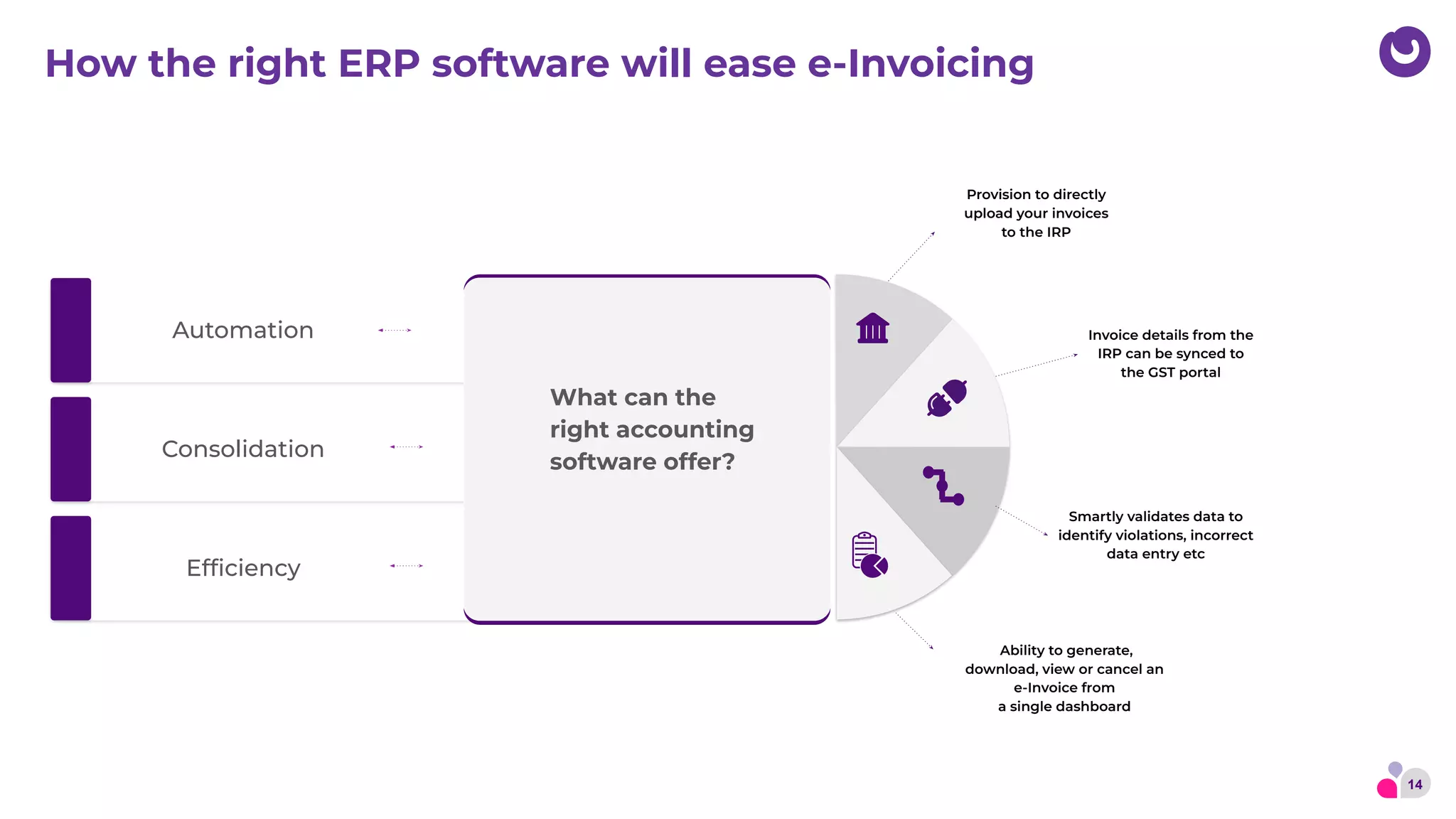

This webinar discusses e-invoicing under GST in India. It provides an introduction to e-invoicing requirements and timelines, how to create e-invoices following the standard format and schema, and debunks common myths. Benefits of e-invoicing for businesses include reduction in disputes and costs, better record keeping and compliance. The presentation demonstrates how to generate e-invoices using the Open accounting software which facilitates automated e-invoicing and syncing with GST filings.