The document discusses interest liability under the GST Act. Section 50 deals with interest payable for delayed tax payments. Per the section and various court judgments, interest is typically levied on the net tax amount owed after considering available input tax credits. However, a recent Telangana High Court judgment dismissed a writ petition and held that interest should be calculated on the full gross tax liability until returns are filed to claim credits. Stakeholders now face uncertainty as amendments aligning the law with the intent of compensating the government for delayed net amounts have not been enacted.

![Analysis of section 50

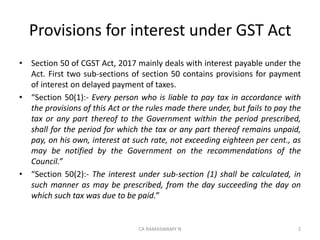

• a) Who is liable to pay interest:-

– Every person who is liable to pay tax in accordance with the provisions of this Act or the

rules made there under, but fails to pay the tax or any part thereof to the Government

within the period prescribed is liable to pay interest. [50(1)]

• b) At what rate:-

– At such rate not exceeding 18%, as may be notified by the Government on the

recommendations of the Council. The Government has notified 18% vide Notification

13/2017 Central tax dated 28-06-2017 [50(1)]

• c) On which amount is to be paid:- Not specifically mentioned in the section 50.

• d) For which period:- period for which the tax or any part thereof remains unpaid. [50(1)]

• e) When to pay the interest: Not mentioned in the section. However as per rule 61(3),

every registered person furnishing the return under sub-rule (1) shall, subject to the

provisions of section 49, discharge his liability towards tax, interest, penalty, fees or any

other amount payable under the Act or the provisions of this Chapter by debiting the

electronic cash ledger or electronic credit ledger and include the details in Part B of the

return in FORM GSTR-3.

• f) Whether any notice is required:-No. Interest is to be paid on his own. [50(1)]

3CA RAMASWAMY N](https://image.slidesharecdn.com/interestliabilityundergst-190522170127/85/Interest-liability-under-gst-3-320.jpg)

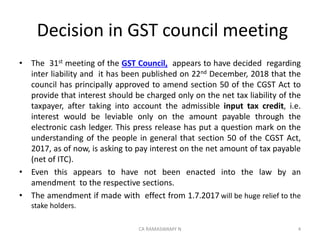

![Standing order of the Principal Commissioner

Central Tax Hyderabad[ 04-02-2019.]

• An order was issued by Principal Commissioner of Central taxes Hyderabad on 4-2-

2019 on the subject of interest liability whenever returns are filed belatedly. The

said order inter-alia contained “Since ITC/Credit in balance in the ‘Electronic Credit

Ledger’ cannot be treated as the Tax paid, unless it is debited in the said credit

ledger while filing the return for off-setting the amount in the ‘Liability Ledger’, the

interest liability under Sec. 50 is mandatorily attracted on the entire Tax remained

unpaid beyond the due date prescribed”.

• However, it is to be noted that Section 50 does not support the standing order

which inter-alia contains that the interest liability under Sec. 50 is mandatorily

attracted on the entire Tax remained unpaid beyond the due date prescribed. The

section, at least in its literal meaning, does not mandate or prescribe to levy

interest on the total amount of output tax regardless of credit of input tax

available , without deducting the available credit of input tax. The effective words

are” fails to pay the tax or any part thereof to the Government within the period

prescribed, shall for the period for which the tax or any part thereof remains

unpaid, pay, on his own,”

5CA RAMASWAMY N](https://image.slidesharecdn.com/interestliabilityundergst-190522170127/85/Interest-liability-under-gst-5-320.jpg)

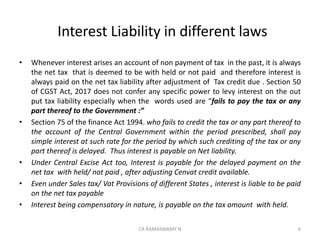

![Interest Liability in different laws

• The levy of interest is geared to actual amount of tax withheld and the extent of

the delay in paying the tax on the due date. Essentially, it is compensatory and

different from penalty– which is penal in character. [Prathibha Processors Vs. UOI

(1996) 11 SCC 101 (SC)]

• Tax becomes payable by an Assessee by virtue of the charging Section. Penalty

becomes payable on willful violation of any of the provisions of the taxing statute.

Interest is claimed from an assessee who has withheld payment of any tax payable

by him and it is always calculated at the prescribed rate on the basis of the actual

amount of tax withheld and the extent of delay in paying it. It may be noted

interest is compensatory in character [Associated Cement Co. Ltd. Vs. Commercial

Tax Officer, Kota and Others (1981) 048 STC 0466 (SC)]

• Interest under section 50 of CGST Act, 2017, is leviable for delay in effecting

payment of GST. No assessment or notice required and has to be paid through

Electronic Cash ledger , on his own. Accordingly in the words of the Apex Court

interest, being a compensatory levy is to be calculated at the prescribed rate on

the basis of the actual amount of tax withheld and the extent of delay in paying it.

7CA RAMASWAMY N](https://image.slidesharecdn.com/interestliabilityundergst-190522170127/85/Interest-liability-under-gst-7-320.jpg)