1. The document discusses input tax credit under the Goods and Services Tax (GST) in India. It provides definitions of key terms related to input tax credit like input, input service, capital goods, and input tax.

2. It summarizes the conditions for claiming input tax credit, such as possessing valid tax invoices, receiving the goods or services, ensuring the tax has been paid to the government, and filing returns. There are also time limits for claiming input tax credit.

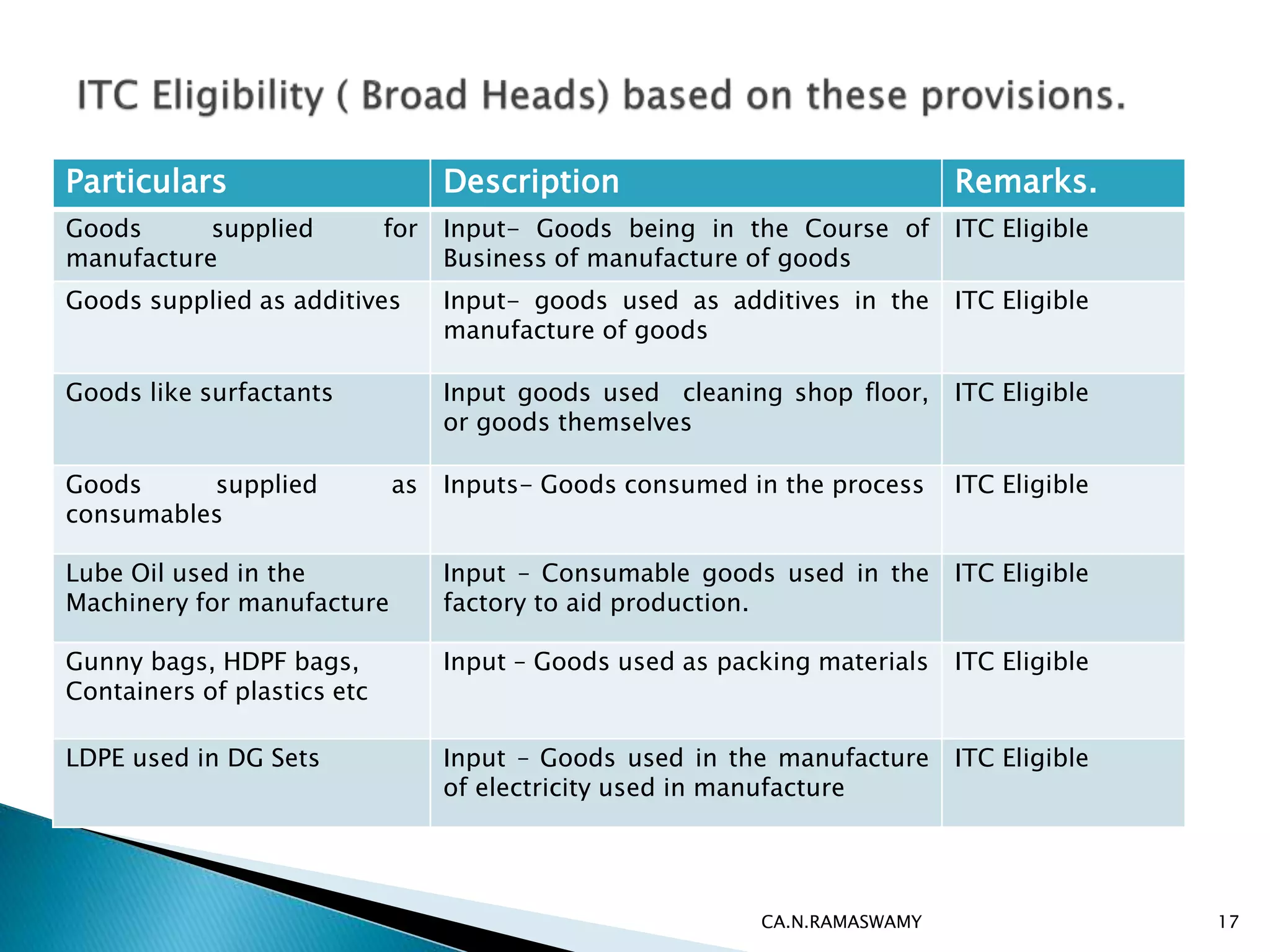

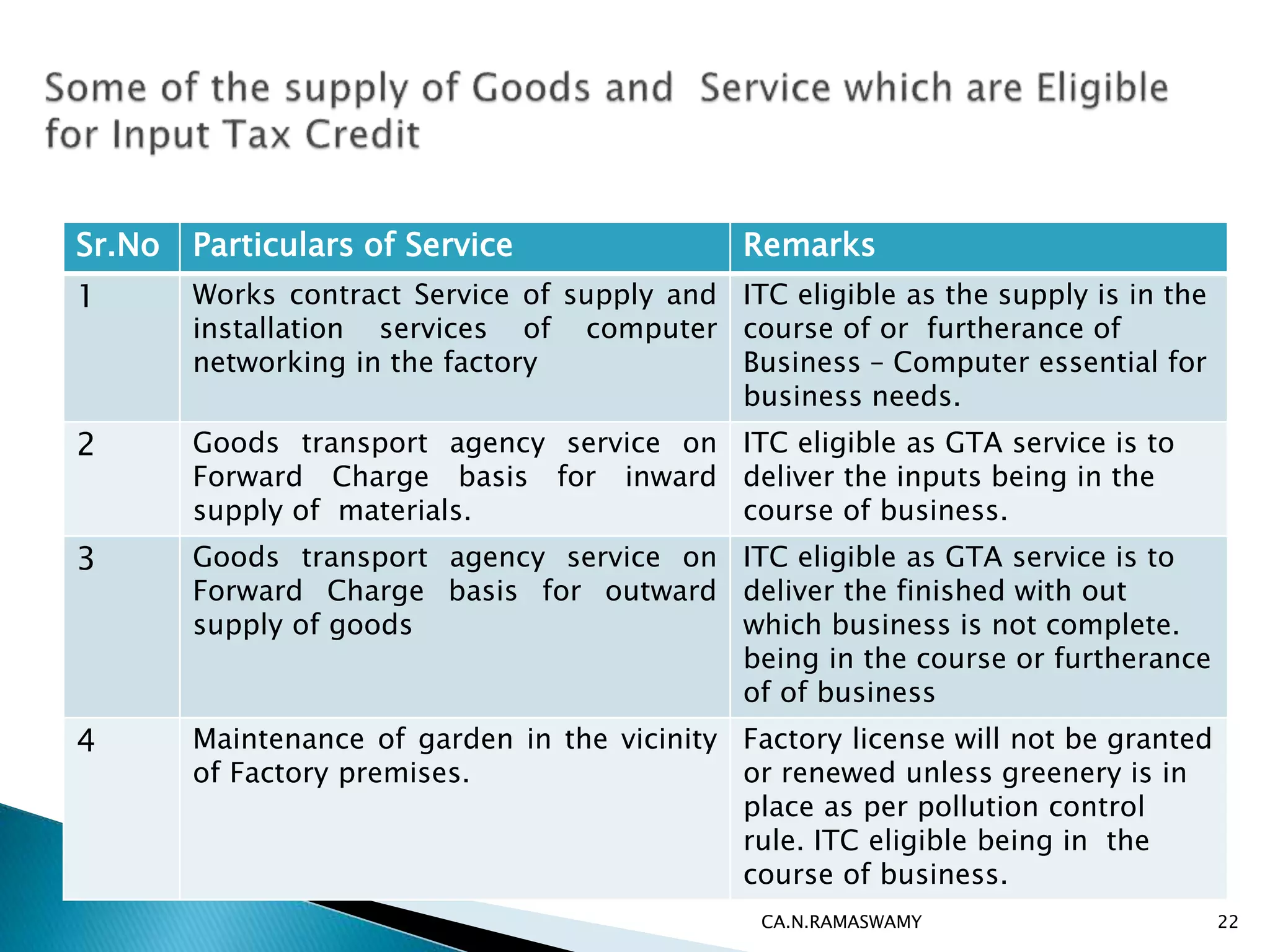

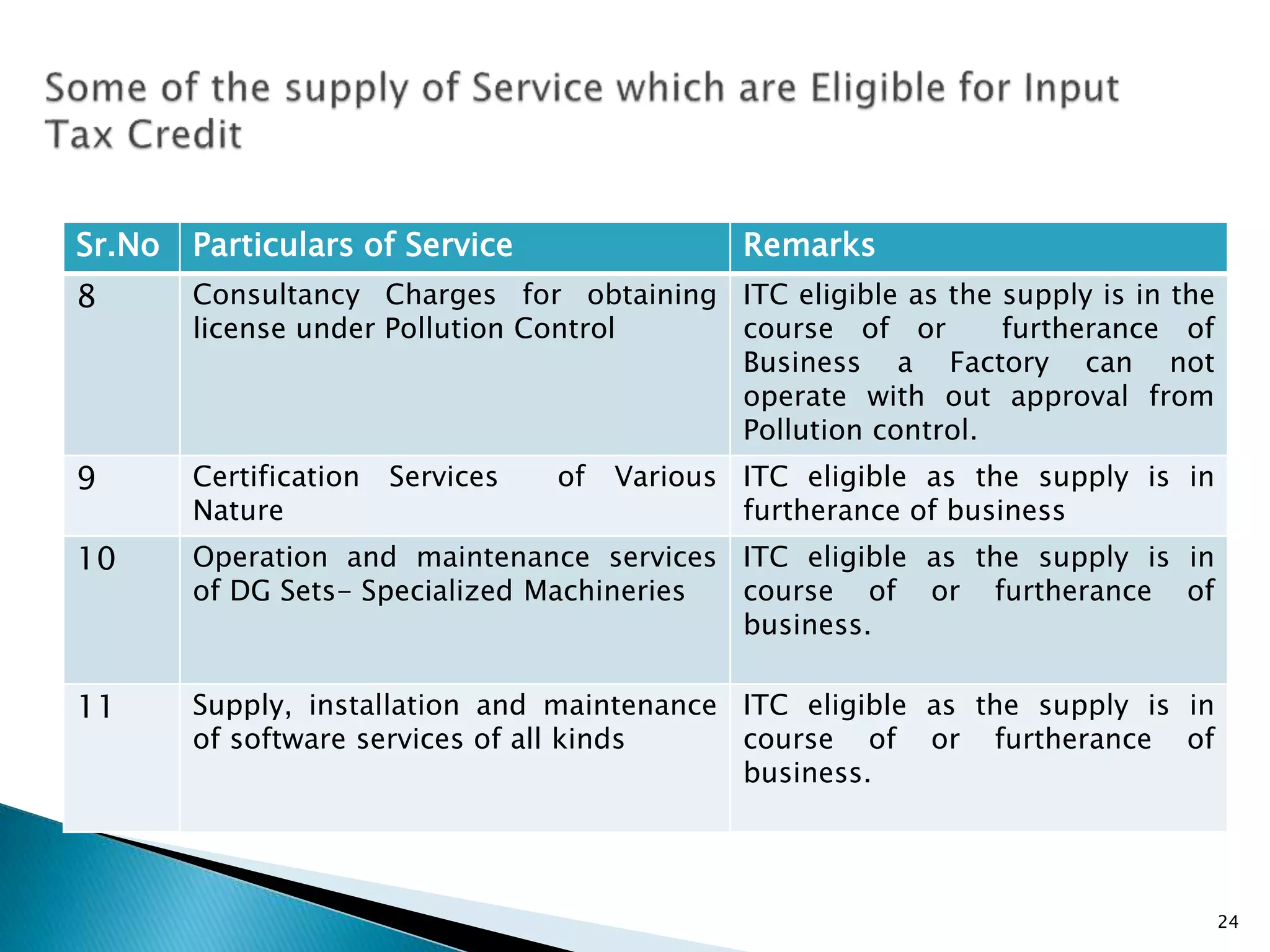

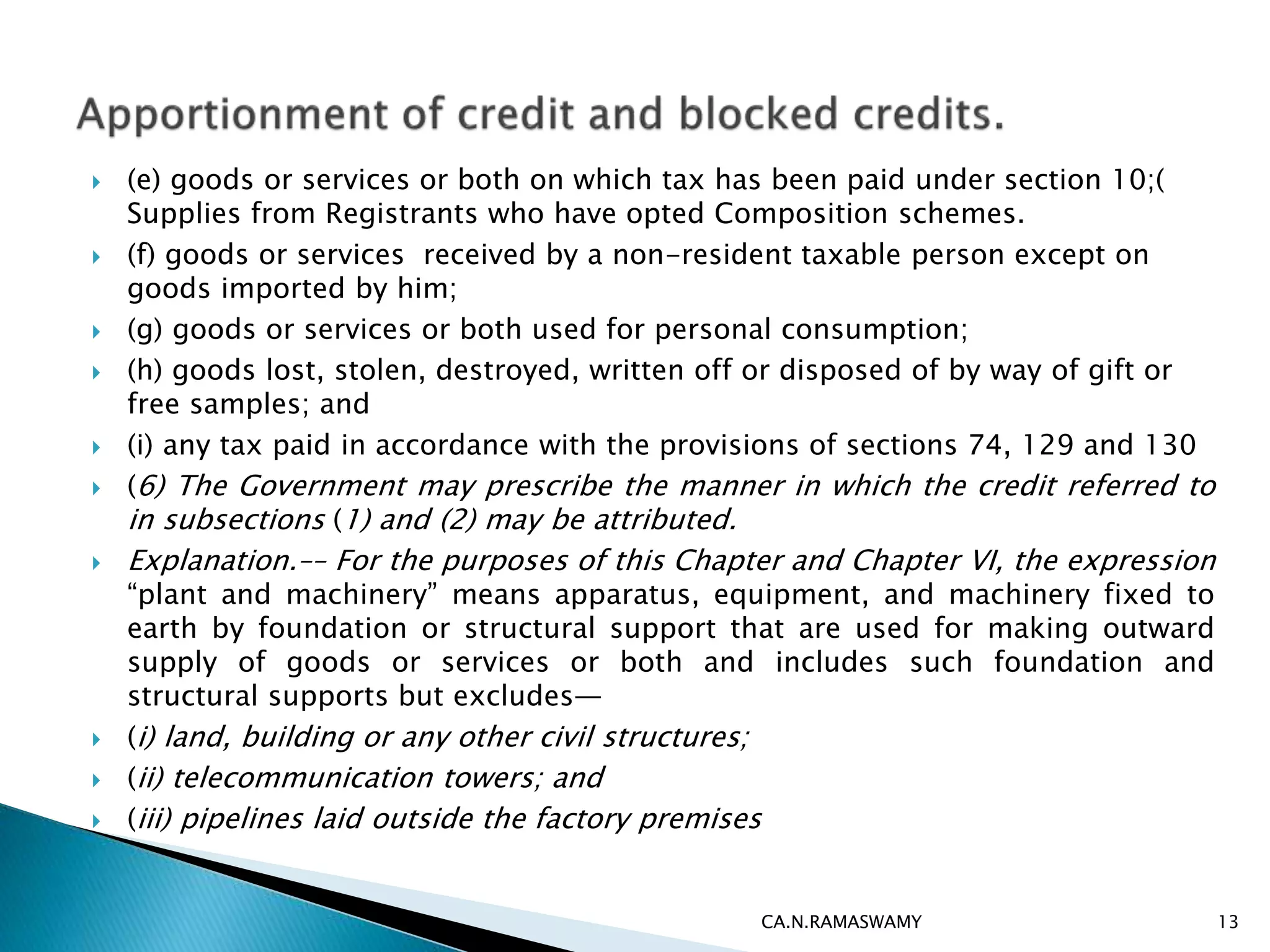

3. The document outlines circumstances where input tax credit is not available, such as when goods or services are used for non-business purposes or making exempt supplies. It also discusses provisions for apportioning credit between taxable and exempt

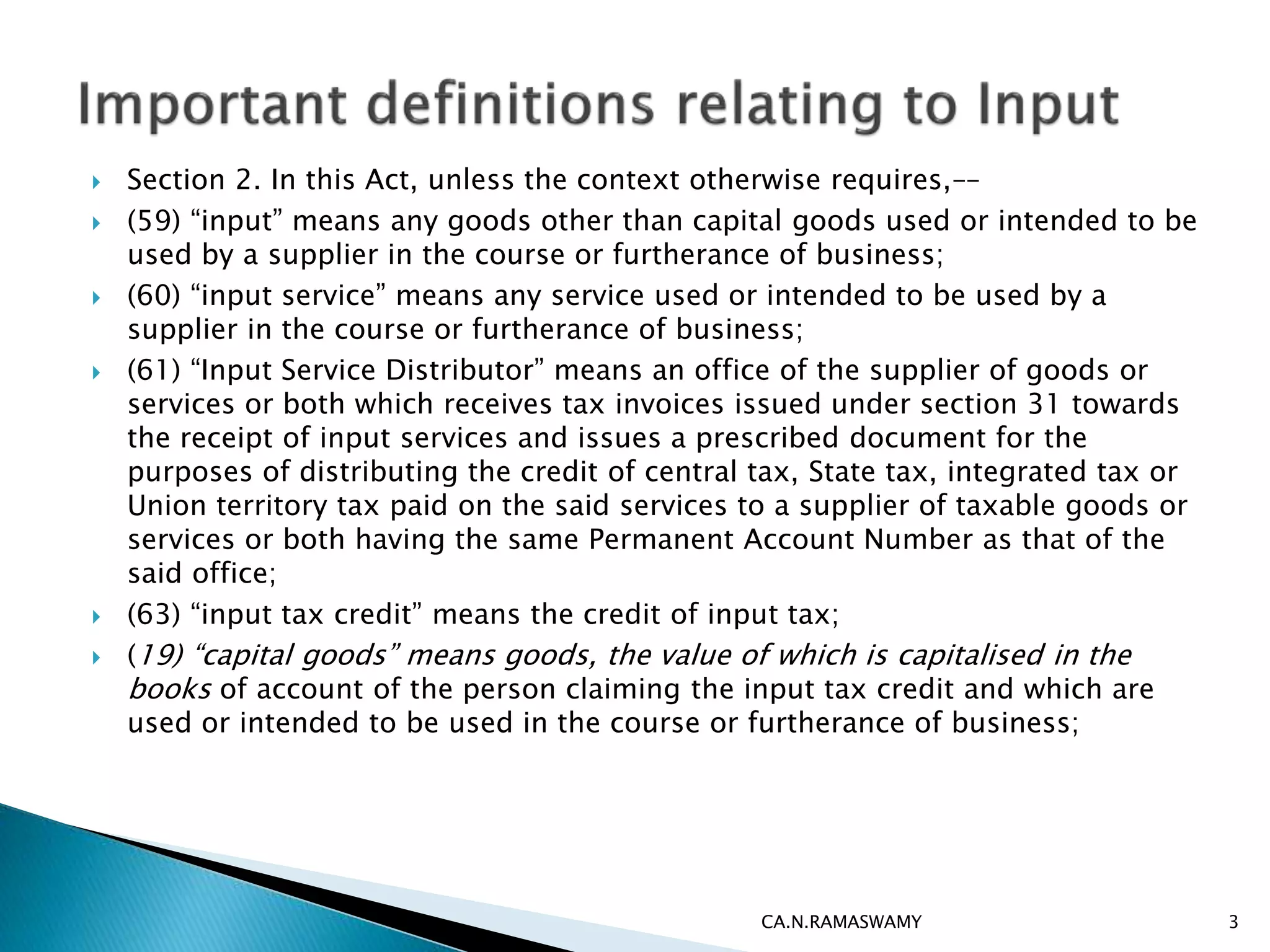

![ [(4) Input tax credit to be availed by a registered person in respect of invoices

or debit notes, the details of which have not been uploaded by the suppliers

under sub-section (1) of section 37, shall not exceed 20 per cent. of the

eligible credit available in respect of invoices or debit notes the details of

which have been uploaded by the suppliers under sub-section (1) of section

37.]40

The said sub-rule provides restriction in availment of input tax credit (ITC) in

respect of invoices or debit notes, the details of which have not been uploaded

by the suppliers under sub-section (1) of section 37of the Central Goods and

Services Tax Act, 2017 (hereinafter referred to as the CGST Act). Effective from

19-10-2019. To clarify and ensure uniform practices, CBIC has issued a

Board circular 123/42/2019– GST, the 11th November, 2019.

Further, Restriction 20% as stated above was amended to 10% with effect

from01-01-2020 vide notification no.75/2019 dated 26-12-2020

In view of COVID -19, the restriction will not apply during the period Till Aug

2020, to be effective as to allow cumulative application of the condition in rule

36(4) for the months of February, 2020 to August, 2020 in the return for Tax

period Sept 2020 vide circular no 136/06/2020-GST dated 3-4-2020.

CA.N.RAMASWAMY 14](https://image.slidesharecdn.com/inputtaxcredit-overview-200810051234/75/Input-tax-credit-overview-14-2048.jpg)