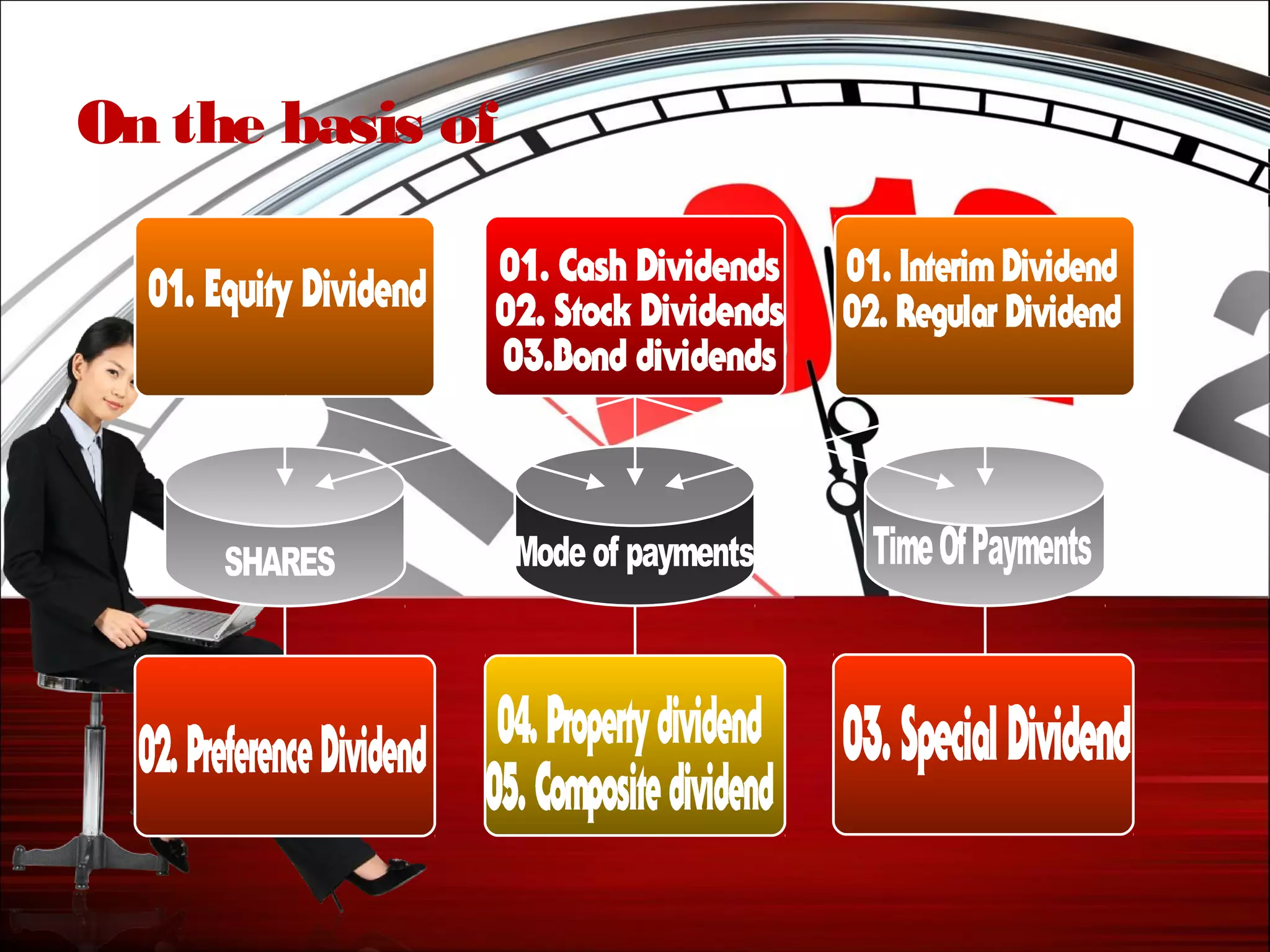

Dividends can be classified in several ways:

1. Based on the source of funds, dividends are either profit dividends paid from earnings or liquidation dividends paid from capital.

2. Based on the type of shares, dividends are either equity dividends paid to ordinary shareholders or preference dividends paid to preferred shareholders.

3. Based on the payment method, dividends can be paid in cash, stock, bonds, property, or a combination through composite dividends.