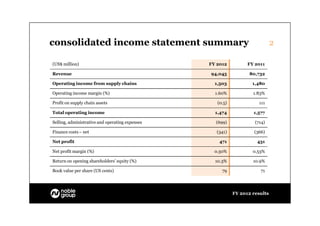

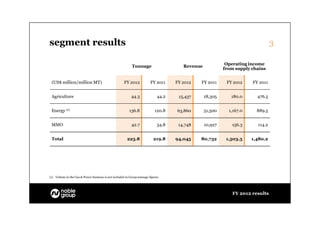

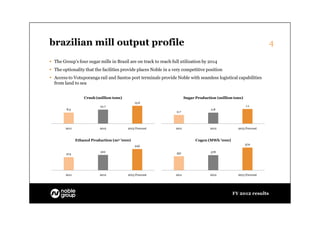

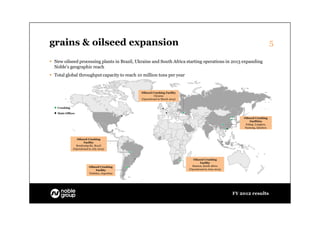

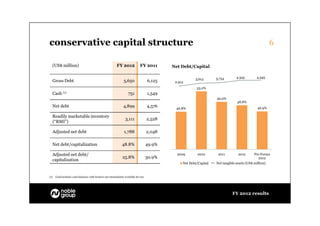

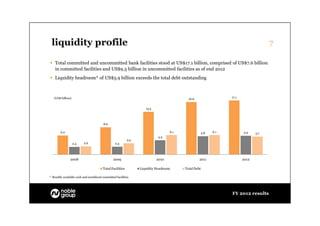

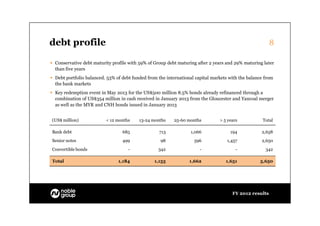

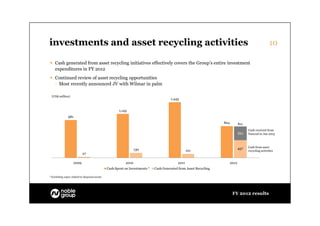

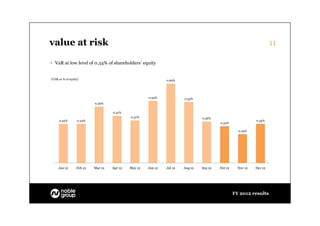

The document provides a summary of a company's full year 2012 results, highlighting record revenue and tonnage. Key points include growth in revenue and profit, ongoing investment expenditures, strong liquidity position, and conservative capital structure. Segment results and various expansion projects are also summarized.