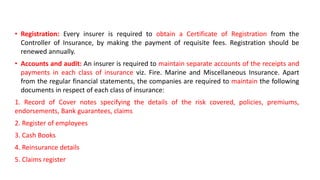

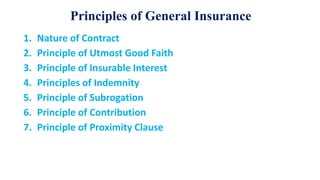

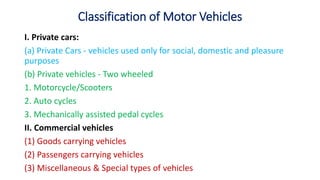

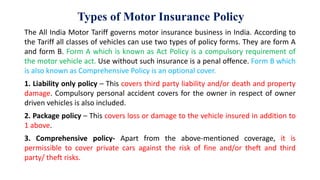

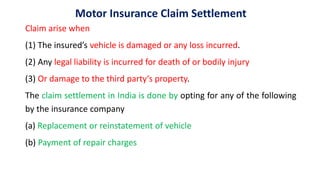

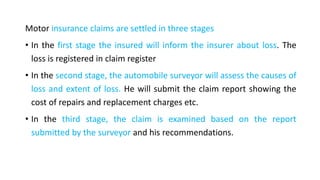

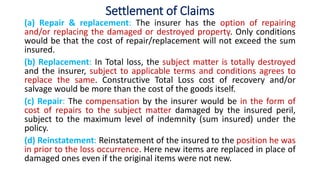

This document provides an overview of general insurance. It begins with an introduction that defines general insurance as non-life insurance that covers property, personal accidents, liability, and other risks. It then lists the main types of general insurance like fire, motor, health, and burglary insurance. The rest of the document discusses the principles and regulations governing general insurance in India, including utmost good faith, insurable interest, indemnity, and subrogation. It provides details on key concepts like the nature of insurance contracts and the statutes that regulate the general insurance industry in India.