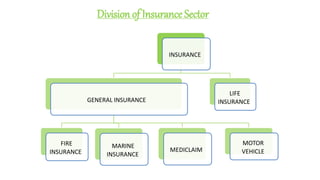

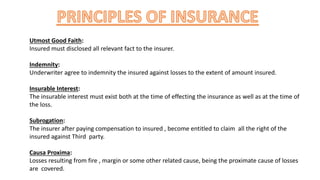

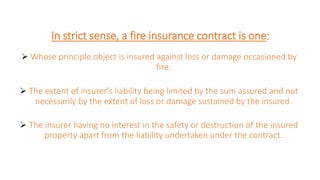

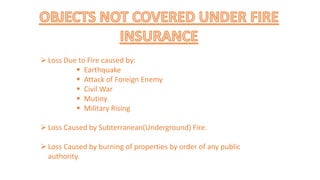

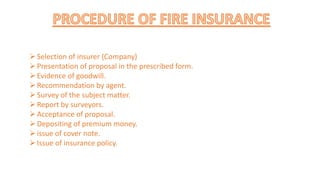

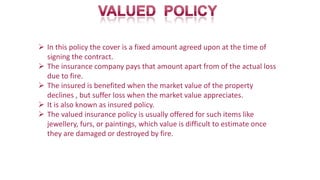

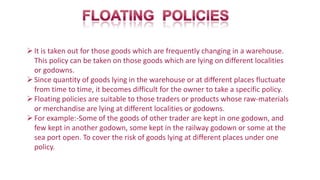

This document provides an overview of fire insurance. It discusses key concepts such as utmost good faith, indemnity, insurable interest, and subrogation. It describes what can be covered by fire insurance including buildings, machinery, goods, and household contents. It also summarizes different types of fire insurance policies such as specific insurance, floating insurance, and standing insurance.