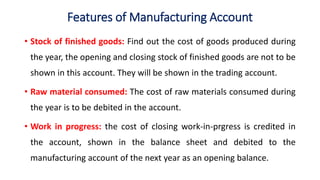

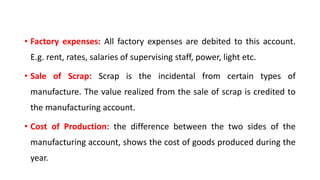

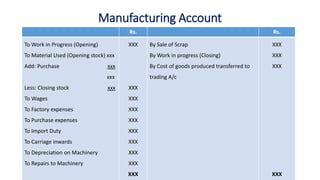

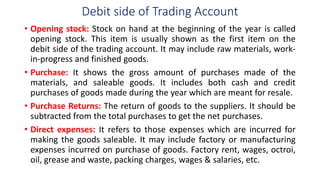

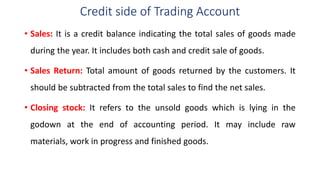

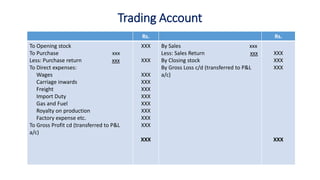

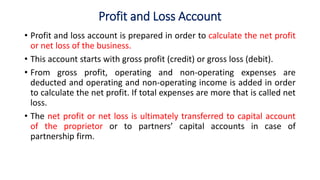

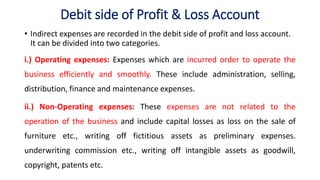

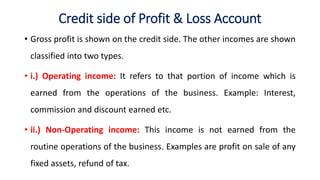

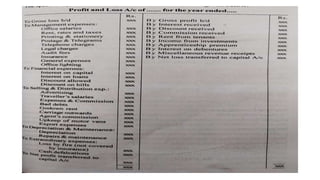

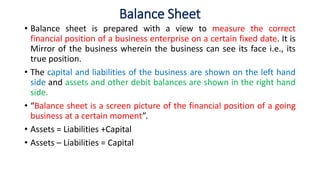

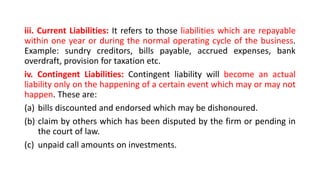

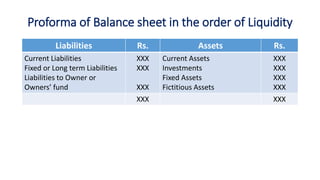

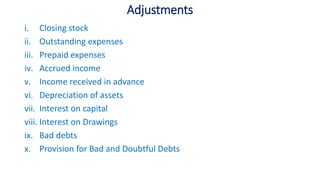

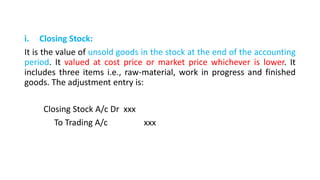

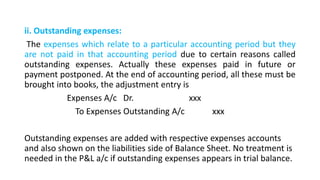

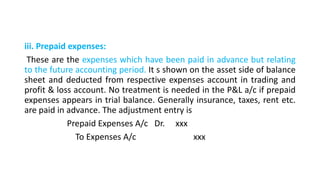

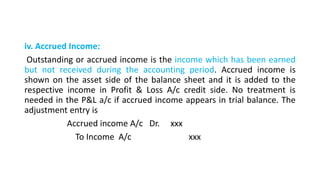

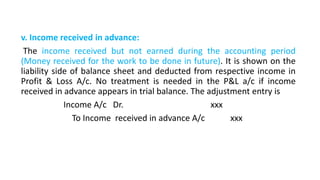

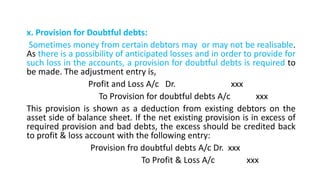

This document provides an overview of preparing final accounts for a sole proprietorship business. It discusses preparing a trading account, profit and loss account, and balance sheet. It also covers manufacturing accounts, features of these accounts, classifications of assets and liabilities, and various account adjustments like closing stock, outstanding expenses, depreciation, bad debts, and provisions. The key information presented includes the objectives and format of the trading account, profit and loss account, and balance sheet, as well as explanations of common account adjustments made when preparing final accounts.