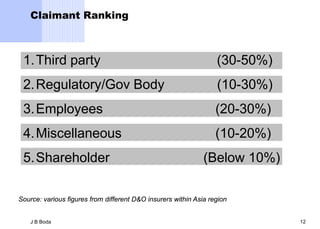

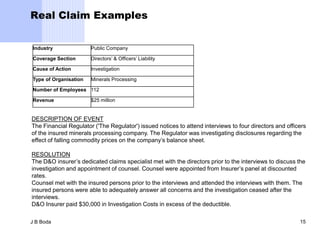

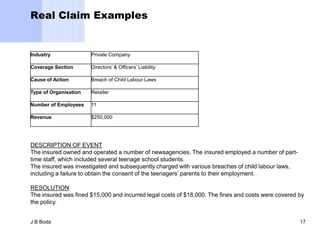

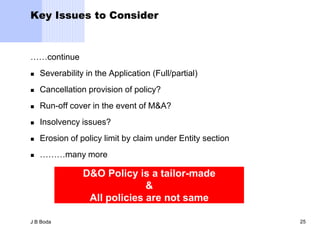

Directors and officers (D&O) liability insurance protects directors and officers from legal liabilities arising from their managerial duties. Some key risks include regulatory investigations, shareholder lawsuits, and employment claims. Successful claims can cost millions in legal fees and damages. It is important for companies to carefully consider their D&O coverage needs, key policy terms and exclusions, and ongoing risks from mergers or director retirements. Purchasing adequate D&O insurance can help protect personal assets and support good corporate governance.