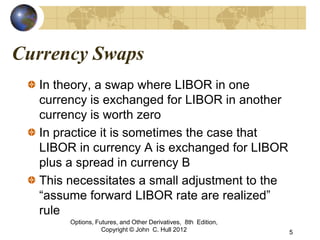

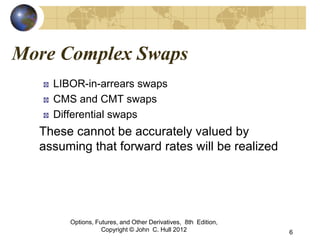

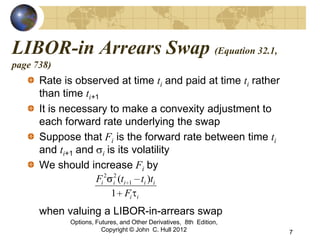

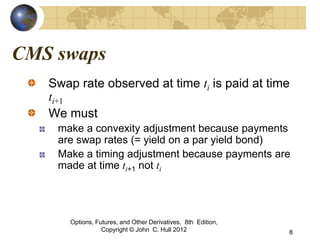

The document discusses various types of interest rate swaps and how to value them. It begins by explaining how the standard approach values plain vanilla interest rate and currency swaps by assuming forward rates will be realized. It then describes how this approach can also value swaps with variations like different payment frequencies or floating rates. More complex swaps like LIBOR-in-arrears, CMS, differential, and equity swaps require adjustments to the standard approach for accurate valuation. The document also discusses swaps with embedded options and other unique types of swaps.