Mark Tuminello Future Hedging

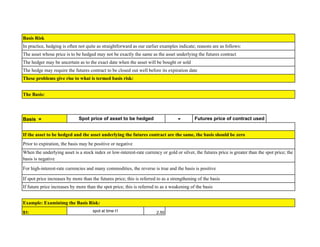

- 1. Basis Risk In practice, hedging is often not quite as straightforward as our earlier examples indicate; reasons are as follows: The asset whose price is to be hedged may not be exactly the same as the asset underlying the futures contract The hedger may be uncertain as to the exact date when the asset will be bought or sold The hedge may require the futures contract to be closed out well before its expiration date These problems give rise to what is termed basis risk: The Basis: Basis = - Spot price of asset to be hedged Futures price of contract used If the asset to be hedged and the asset underlying the futures contract are the same, the basis should be zero Prior to expiration, the basis may be positive or negative When the underlying asset is a stock index or low-interest-rate currency or gold or silver, the futures price is greater than the spot price; the basis is negative For high-interest-rate currencies and many commodities, the reverse is true and the basis is positive If spot price increases by more than the futures price; this is referred to as a strengthening of the basis If future price increases by more than the spot price; this is referred to as a weakening of the basis Example: Examinimg the Basis Risk: spot at time t1 S1: 2.50

- 2. spot at time t2 S2: 2.00 F1: futures price at time t1 2.20 F2: futures price at time t2 1.90 b1: (S1 - F1) basis at time t1 0.30 b2: (S2 - F2) basis at time t2 0.10 Short Hedge: Price realized The effective price that is obtained for the asset with short hedging is therefore: S2 + F1 - F2 = F1 + b2 2.30 = 2.30 Profit (F1 - F2) 0.30 The hedging risk is the uncertainty associated with b2 (the basis risk) Long Hedge: Price realized The effective price that is paid for the asset with long hedging is therefore: S2 + F1 - F2 = F1 + b2 2.30 = 2.30 Profit (F1 - F2) -0.30 The hedging risk is the uncertainty associated with b2 (the basis risk) For investment assets such as currencies, stock indices, gold and silver, the basis risk tends to be less than for consumption commodities; because arbitrage arguments lead to well-defined relationship between the future price and the spot price of an investment asset

- 3. The basis risk for an investment asset arises mainly from uncertainty as to the level of the risk-free interest rate in the future. The asset that gives rise to the hedger's exposure is sometimes different from the asset underlying the hedge; the basis risk is usually greater. Example: Examining the Basis Risk: S1*: spot at time t1 2.50 S2*: spot at time t2 2.00 S2: spot of asset being hedged 2.20 F1: futures price at time t1 2.20 F2: futures price at time t2 1.90 b1: (S1 - F1) basis at time t1 0.30 b2: (S2 - F2) basis at time t2 0.10 The effective price that is obtained for the asset with hedging is therefore: S2 + F1 - F2 = F1 + b2 2.50 ≠ 2.30 Profit = (F1 - F2) 0.30 (+) (S2 - S2*) 0.20 Profit = 0.50 F1 + (S2* - F2) + (S2 - S2*) This can be written as: 2.50 Example: Examinimg the Basis Risk in a Short Hedge (Receive 50 million Yen in July; enter Short September Futures) Short four (4) September yen futures contracts on March 1 Close out contract when yen arrive at end of July Basis Risk: uncertainty as to the difference between the spot price and September futures price of the yen at the end of July S1: spot at time t1 S2: spot at time t2 0.7200 Short Hedge: Price realized

- 4. F1: futures price at time t1 0.7800 F2: futures price at time t2 0.7250 b1: (S1 - F1) basis at time t1 b2: (S2 - F2) basis at time t2 -0.0050 Short Hedge: Price realized The effective price that is obtained for the asset with short hedging is therefore: S2 + F1 - F2 = F1 + b2 0.7750 = 0.7750 Profit (F1 - F2) 0.0550 The hedging risk is the uncertainty associated with b2 (the basis risk) Example: Examinimg the Basis Risk in a Long Hedge (Airline needs to purchase 20,000 barrels of crude oil in October or November; enter Long December Futures) Takes a long position in 20 NYM December oil futures contracts in June Closes out contract when it is ready to purchase the oil Basis Risk: uncertainty as to the difference between the spot price and December futures price of oil when the oil is needed S1: spot at time t1 S2: spot at time t2 20.0000 F1: futures price at time t1 18.0000 F2: futures price at time t2 19.1000 b1: (S1 - F1) basis at time t1 b2: (S2 - F2) basis at time t2 0.9000 Long Hedge: Price realized The effective price that is obtained for the asset with short hedging is therefore: S2 + F1 - F2 = F1 + b2 18.90 = 18.90 Profit (F2 - F1) 1.1000 The hedging risk is the uncertainty associated with b2 (the basis risk)

- 5. Minimum Variance Hedge Ratio The hedge ratio is the ratio of the size of the position taken in futures contracts to the size of the exposure If the objective of the hedger is to minimize risk, setting the hedge ratio equal to one (1.0) is not necessarily optimal ΔS ΔF δS δF p h* correlation of coefficient betw: ΔS & ΔF δS δF Hedge Ratio: h The Optimal Hedge Ratio The Optimal Hedge Ratio h* = p h* 0.5 δΔF δΔS Variance of Position Dependence of variance of hedger's position on hedge ratio 1 = 1

- 6. 0.5 0.5 1 1 = 1 = 1 0.5 Data to calculate Minimum Varaiance Hedge Month ΔF ΔS i xi Xi^2 yi Yi^2 1 0.021 0.000441 0.0290 0.000841 0.000609 2 0.035 0.001225 0.0200 0.000400 0.0007 3 -0.046 0.002116 -0.0440 0.001936 0.002024 4 0.001 0.000001 0.0080 0.000064 0.000008 5 0.044 0.001936 0.0260 0.000676 0.001144 6 -0.029 0.000841 -0.0190 0.000361 0.000551 7 -0.026 0.000676 -0.0100 0.000100 0.00026 8 -0.029 0.000841 -0.0070 0.000049 0.000203 9 0.048 0.002304 0.0430 0.001849 0.002064 10 -0.006 0.000036 0.0110 0.000121 -0.000066 11 -0.036 0.001296 -0.0360 0.001296 0.001296 12 -0.011 0.000121 -0.0180 0.000324 0.000198 13 0.019 0.000361 0.0090 0.000081 0.000171 14 -0.027 0.000729 -0.0320 0.001024 0.000864 15 0.029 0.000841 0.0230 0.000529 0.000667 ΣXi^2 ΣYi^2 ΣXiYi ΣXi -0.0130 0.0138 ΣYi 0.0030 0.0097 0.0107 Mean = -0.00086667 δF 0.03134341 δS 0.026254795 p 0.928 0.0263 0.0313 0.778 = 0.928

- 7. This means that the futures contracts bought should have 77.8% of the face value of the asset being hedged Optimal Number of Contracts NA size of position being hedged (units) 20,000.00 QF size of one futures contract (units) 1,000.00 N* Optimal number of future contracts for hedging Futures contracts used should have a face value of = h*NA h*NA 1 5,553.01 h*NA QF 0.778*20,000 1,000 N* = 15.55 = Notation Transition: S = value of position being hedged NA * S F = Futures contract price QF * F δS = Std. Dev New S δF = Std. Dev. New F p = Coefficient of correlation betw: new S and new F δS δF The Optimal Hedge Ratio N* = p

- 8. Stock Index Futures - Hedging ß=(beta); this is the slope of the best fitted line obtained when the excess return on the portfolio over the risk-free rate is regressed against the excess return on the market over the risk-free rate SF N* = ß Example: Futures contract on SP 500 with 4 mos. to maturity, over the next three = 200.00 = ######### = 0.10 = 0.04 = 1.50 = 0.33 $ 500.00 204.04 ######## ######## Value of S&P index Value of portfolio Risk-free interest rate Dividend yield on S&P 500 Beta of Portfolio Maturity - Four mos. Future contract is for delivery of Multiplier: Current Fo= 30.0 = 1.50 Spot Index . = 180 180 180.90 Current One mos. Fo= Gain = #########

- 9. Loss on Index = 10.0% Dividend 4% p.a. 1.0% Net Loss o/ 3 mos 9.0% Expected Return on the portfolio - Risk-free interest rate = 1.5 X (Return on Index - Risk-free interest rate) = -0.1475 Portfolio Value = ######### Gain = ######### Hedged Port. Value = ######### Beta: Has been reduced to zero Changing Beta (using the above example of 30 contracts To reduce the beta of a portfolio to some value other than zero: From 1.5 to .75 Short 15 contracts From 1.5 to 2.0 Long poistion in 10 contracts To change beta of the portfolio brom ß to ß*; where ß > ß*; pursue a short position in: SF 15.00 (ß - ß*) 15.00 0.75 20.00 To change beta of the portfolio brom ß to ß*; where ß < ß*; pursue a Long position in: SF 10.00 (ß* - ß) 10.00 0.50 20.00