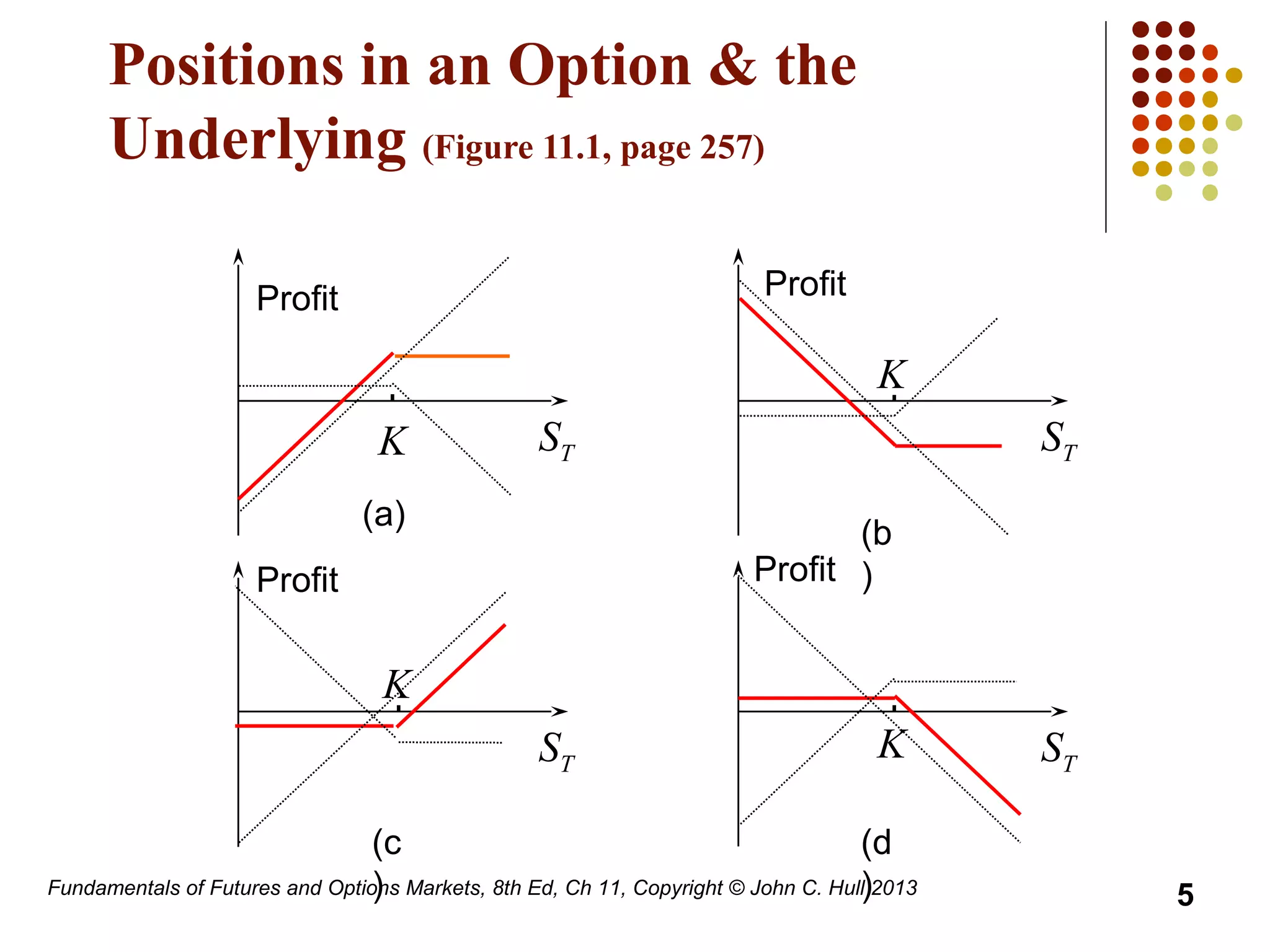

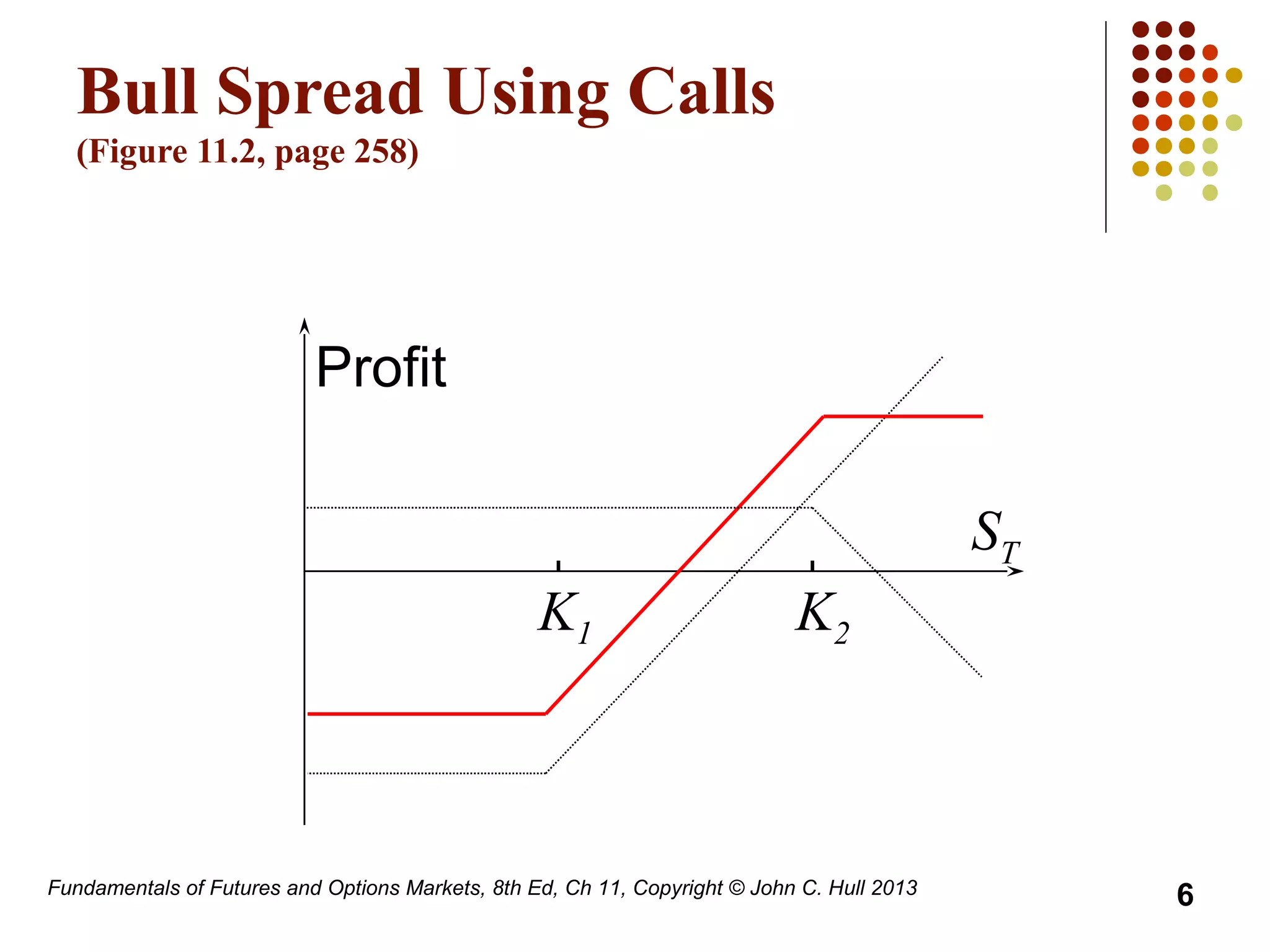

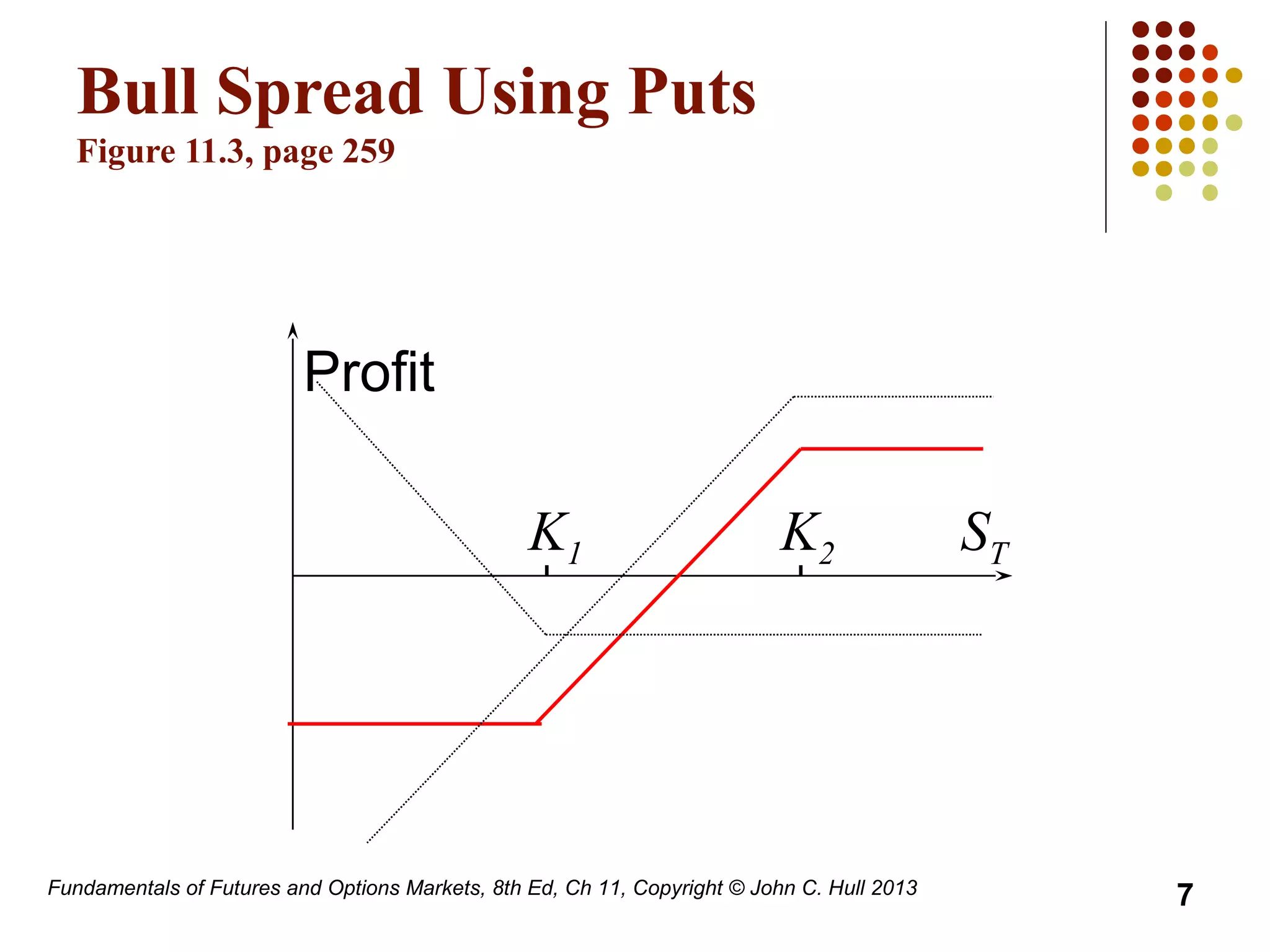

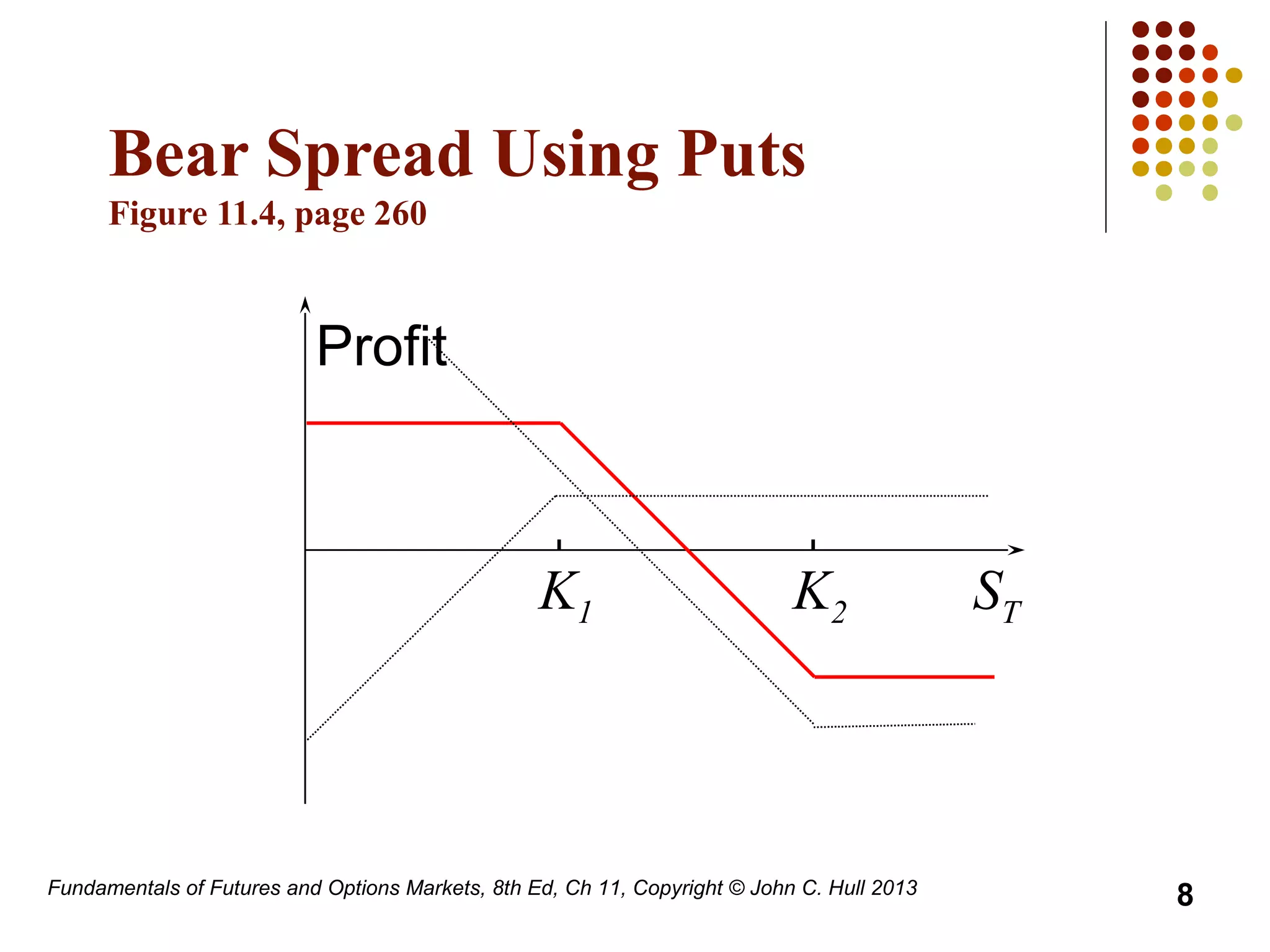

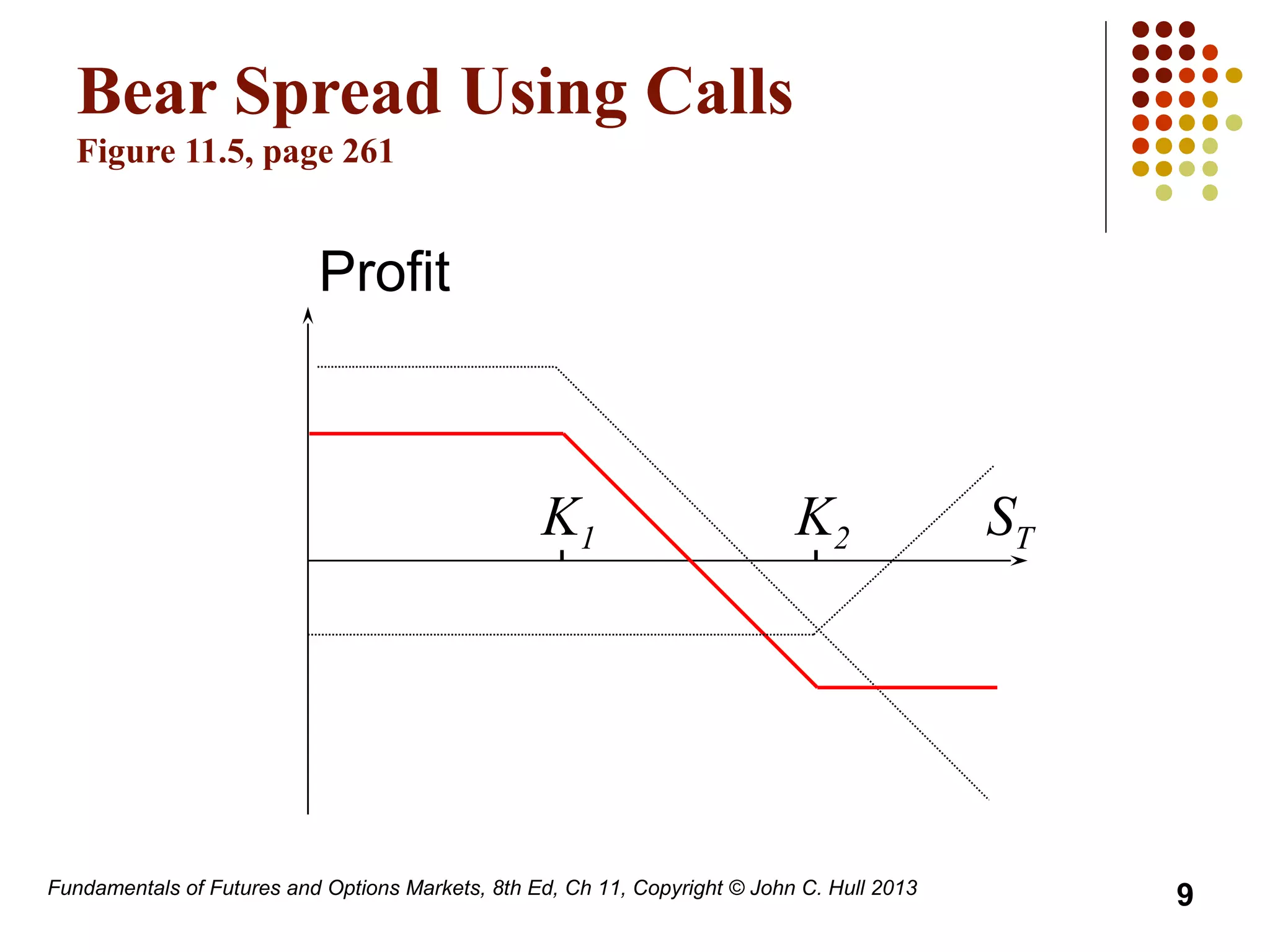

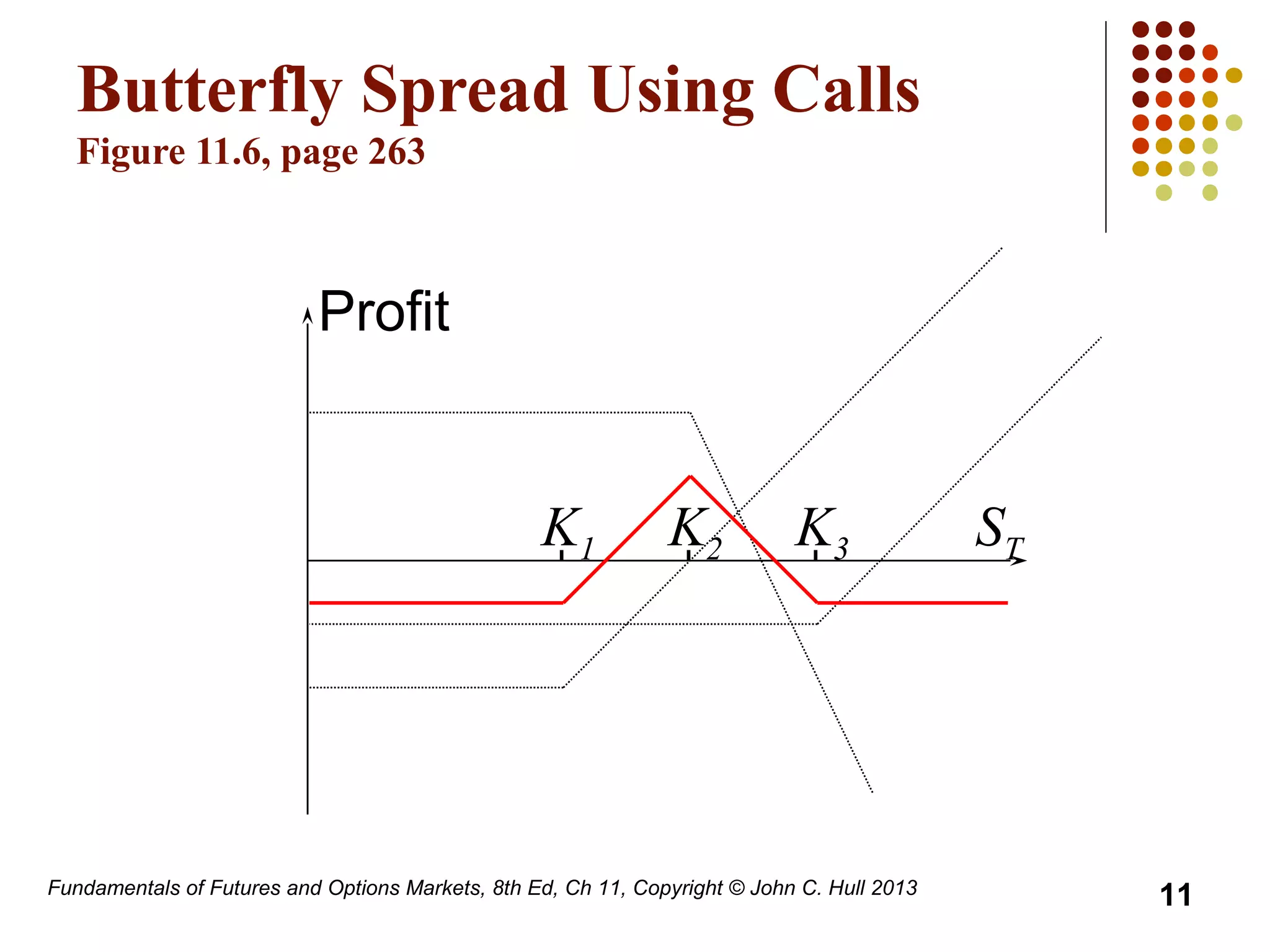

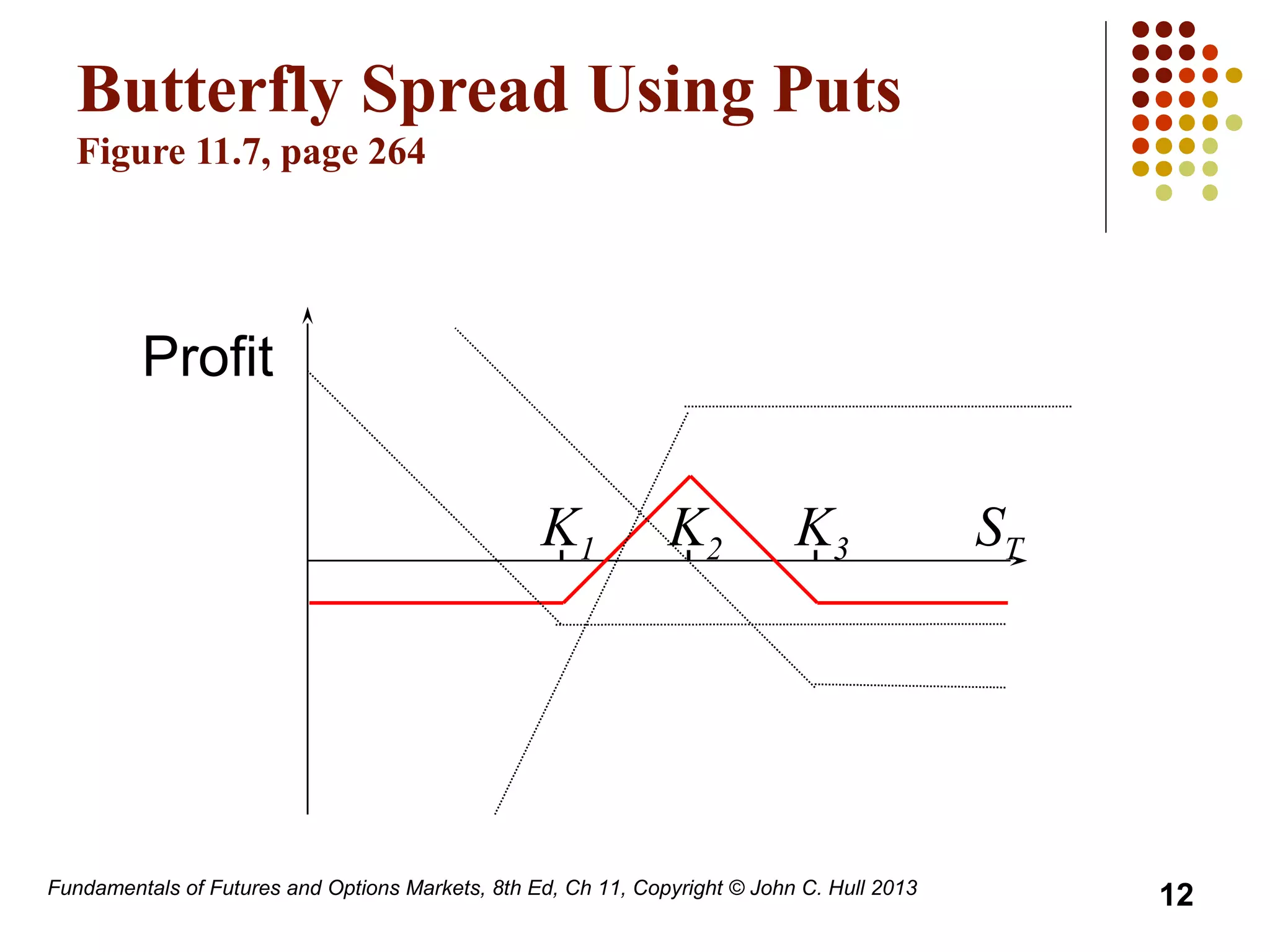

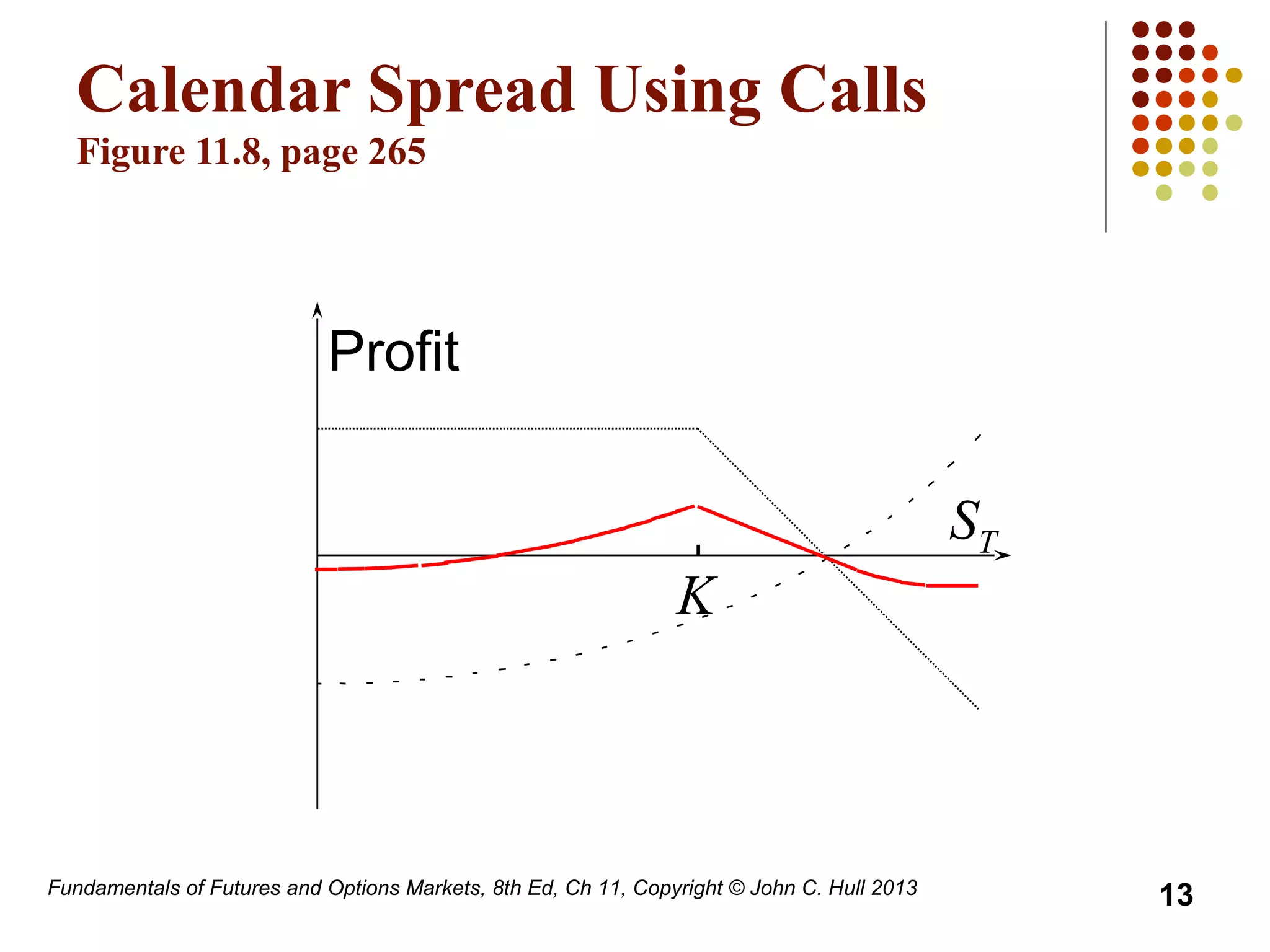

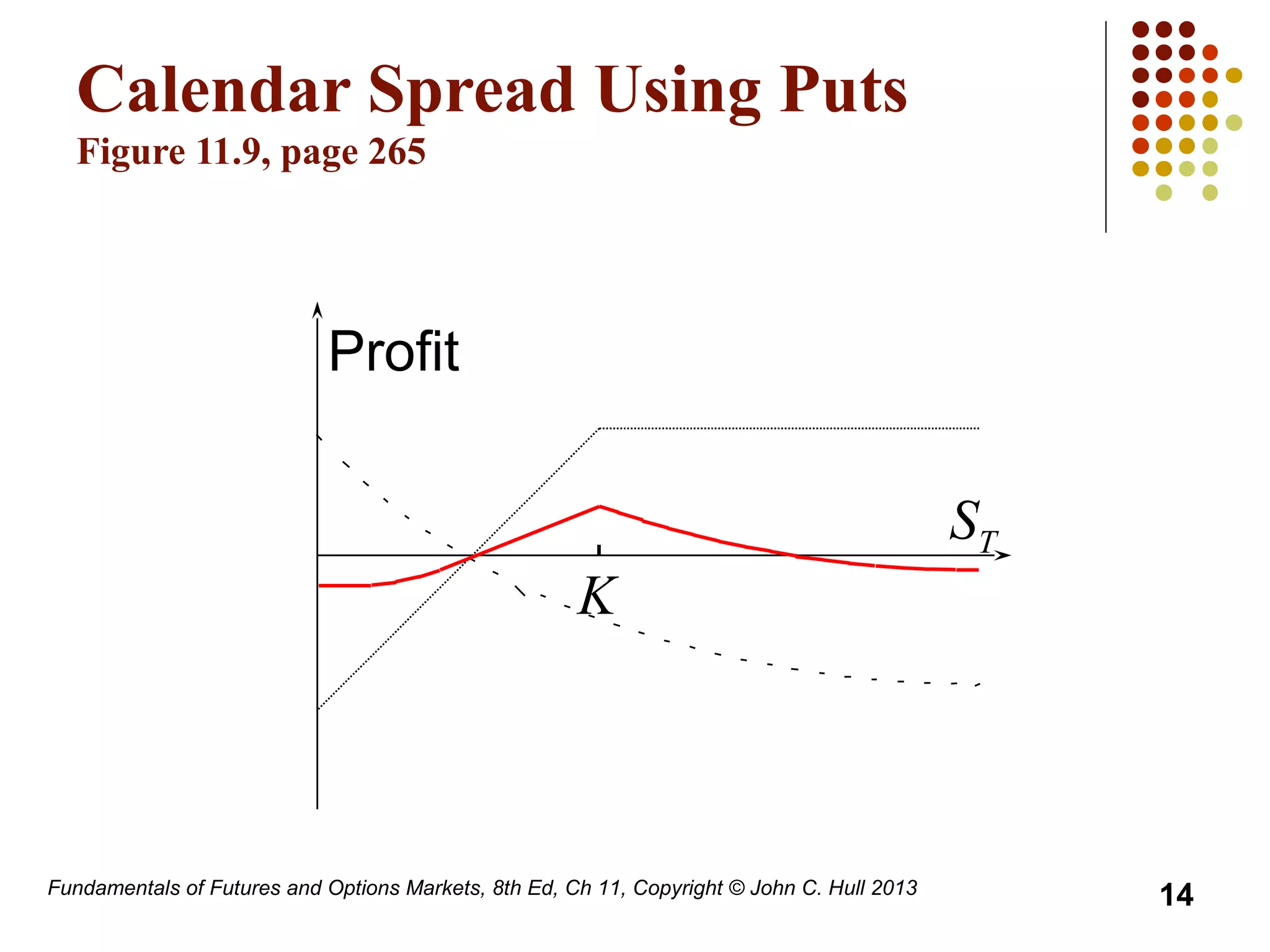

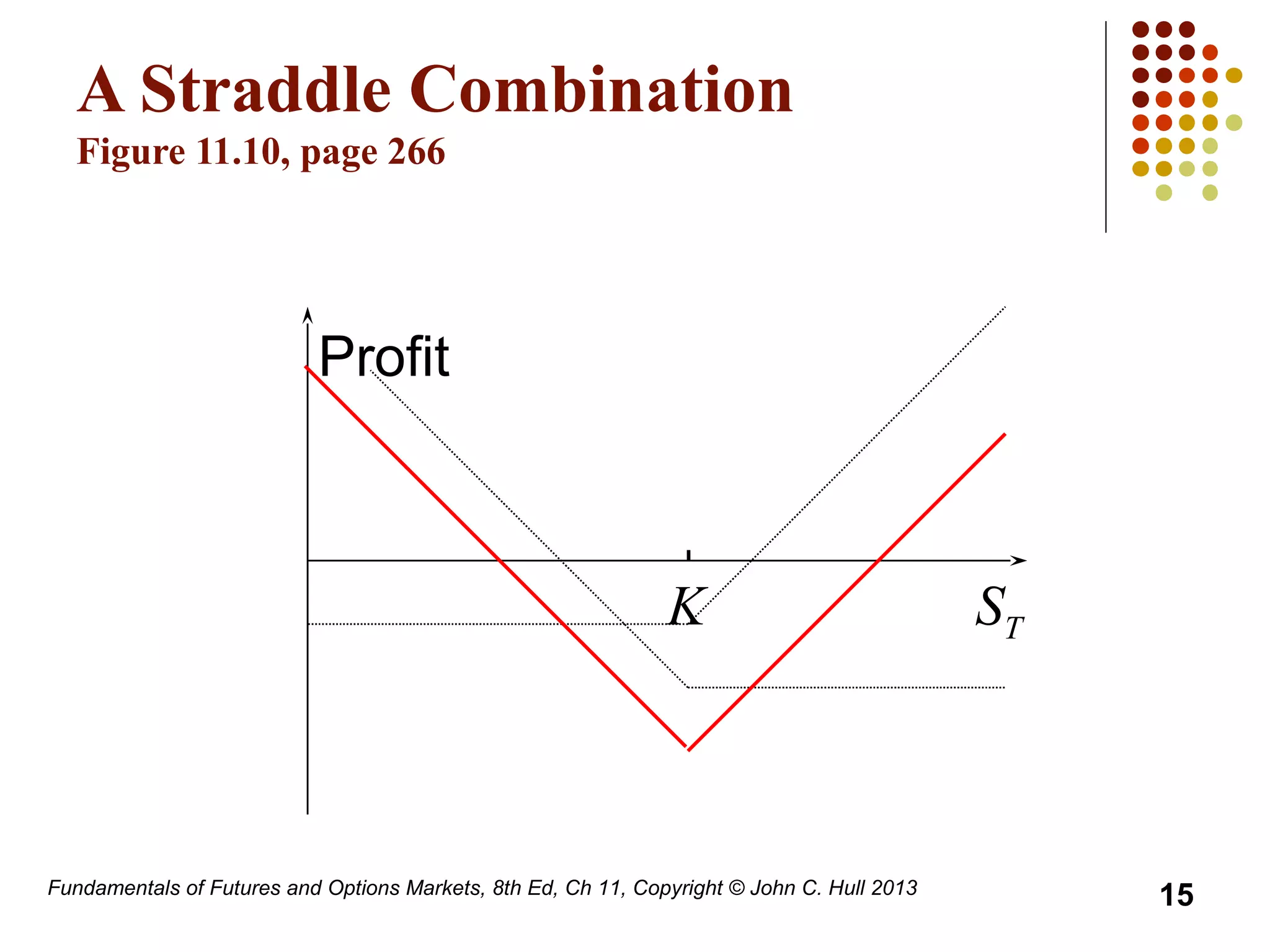

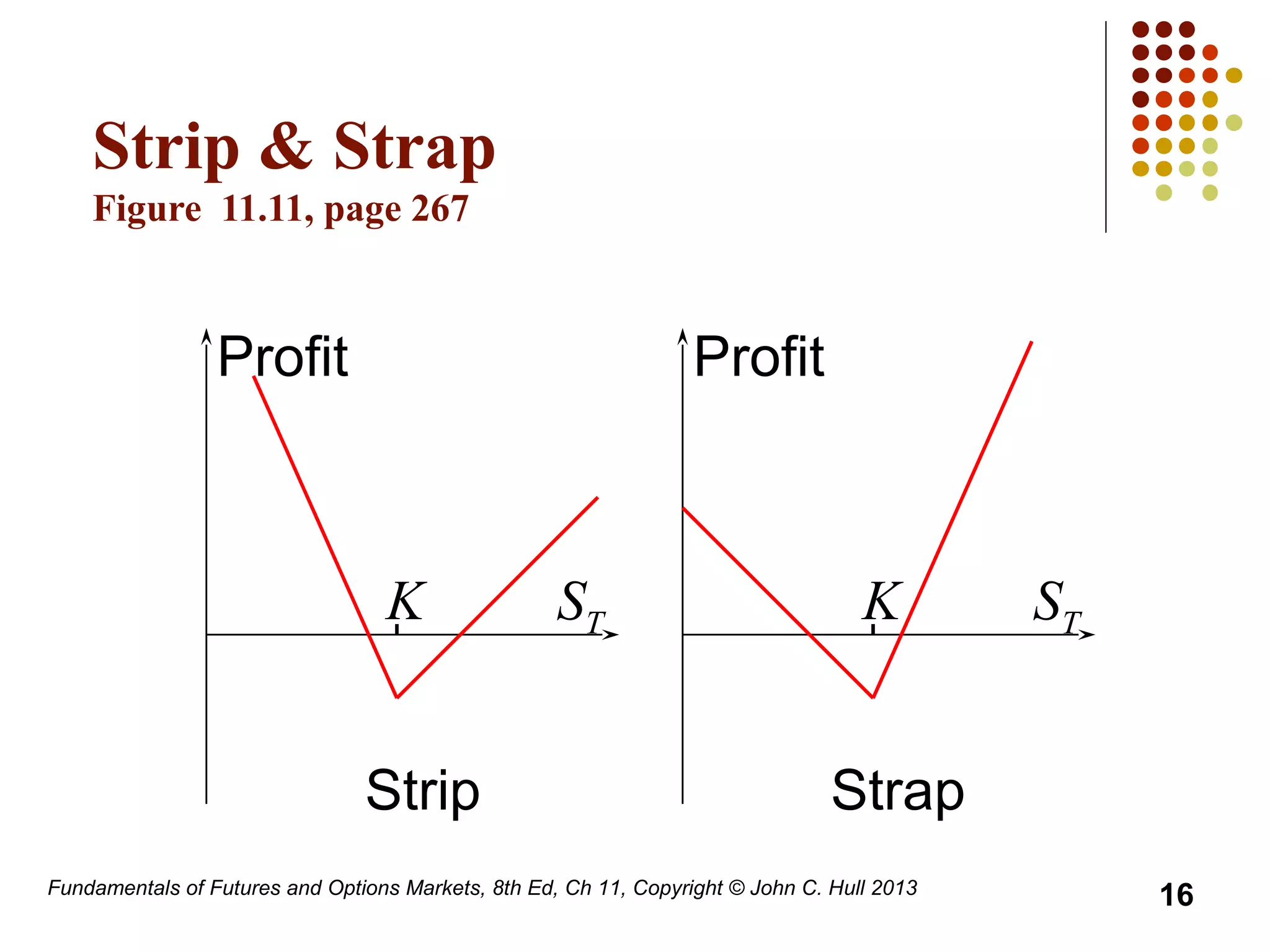

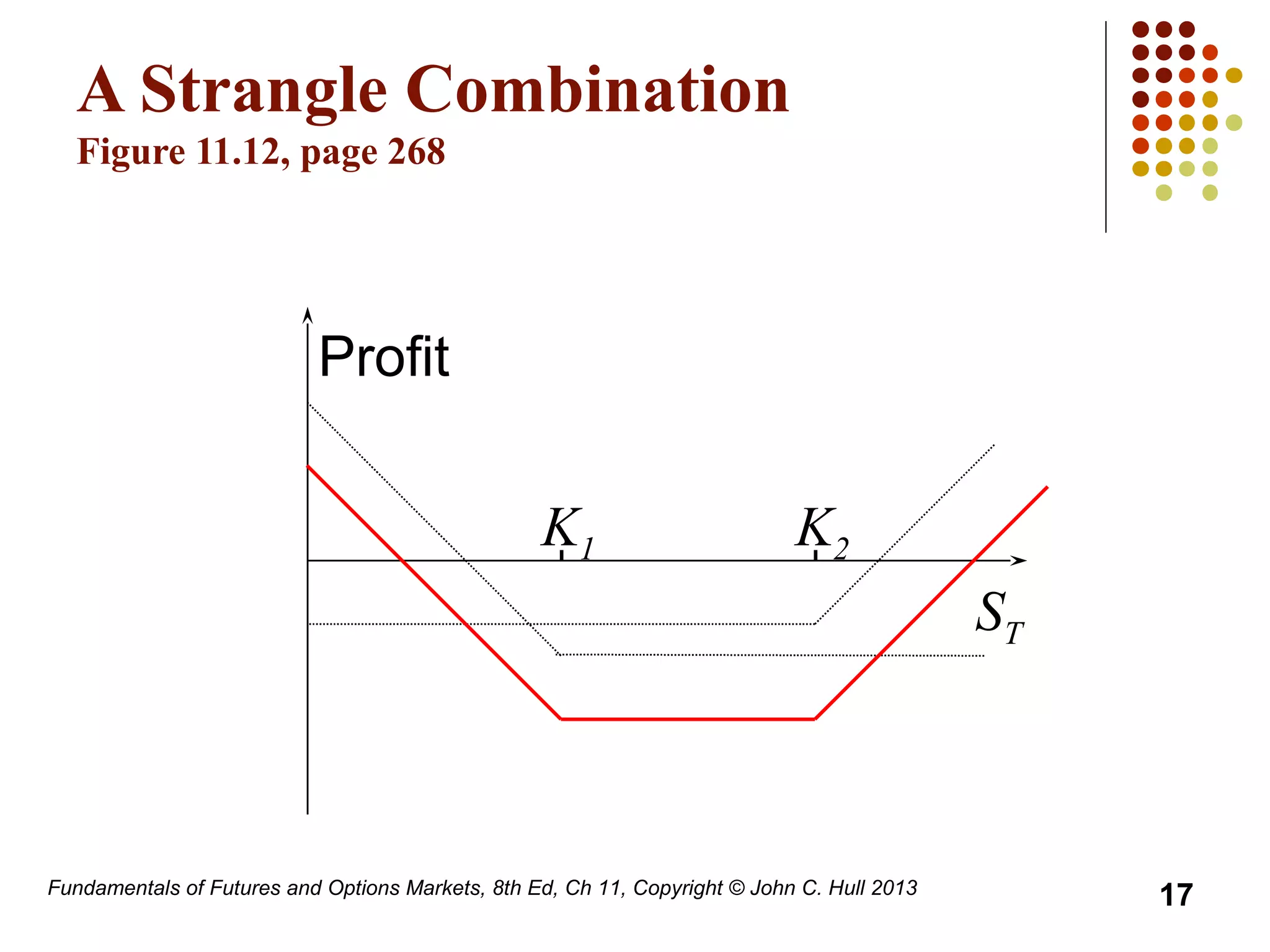

This chapter discusses various trading strategies involving options, including using a bond and option to create a principal protected note, positions in individual stocks and options, option spreads, and option combinations. It provides examples of bullish and bearish call and put spreads, butterfly spreads, calendar spreads, straddles, strips and straps. The payoffs of these strategies are illustrated through diagrams. Principal protected notes allow investors to take on risk without jeopardizing principal. Option spreads and combinations can be used to speculate on the direction of the underlying asset or to hedge exposures.