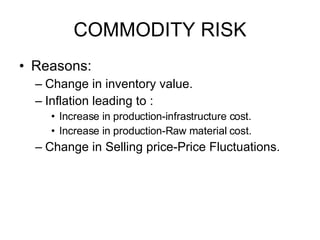

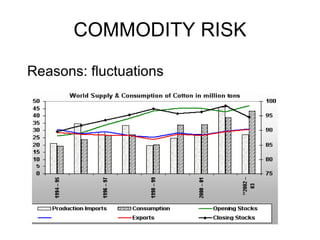

The document discusses commodity risk management and hedging strategies. It provides examples of hedging cotton and copper prices using commodity futures contracts on exchanges. Various hedging techniques are defined, including long hedges, short hedges, cross hedges, and spread hedges. Factors that influence commodity prices like production, consumption, storage costs are also summarized.