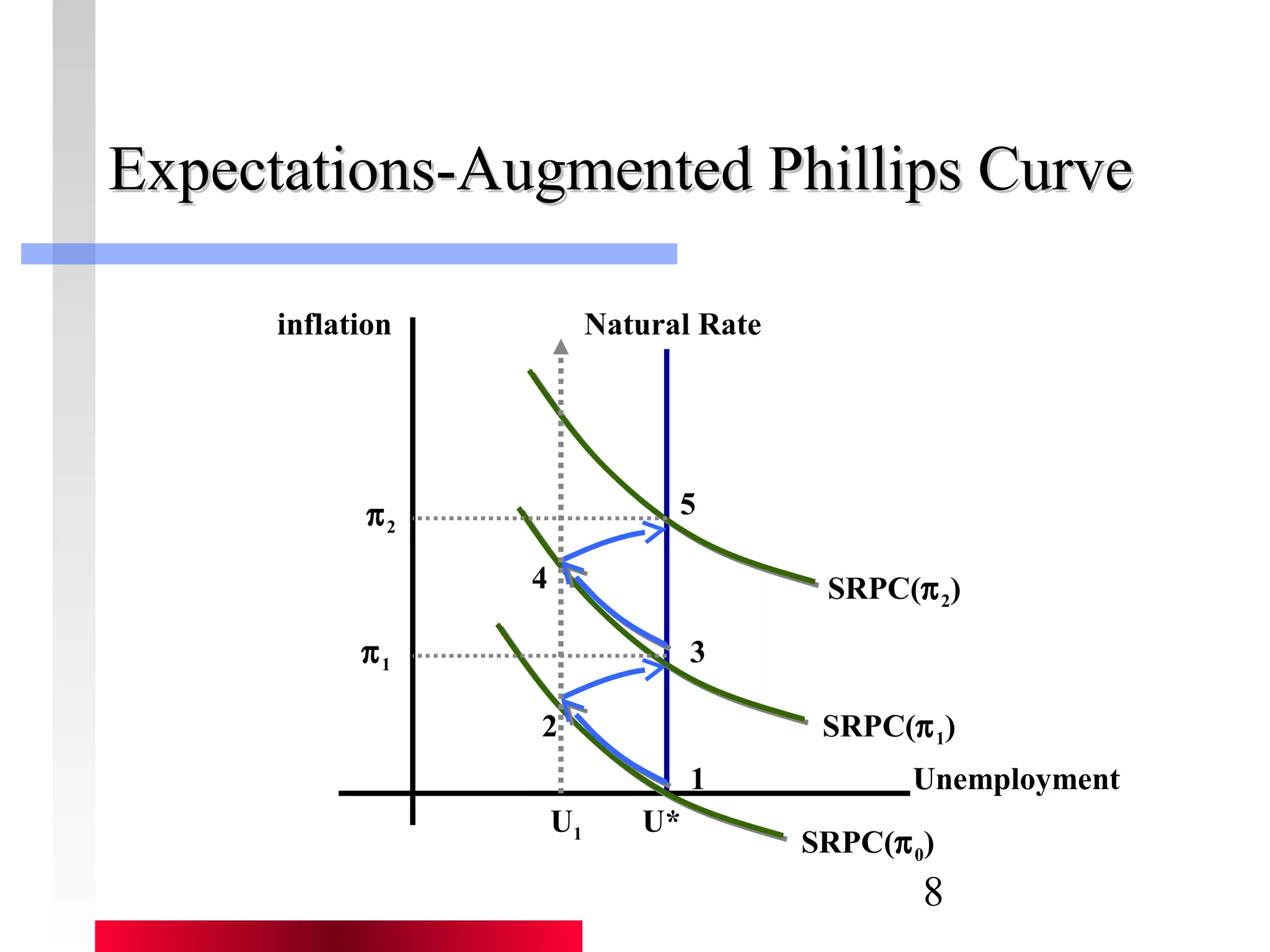

This document summarizes key concepts relating to output, inflation, and unemployment from chapters in an intermediate macroeconomics textbook. It discusses the original Phillips curve developed by A.W. Phillips showing the relationship between wage inflation and unemployment. It then covers Milton Friedman's natural rate theory which argues that in the long run, real variables like employment are determined by real factors, not monetary factors. The document also discusses how expectations of future inflation can shift the short-run Phillips curve and the policy implications of these concepts.