This document provides an overview of monetary policy and inflation in Pakistan. It discusses key topics such as:

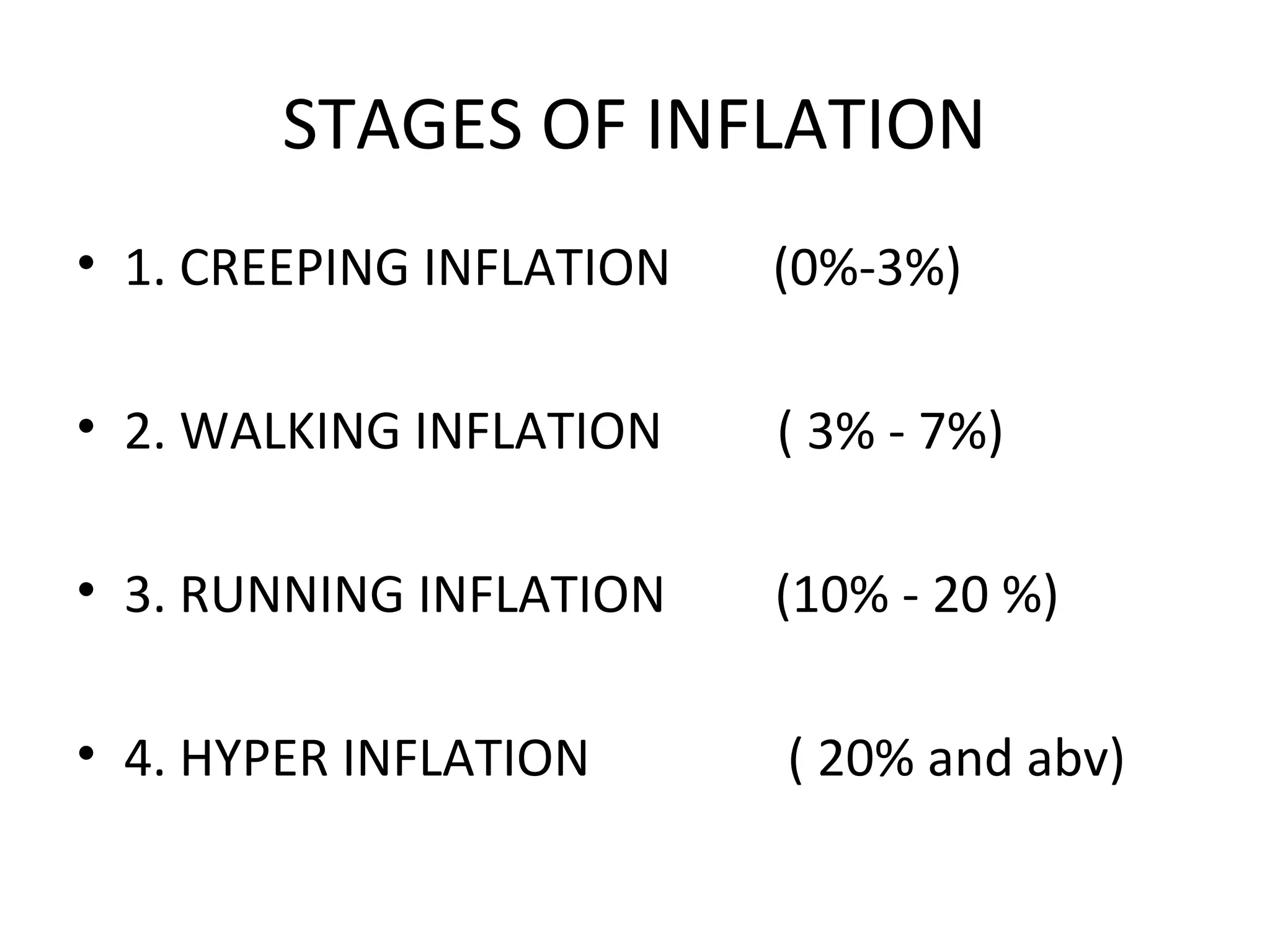

1) The different stages and types of inflation including creeping, walking, running, and hyper inflation.

2) The causes of inflation including demand-pull and cost-push factors.

3) The objectives, instruments and how monetary policy differs from fiscal policy in Pakistan.

4) The instruments of monetary policy used by the State Bank of Pakistan to control inflation including bank rate, cash reserve ratio, open market operations, and others.