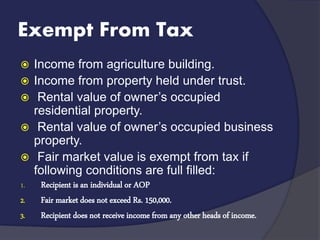

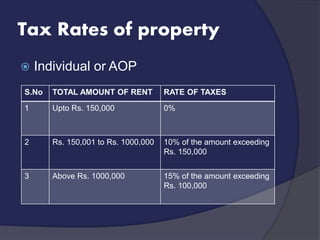

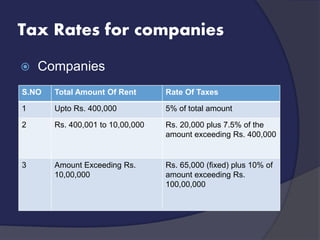

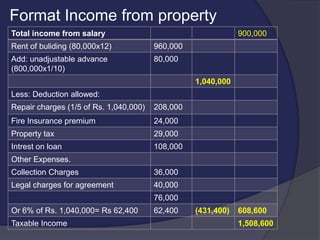

The document discusses the taxation of income from property as outlined in Section 15 of the Income Tax Ordinance, detailing allowable deductions such as collection charges, repair charges, and insurance premiums. It specifies exemptions from tax, including income from agricultural buildings and rental value of owner-occupied properties, and provides tax rates for individuals, associations of persons (AOP), and companies based on the amount of rent received. Additionally, examples of income calculations and deductions are presented, illustrating how to arrive at taxable income.