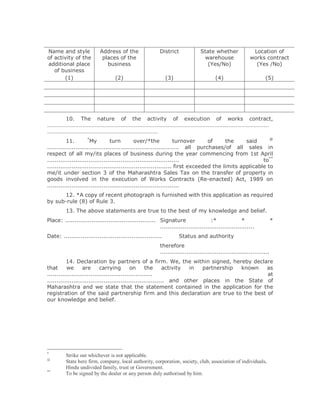

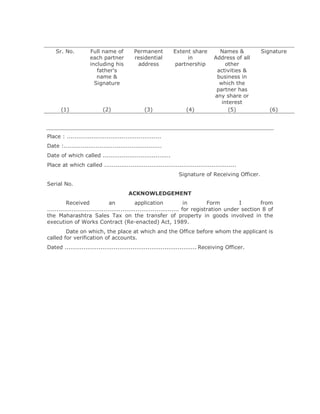

1. The document is an application form for registration under the Maharashtra Sales Tax on the transfer of property in goods involved in the execution of Works Contract Act.

2. It collects information such as the applicant's name, address, partners/members, other registrations held, date of commencement of business, and reasons for applying.

3. Financial information like accounts, language kept in, additional places of business, and turnover exceeding thresholds is also requested.

![FORM I

[(See rule 3(2),(6)]

Application for registration

To

The Registering Authority,

.............................................

*I ................... undertaking the activity of execution of works contract

known as ................... *I ................... the ................... (state here the capacity

such as partner, manager, managing trustee, director, secretary, principal officer) of

................... (state here the name of the firm, company, local authority,

corporation, society, club, association of individuals, Hindu undivided family or trust)

undertaking the activity of execution of works contract known as

......................................I, ................... the officer-in charge the activity of

execution of works contract known as*................... carried on by the Government

of the State of. .................../ the Central Government whereof the* only/chief place

of activity of execution of works contract within the jurisdiction of the Sales Tax

Officer/Assistant Commissioner of Sales Tax ................... in the district of

................... is situated at Room/Flat No ................... Name of the building

......................................Ward/Locality ................... Road ...................Village

................... Post Office ...................Taluka ......................................, hereby

apply for registering me/the said firm, company, local authority, corporation, society,

club, association of individuals, Hindu Individed family trust or Government under

section 8 of the Maharashtra Sales Tax on the transfer of property in goods involved

in the execution of Works Contract (Re-enacted) Act, 1989.

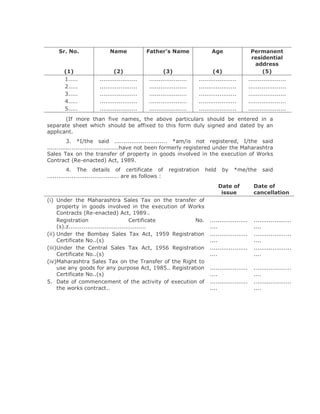

2. *The name and permanent residential address of the proprietor/*the

names and permanent residential addresses of all the partners of the activity or of all

the members of the managing committee of the society, club or other association or

of all persons having any interest in the activity (including the members of Hindu

undivided family), their age and father's name are as follows (not to be filed in if the

applicant is a body corporate, incorporated under any law or a department of

Goverment):](https://image.slidesharecdn.com/turst-100812093725-phpapp02/75/Turst-1-2048.jpg)