Embed presentation

Download to read offline

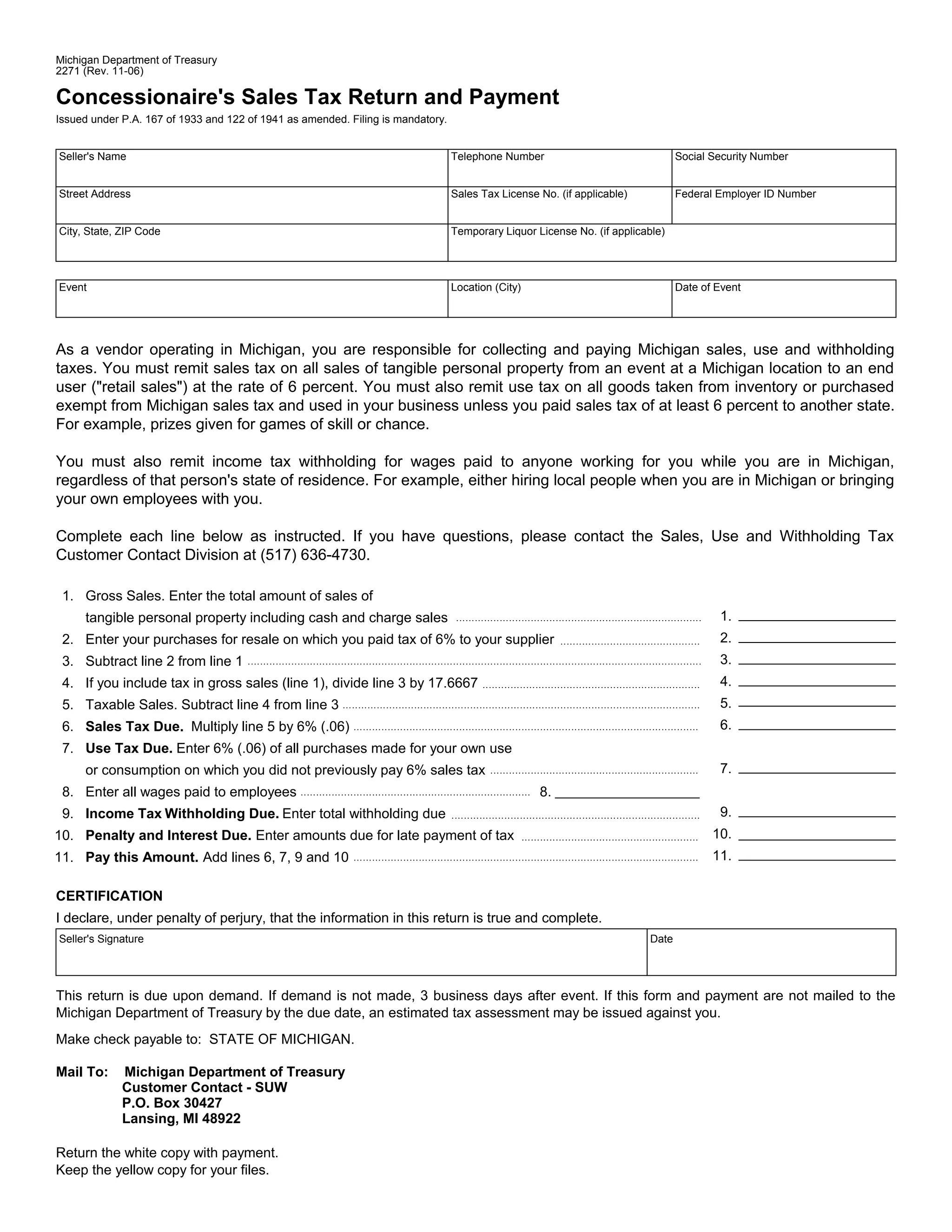

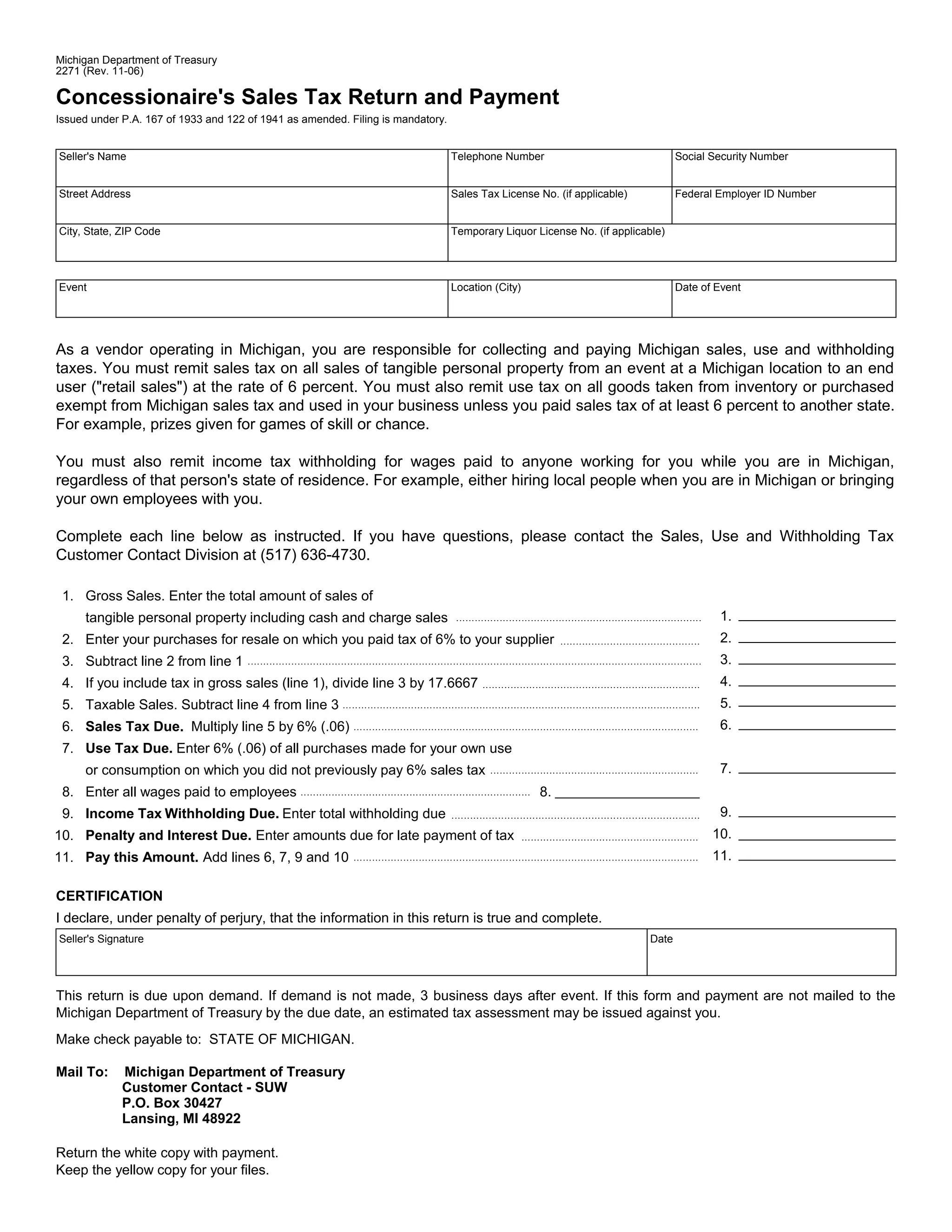

Michigan requires concessionaires operating at events to collect and remit sales, use, and income tax withholding. This document provides instructions for concessionaires to complete the Concessionaire's Sales Tax Return and Payment form to file the required taxes. It explains how to calculate the amounts due for sales tax on goods sold, use tax on items purchased for business use, and income tax withholding for wages paid to employees. Late fees are charged as a percentage of unpaid taxes and daily interest is applied if taxes are paid after the due date, which is 3 business days after the event.