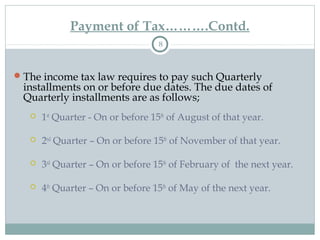

The document discusses key aspects of income tax administration in India, including the requirement for taxpayers to file an annual return of income by November 30 each year. It notes certain income sources that do not require filing, and penalties for failing to file. It also outlines important details like opening a tax file, information to disclose in the return, payment of quarterly tax installments, penalties for late payment, and the assessment process.