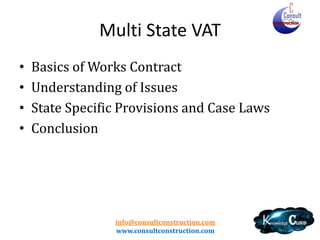

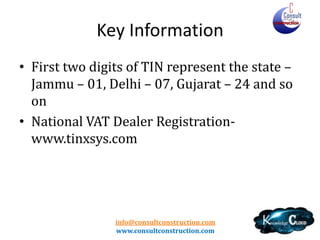

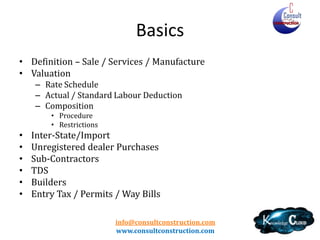

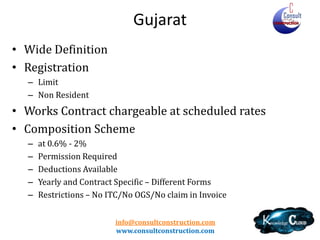

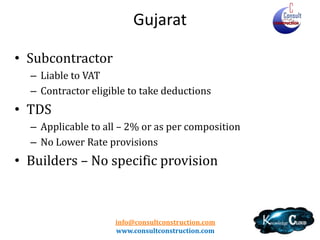

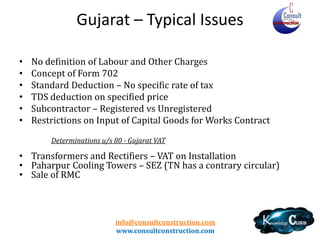

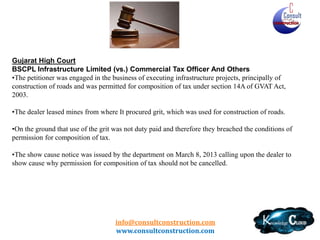

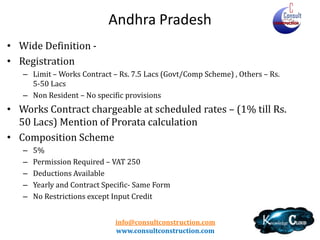

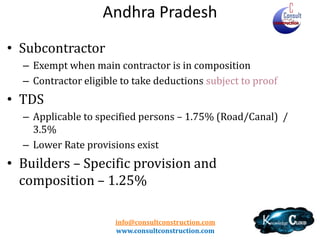

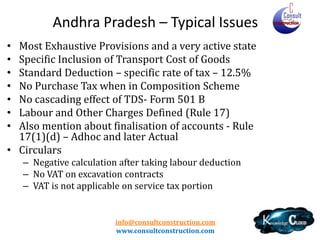

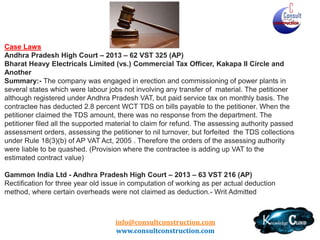

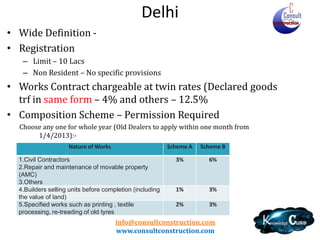

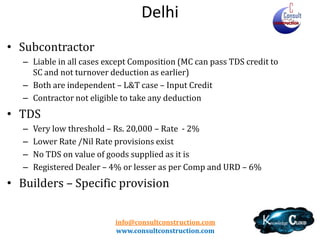

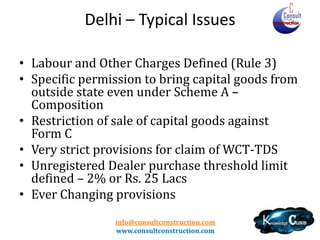

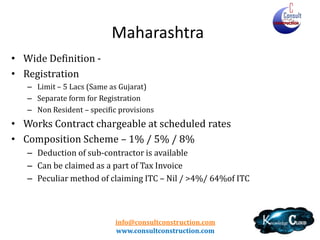

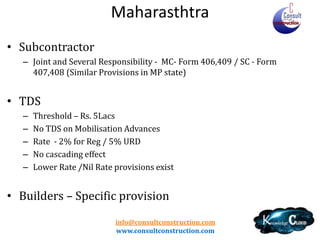

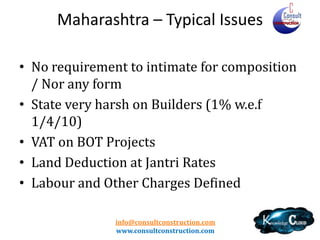

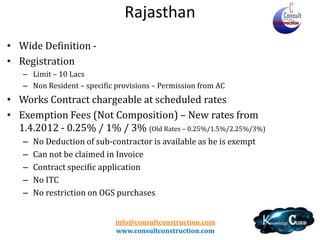

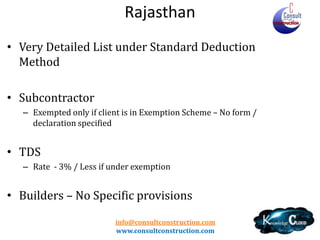

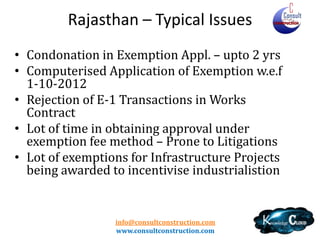

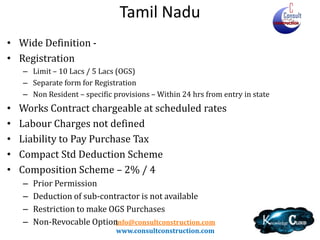

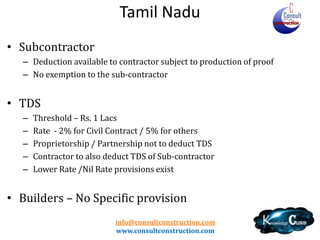

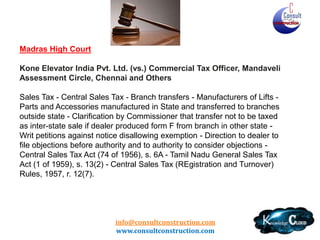

The document provides comprehensive information on multi-state VAT regulations pertaining to works contracts in India, focusing on various state-specific provisions, compliance requirements, and tax structures. It outlines guidance on indirect tax optimization, legislative changes, and important case laws affecting the construction sector. The content highlights various operational implications, registration limits, works contract definitions, and tax deduction protocols across different states such as Gujarat, Andhra Pradesh, Delhi, Maharashtra, Rajasthan, and Tamil Nadu.

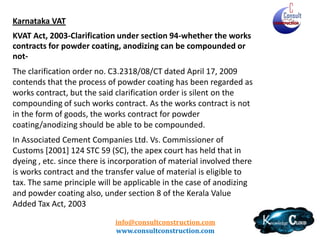

![Karnataka VAT

KVAT Act, 2003-Clarification under section 94-whether the works

contracts for powder coating, anodizing can be compounded or

notThe clarification order no. C3.2318/08/CT dated April 17, 2009

contends that the process of powder coating has been regarded as

works contract, but the said clarification order is silent on the

compounding of such works contract. As the works contract is not

in the form of goods, the works contract for powder

coating/anodizing should be able to be compounded.

In Associated Cement Companies Ltd. Vs. Commissioner of

Customs [2001] 124 STC 59 (SC), the apex court has held that in

dyeing , etc. since there is incorporation of material involved there

is works contract and the transfer value of material is eligible to

tax. The same principle will be applicable in the case of anodizing

and powder coating also, under section 8 of the Kerala Value

Added Tax Act, 2003

info@consultconstruction.com

www.consultconstruction.com](https://image.slidesharecdn.com/multistatevatonworkscontract-131102044708-phpapp01/85/Multi-state-vat-on-works-contract-40-320.jpg)