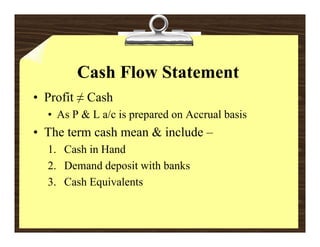

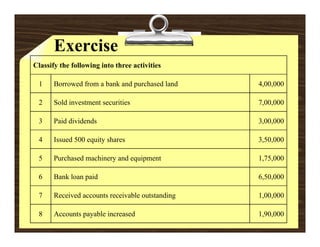

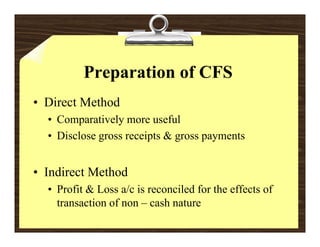

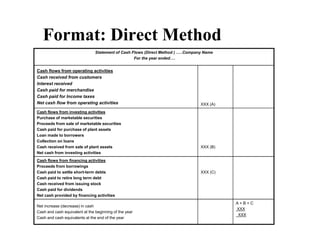

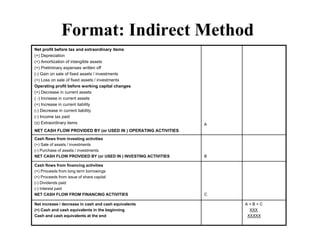

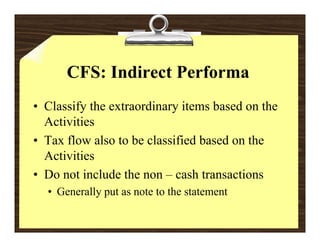

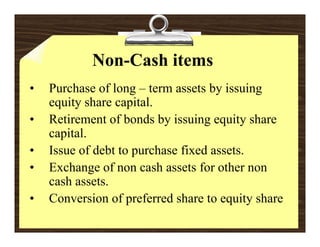

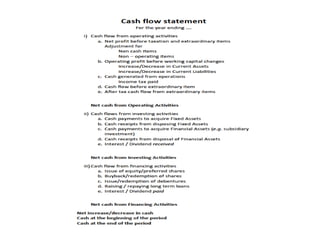

The document discusses the preparation of a cash flow statement. It explains that a cash flow statement reflects the movement of cash from three activities: operating, investing, and financing. It provides examples of items that would be classified under each activity. It also discusses the direct and indirect methods for preparing the cash flow statement and provides sample formats for both.