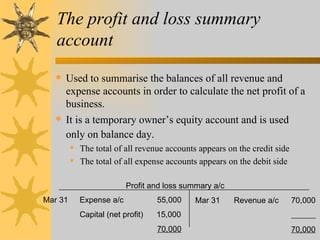

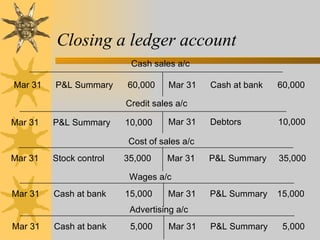

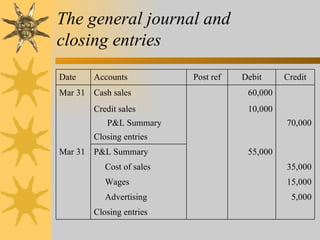

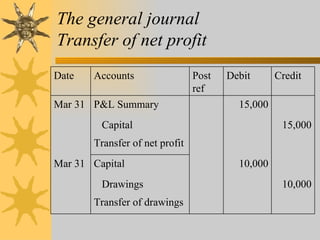

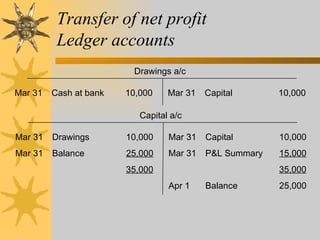

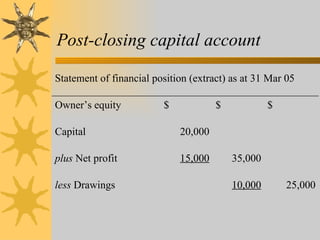

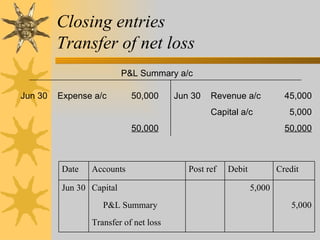

This document summarizes the process of closing the general ledger at the end of an accounting period. It discusses transferring revenue and expense account balances to the profit and loss summary account to calculate net profit or loss. Closing entries are then made to zero out revenue and expense accounts by transferring their balances to the profit and loss summary. Net profit is transferred to the capital account, while a net loss is transferred from the profit and loss summary to debit the capital account. The general journal is used to record these closing entries.