This document provides an overview of key financial statements:

- The balance sheet summarizes a company's financial position at a point in time, including assets, liabilities, and owners' equity.

- The income statement shows revenues and expenses over a period of time to determine net income or loss.

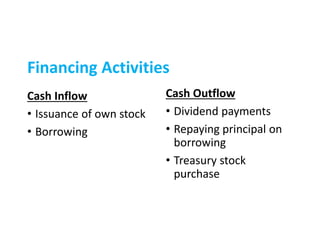

- The statement of cash flows reports cash inflows and outflows from operating, investing, and financing activities.

- The statement of owners' equity tracks changes in retained earnings from one period to the next.

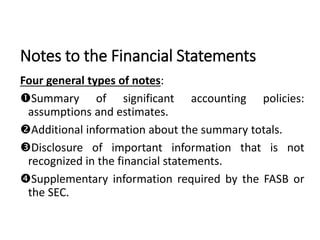

Footnotes also provide important explanatory information to the financial statements.