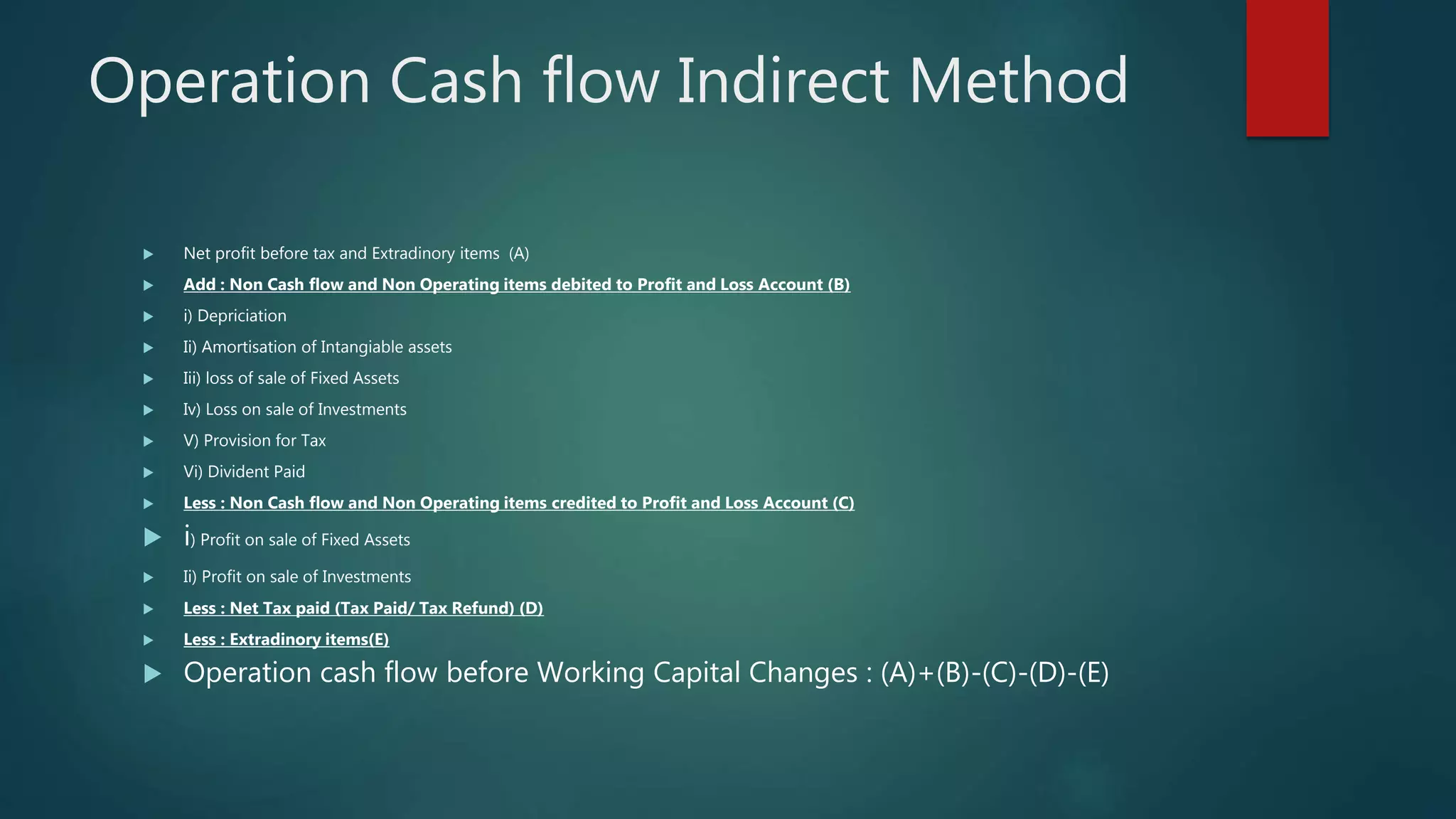

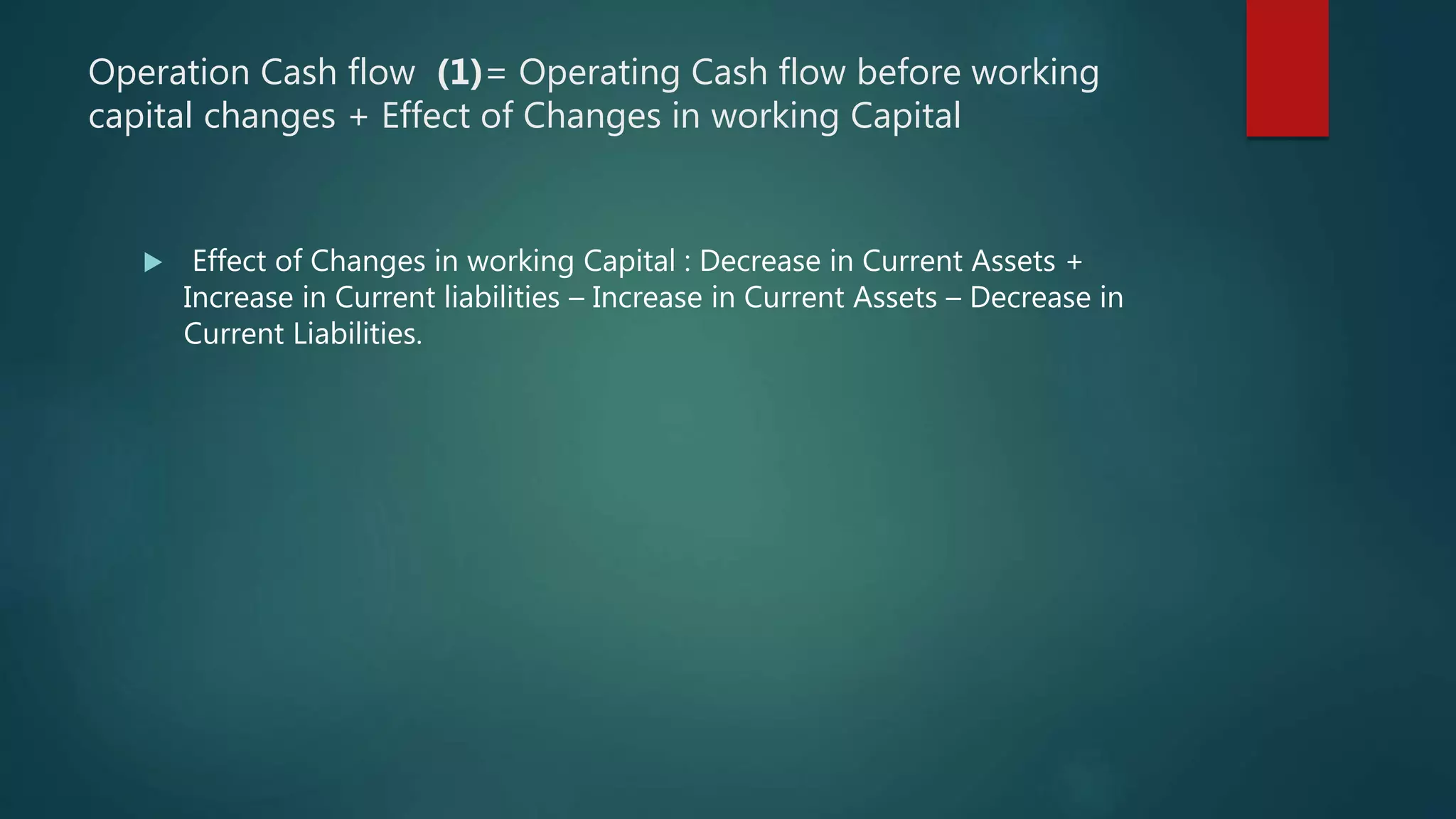

The document discusses the indirect method for preparing a cash flow statement. It explains that the cash flow statement has three sections - operating, investing, and financing activities. It provides details on how to calculate cash flow from operating activities indirectly by making adjustments to net income. It also describes how to determine cash flow from investing and financing activities, such as cash inflows from sale of assets and cash outflows for purchase of investments. The cash flow statement shows the total cash flow for a period as the sum of cash flows from the three activities plus the opening cash balance.