- Development Financial Institutions (DFIs) were established by governments to provide long-term financing for industrial and infrastructure projects due to the risky and long-gestation nature of such projects.

- Over time, as financial systems became more sophisticated in risk management, banks and bond markets became better able to finance such projects, reducing the need for DFIs with government support.

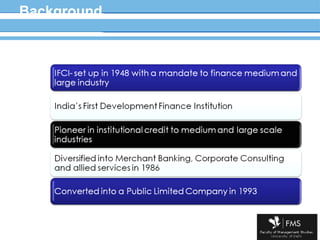

- In India, the first DFI was established in 1948 and many more were set up over the subsequent decades to promote development across various sectors, with some focused on long-term lending and others on refinancing.